Is FET’s recent 40% drop a setup for a bullish reversal?

- FET’s price has dipped by 40% in the past 14 days to a key support level at $1.0569.

- Metrics indicate mixed signals for potential recovery

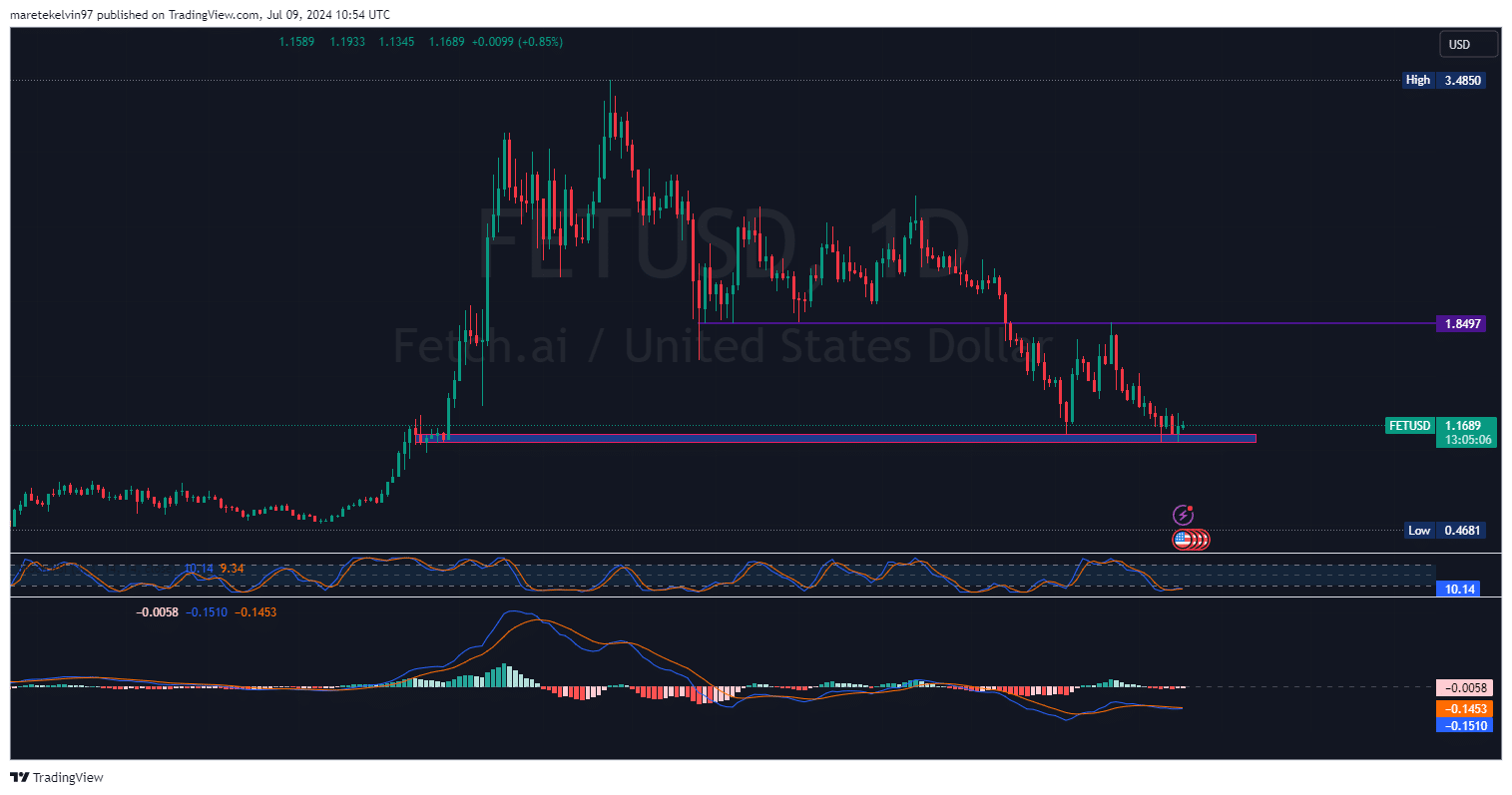

The Fetch.ai [FET] token has seen better days after a steep 40% decline over the past 14 days. The token is now testing a key support level at $1.0569 that could determine its short-term outlook.

