Is Chainlink [LINK] ready for a bullish breakout? Insights revealed

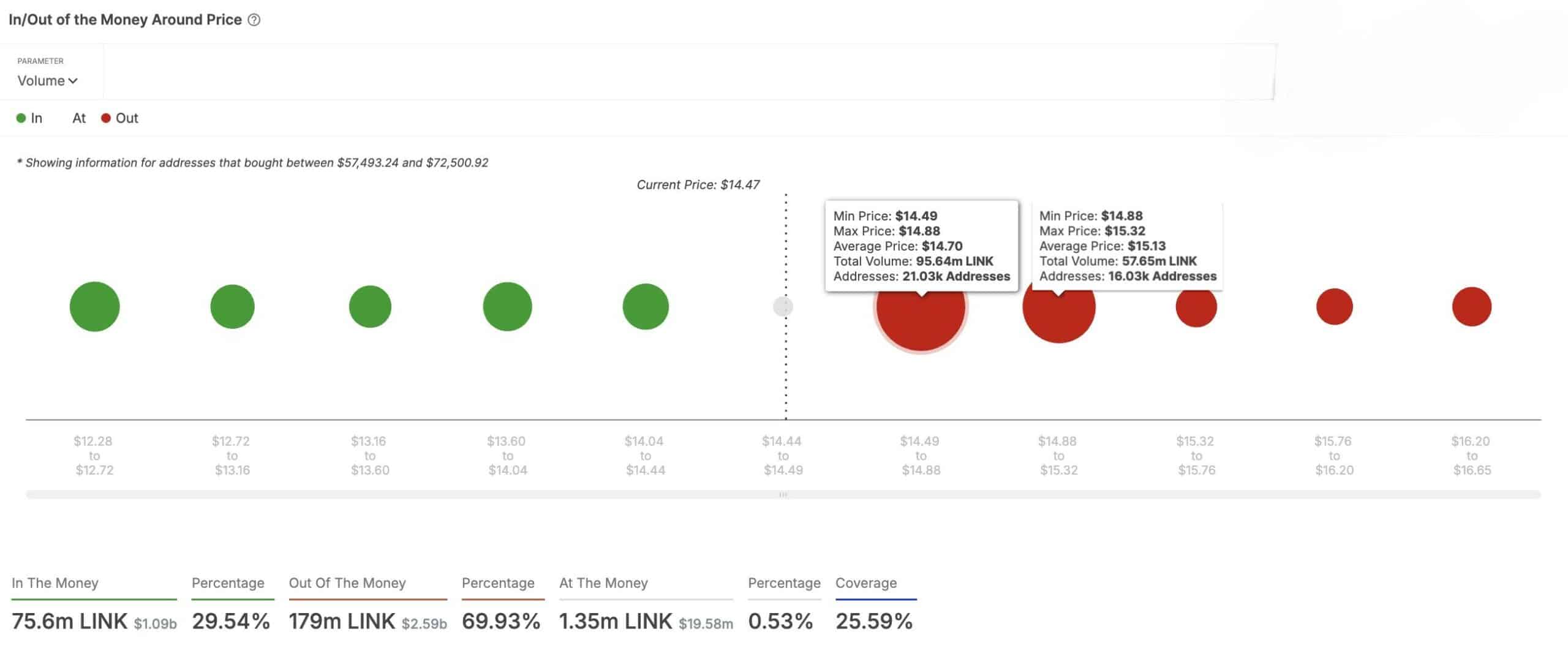

- LINK faces critical resistance at $14.50-$15.30, with 153 million tokens accumulated by investors.

- Exchange reserve decline and increased active addresses suggest potential for a price surge.

Chainlink [LINK] faced a significant resistance zone between $14.50 and $15.30, where 37,000 investors accumulated a total of 153 million LINK tokens.

This accumulation signals growing investor confidence, suggesting that LINK is preparing for a potential breakout.

However, the question remains: will LINK successfully break through this resistance and initiate a new bullish trend?

What does LINK’s price action reveal?

