Is Litecoin aiming for $282 next? Examining key levels

- Litecoin’s bullish breakout above $113 signaled potential gains, with targets set at $199, $243, and $282.

- Active addresses grew 3.53%, but a 6.16% drop in new addresses hinted at mixed market sentiment.

Litecoin [LTC] has confirmed a bullish breakout after closing above its critical resistance level of $113, signaling potential upside momentum.

As of press time, LTC traded at $112.76, with a 12.86% gain over the past week, indicating strong market activity.

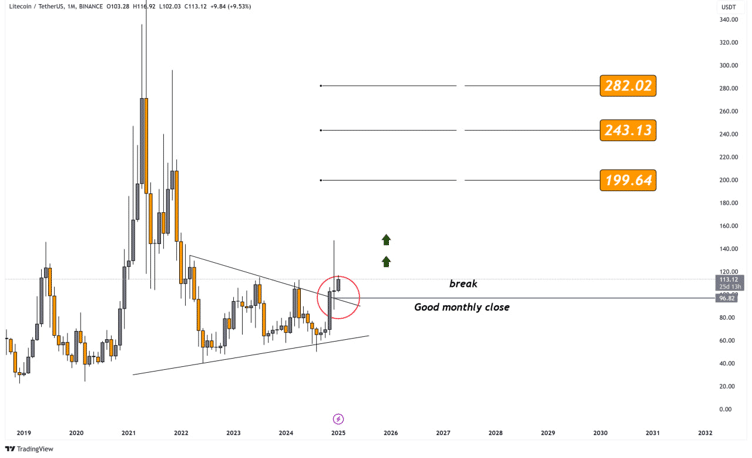

According to technical analysis, LTC has broken out of a long-term ascending triangle pattern, which typically signals a continuation of an uptrend.

The recent monthly close above $113 marks a significant shift in market structure, reinforcing buyer dominance.

This breakout suggests a solid foundation for further price gains in the short to medium term.

The breakout zone around $113 now serves as a key support level. Analysts believe that if LTC remains above this level, the bullish structure will hold.

Additionally, the long-standing ascending trendline near $90 provides dynamic support, making it a critical level to watch during any potential pullbacks.

Litecoin targets set at $199, $243, and $282

Analysts have identified three critical price targets for LTC. The first target at $199.64 represented a historical resistance zone. The second level, $243.13, marked an important psychological and technical threshold.

If LTC sustains its momentum, the third target of $282.02 could come into focus, representing a potential return to multi-year highs.

Market experts caution that resistance near $120 has capped price movements in recent sessions. A confirmed breakout above this level is seen as necessary to unlock stronger upward momentum toward these targets.

Technical indicators suggest that breaking this resistance could act as a catalyst for the next leg of the rally.

Bullish trends simmer down

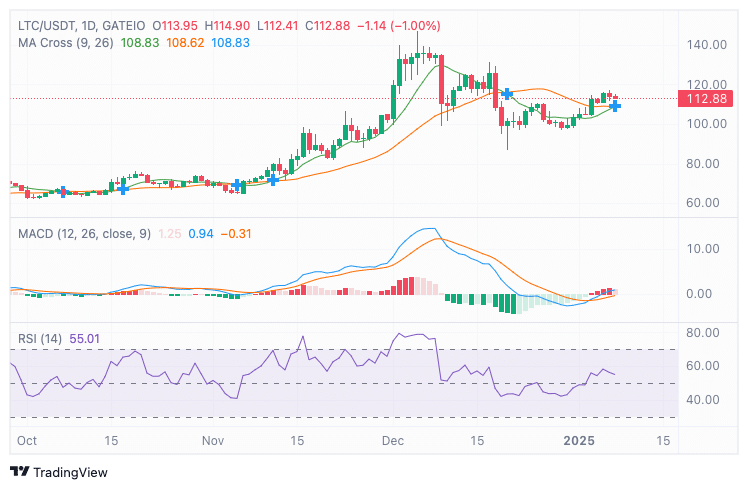

The MACD indicator showed a weak bullish crossover, with the MACD line at 0.94 at press time, slightly above the signal line at 0.31.

However, fading histogram bars indicated mild bullish momentum, signaling the potential for sideways price action in the short term. Market observers noted that stronger volume may be required to sustain the upward trend.

The RSI (14) sat at 55.01, reflecting neutral momentum but leaning slightly toward bullish.

Analysts indicated that a rise above 60 on the RSI could signal stronger buying activity, while a drop below 50 may point to a correction, potentially testing support near $100.

Address activity suggests mixed sentiment

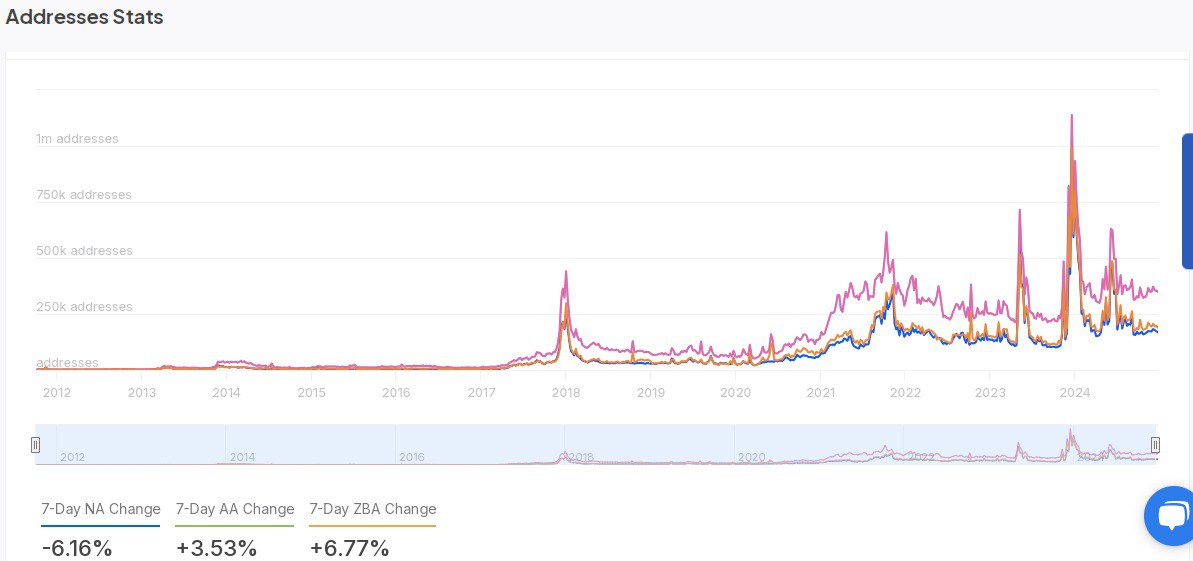

Blockchain data from IntoTheBlock revealed a total of 705.44K LTC addresses as of the 23rd of December 2024.

New addresses created during the week amounted to 168.13K, but this figure reflects a 6.16% decline compared to the previous week.

Meanwhile, active addresses increased by 3.53%, signaling that existing users remained engaged despite reduced interest from new participants.

The number of zero-balance addresses has risen by 6.14%, suggesting profit-taking or the emptying of dormant wallets.

Read Litecoin’s [LTC] Price Prediction 2025–2026

While overall engagement remains steady, reduced new address creation could indicate cautious sentiment among potential new investors.

LTC’s bullish breakout and sustained momentum above critical levels provide optimism for further gains.