Despite the recent downturn, there are some early indications that FET might be entering an accumulation phase. The price has been consolidating near the $1.0569 support level, with decreasing selling pressure evident on shorter time frames.

This could potentially set the stage for a bounce, assuming broader market conditions remain favorable.

The stochastic RSI is in an oversold zone, speculating a potential market reversal to the bullish run.

Metrics paint a mixed picture for FET

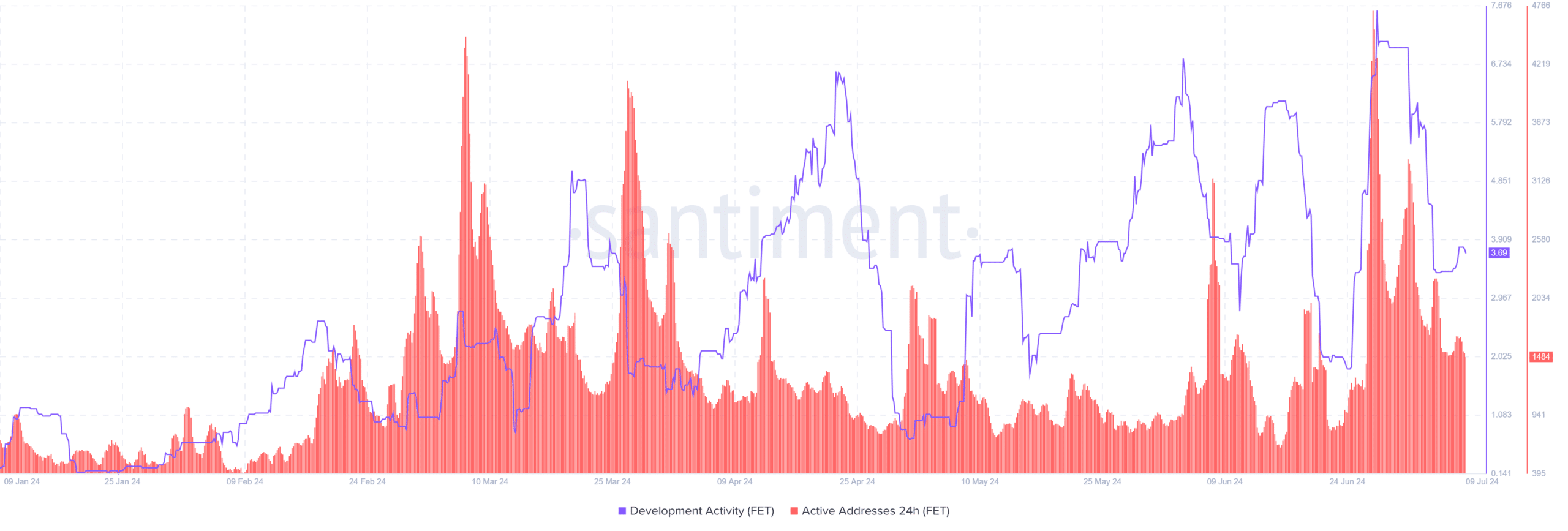

According to data from Santiment, there are some interesting developments for FET.

Development activity for the project has seen significant fluctuations recently. This tracks GitHub commits and other development-related actions and can be a good indicator for the long-term outlook.

Several spikes in Fetch.ai development activity could be seen as a positive sign, potentially offsetting some of the bearish price action.

Active addresses have also shown increased volatility. Periods of increased network activity have correlated with some of the larger price fluctuations.

This suggests that despite the overall downtrend, there is still a significant interest in FET among investors.