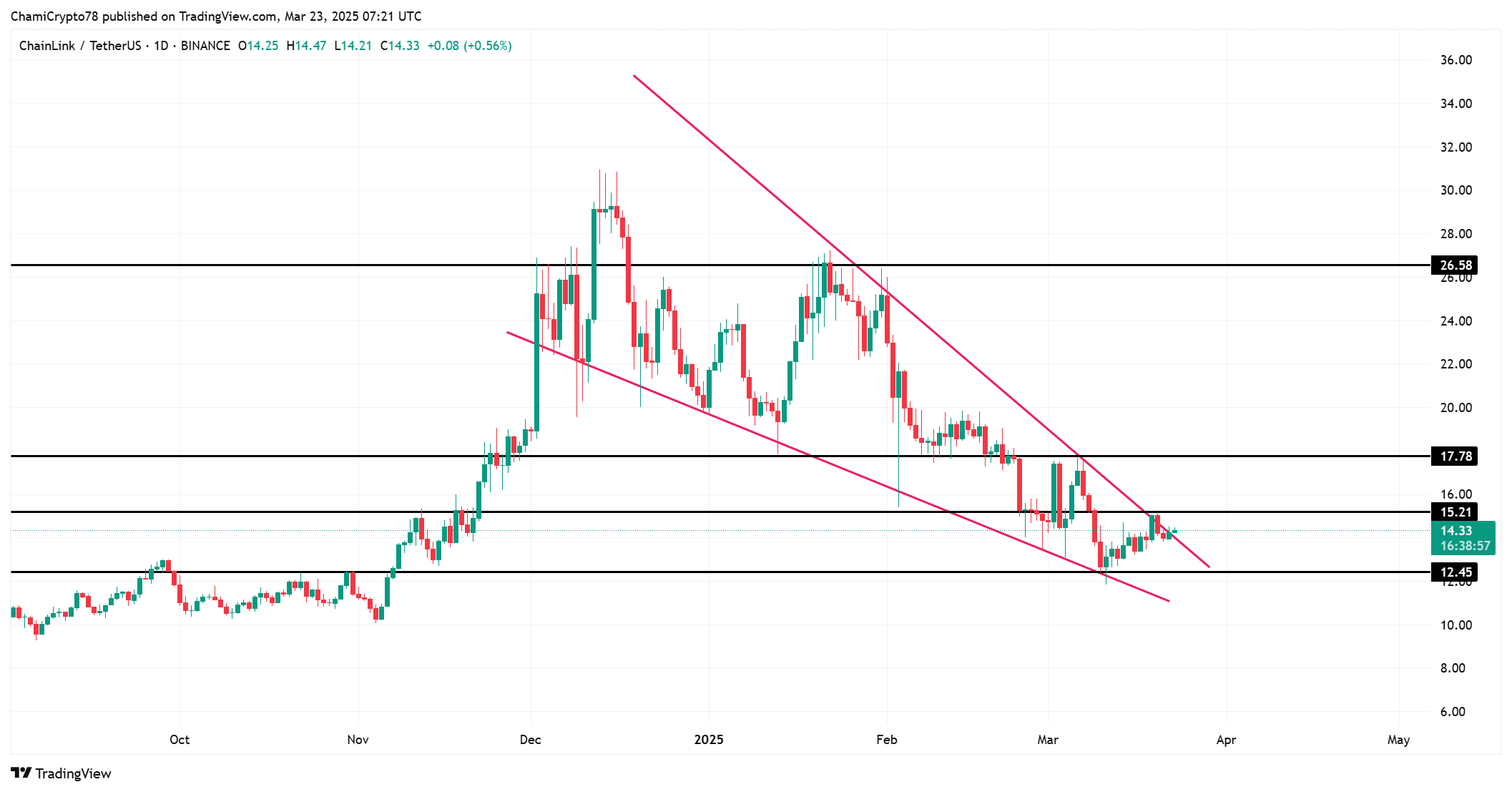

Chainlink’s price action indicated a period of consolidation, with fluctuations primarily contained within the $12.45 to $17.78 range. At press time, LINK was trading at $14.32, showing a 1.54% increase over the past 24 hours.

LINK was testing the support level at $14.33, which remained a critical point for the asset’s movement. If it manages to break through the resistance at $15.30, the next major target could be $17.78.

Therefore, traders will be closely monitoring these price levels to gauge the potential for a breakout.

A decisive move above $15.30 would significantly improve LINK’s outlook, suggesting the possibility of more upward momentum.

