Is it almost the end of Bitcoin bottom fishing

$40,000 has been strong support for Bitcoin in the past month, with the 7-day lowest dipping close to $40,600 on CoinGecko. Well, the interesting question here is- With Bitcoin’s recovery to $43,200 at press time, will it be soon time to cease bottom fishing?

Bloomberg cited an analysis by Genesis Global Trading that noted Bitcoin looks stable on the back of recent options activity. It essentially indicates the possibility of an upside. Apart from that, the analyst noted that the difference in ‘implied volatility of bullish and bearish bets’ is now close to zero. Revealing demand for more call options over put options, which is a bullish indicator.

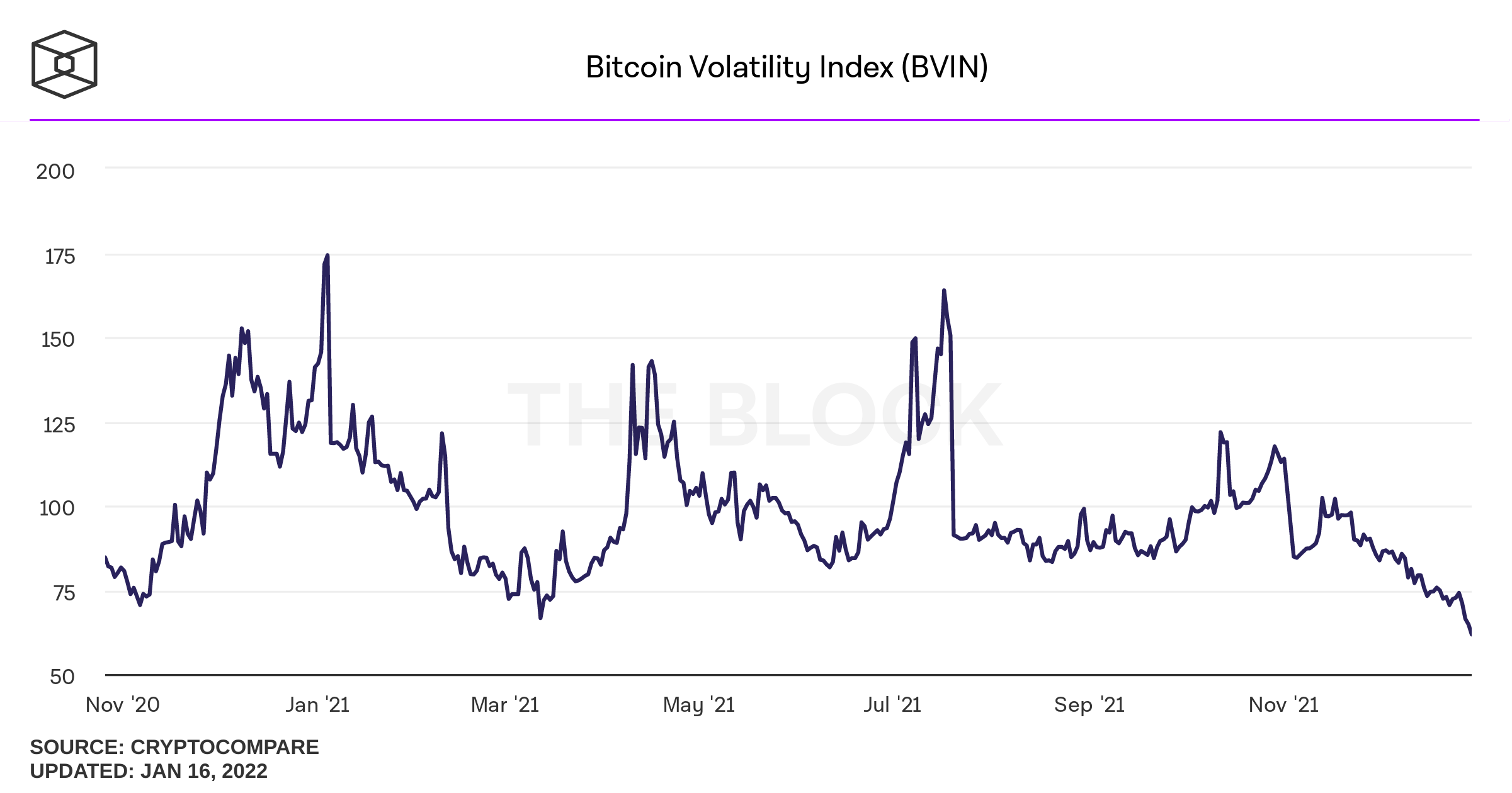

Notably, the Bitcoin Volatility Index (BVIN), which measures the implied volatility of Bitcoin, showed a downtrend in the chart.

Bullish market ahead?

Glassnode recently indicated in its research that 40% of BTC transfer volume is in profit.

40% of #Bitcoin Transfer Volume is currently in profit.

Previous visits to this level took place in March 2020 and July 2021.

Live chart: https://t.co/Jc3y63738B pic.twitter.com/HtKBuFT1kd

— glassnode (@glassnode) January 15, 2022

Having said that, Bloomberg Intelligence’s Mike McGlone also noted that with the demand and adoption on a rise, and supply declining, there could be a reversal. He said,

“Something has to reverse the increasing Bitcoin adoption trend or the rules of economics point to higher prices. I expect demand and adoption trajectories to remain favorable.”

Correlation

But, will the future demand for Bitcoin be on the back of its hedging utility that became victories in 2021? That remains a major question. However, it looks more like an investment product, more correlated to the stock market than it ever was. IMF also pointed out the post-pandemic trajectory of Bitcoin, drawing its highest correlation with the stock.

Victoria Greene, founding partner, and chief investment officer at G Squared Private Wealth, told Bloomberg

“Bitcoin is showing a lot more tendency to track with and correlate with the Nasdaq and the market than it is with inflation and uncorrelated currency.”

Meanwhile, it has led Miracle Mile Advisors’s Anderson Lafontant to believe that continued correlation will diminish BTC’s appeal as a hedge. However, despite that many industry players are betting on a long-due bullish rally. It is worth noting that the BTC balance on exchanges continues to decline, which remains a positive indicator for a price uptick.

However, some are expecting a lower bottom for Bitcoin.

A lot of Teammates are asking me if I am actively buying Bitcoin and Tesla right now, and the short answer is NO. I think the Next Six Months could see downdrafts in both or either Bitcoin and Tesla, so I will be watching to buying more at lower prices. Thank you. https://t.co/cd8n6hQr36

— Pulte (@pulte) January 14, 2022