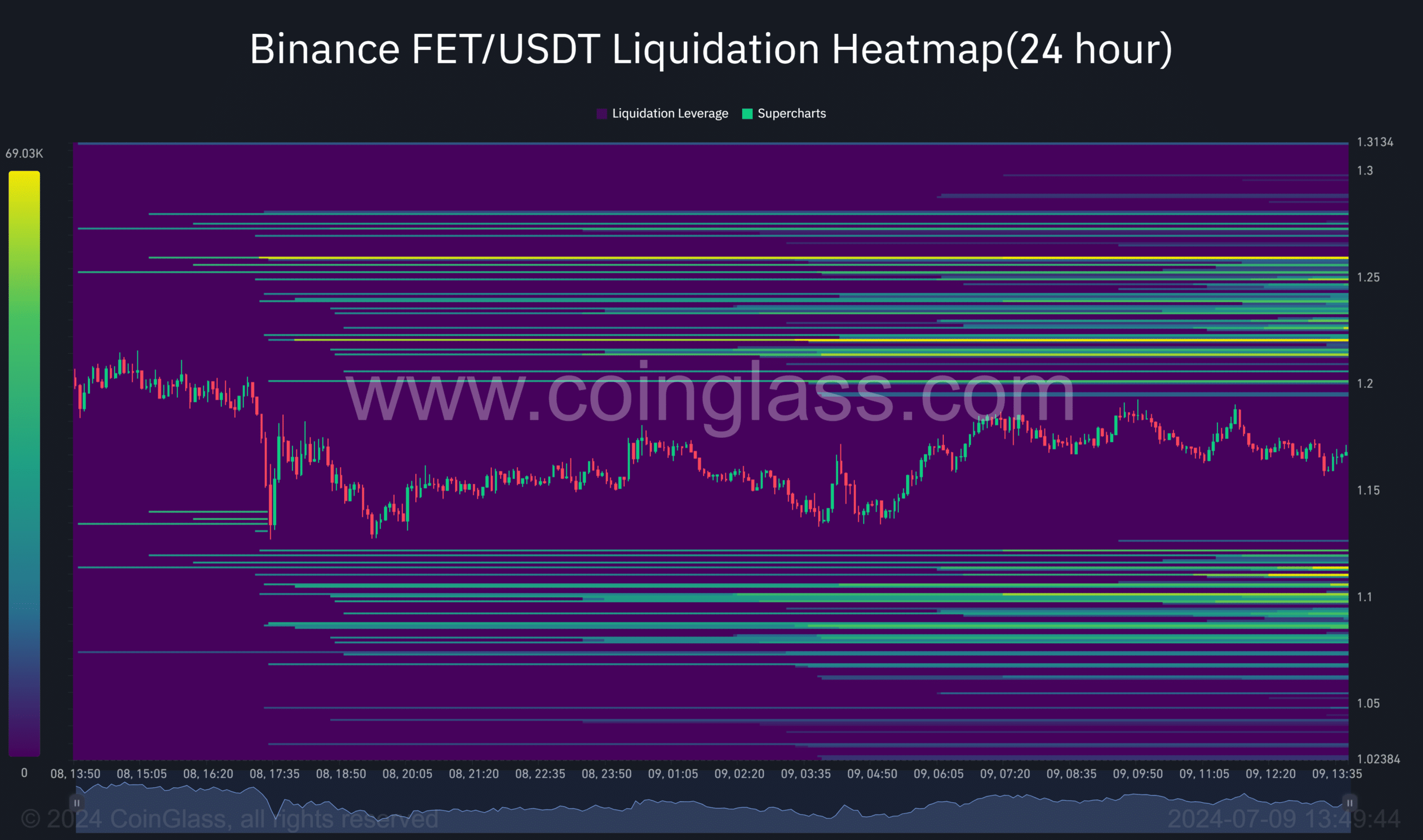

AMBCrypto further analysis of the liquidation heatmap data from Coinglass indicates a balanced market with no significant bullish or bearish bias.

With FET testing support levels, any significant moves could trigger successive liquidations in either direction. This concentration of liquidation levels just above and below the current price suggests a potential for increased volatility.

For the FET price to surge higher, it needs to regain enough bullish momentum to break out of the consolidation phase. Conversely, a breakdown below the current support could lead to further dips.

Read Fetch.ai [FET] Price Prediction 2024-25

FET has certainly taken a beating in recent weeks, but its arrival at a key support level could mark a turning point.

Whether that results in a strong bounce or further decline remains to be seen, but the coming days will likely prove vital for determining FET’s short-term to medium-term outlook.