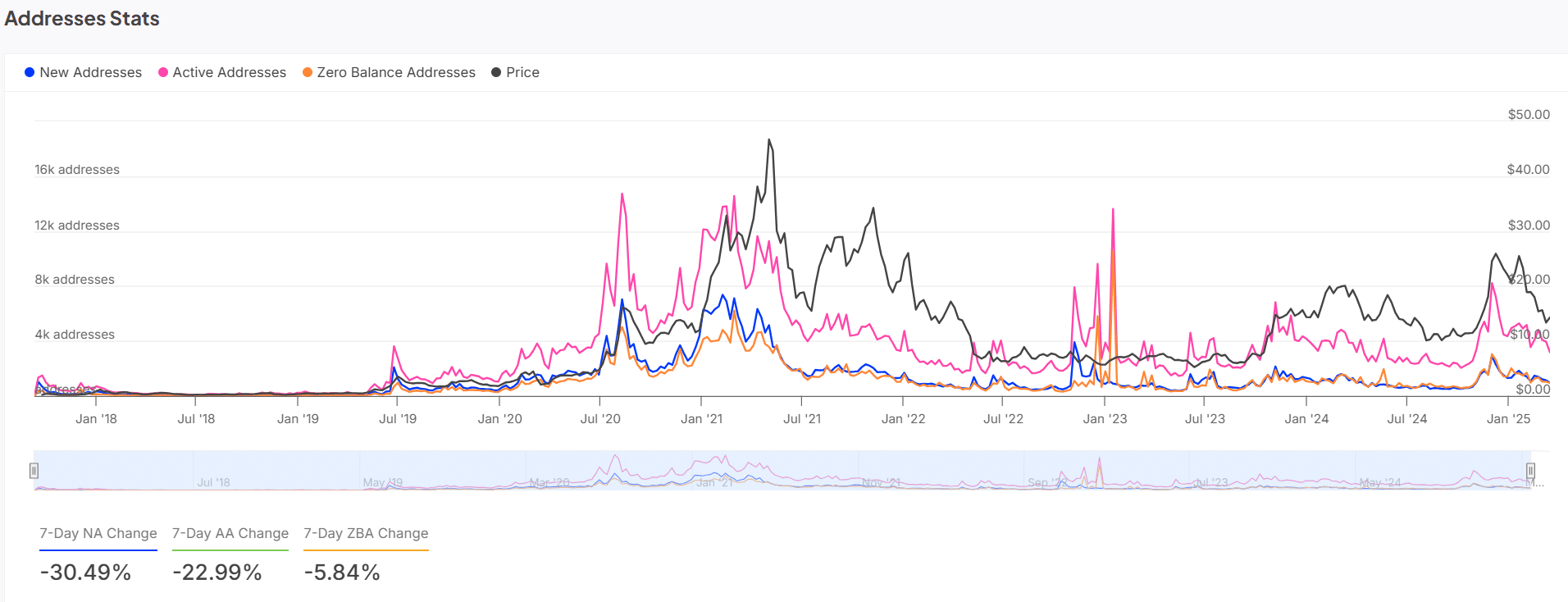

What do Chainlink’s address stats show?

Looking at the address statistics, the picture for LINK is mixed. Over the past seven days, new addresses have decreased by 30.49%, showing a slowdown in fresh interest from new market participants.

On the other hand, active addresses have also decreased by 22.99%, suggesting that there is less engagement from current holders, indicating a cooling of market activity.

Additionally, zero balance addresses have decreased by 5.84%, which means fewer investors are completely exiting their positions.

While the reduction in new addresses and active addresses may seem concerning, it indicates a shift in market sentiment where investors may be in a holding pattern, waiting for a clearer price direction.

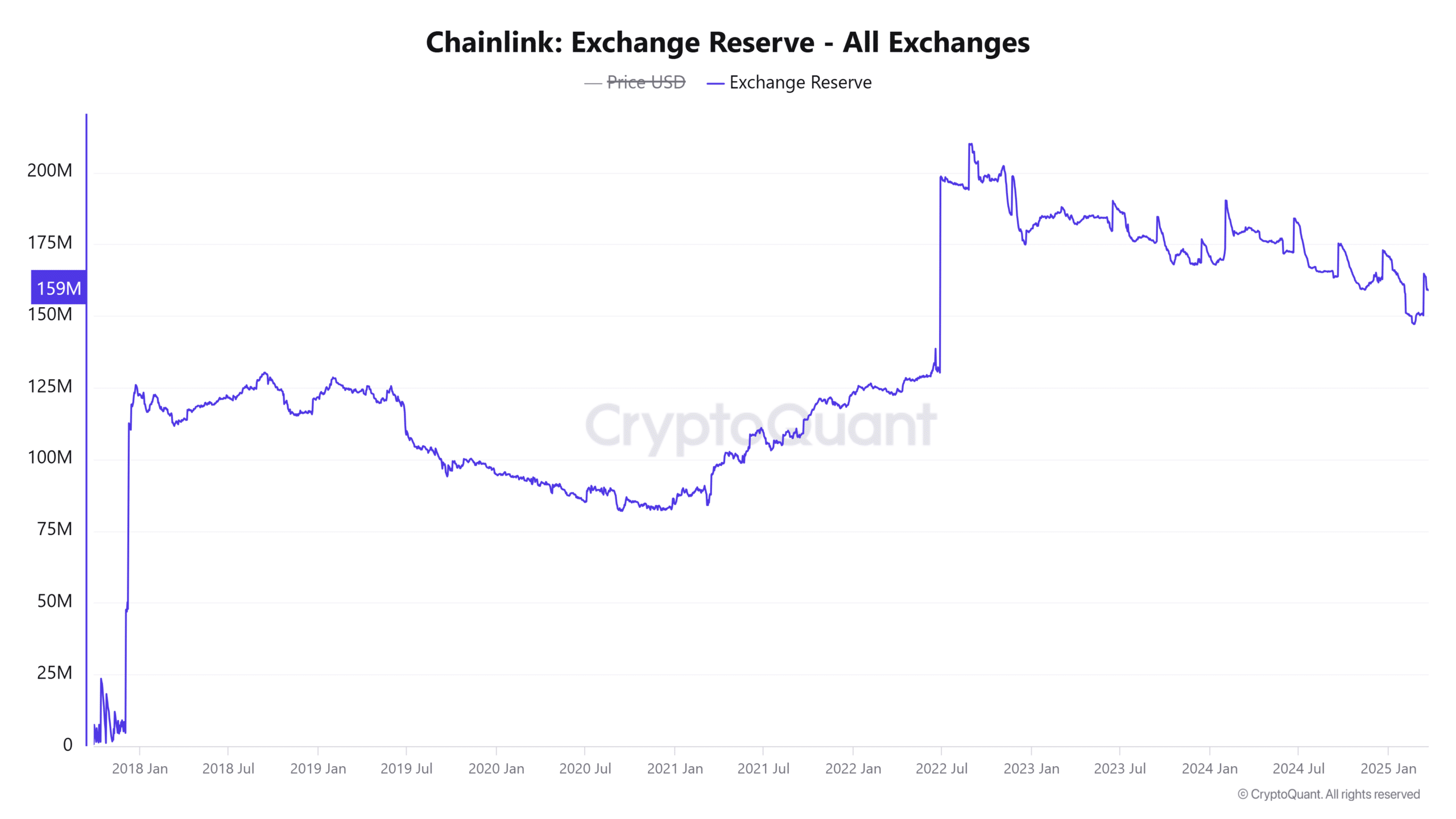

How does LINK’s exchange reserve affect its market outlook?

At press time, Chainlink’s exchange reserve was 159.036 million LINK, with a slight decline of 0.18% over the past 24 hours.

This decrease indicates that investors are pulling their tokens off exchanges, likely in anticipation of holding long-term.

With fewer tokens available for sale on exchanges, selling pressure could decrease, which would likely benefit the price.

Additionally, as investors opt to hold their Chainlink positions, the chances of a price surge increase, especially if buying pressure remains strong.

Can Chainlink break through its resistance?

Chainlink is at a critical juncture, testing important resistance levels.

While the accumulation of 153 million tokens by 37,000 investors suggests confidence in LINK’s future, the reduction in active addresses and new address activity suggests that the market sentiment is less exuberant than it could be.

If LINK can break through the $15.30 resistance, it may open the door to further upward movement. However, a failure to hold support at $14.33 could signal more downside potential.

Therefore, while the potential for a breakout exists, it depends on whether LINK can sustain buying pressure and break through its resistance levels.