Is Loopring [LRC] beginning to show underlying strength despite…

Loopring, the poster boy of scalable Ethereum-based solutions is having a tough time of late. Back towards the end of ‘Uptober’ 2021, LRC had rallied just shy of 1000% in a matter of two weeks. But since then, it has had a huge fall. It practically slid down a slope of valuations and is currently standing at a meager market capitalization of ~$660 million.

Technically speaking, there’s little hope for the coin. Down nearly 90% from its all-time-highs, no technical indication points to any kind of meaningful recovery at the moment with the current market-wide bearishness in mind. This is despite the fact that LRC is one of the most used tokens by the top 100 Ethereum whales in the past 24 hours.

JUST IN: $LRC @loopringorg one of the MOST USED smart contracts among top 100 #ETH whales in the last 24hrs?

We've also got $MANA, $AXS, $FTM, $KNC & $SAND on the list ?

Whale leaderboard: https://t.co/N5qqsCAH8j#LRC #whalestats #babywhale #BBW pic.twitter.com/JS3usDwvk9

— WhaleStats – BabyWhale ($BBW) (@WhaleStats) May 28, 2022

Take a look at the charts. It is quite evident that it has suffered heavy losses on the books and there would be strong selling pressures at each and every resistance level going forward.

Metrics say different

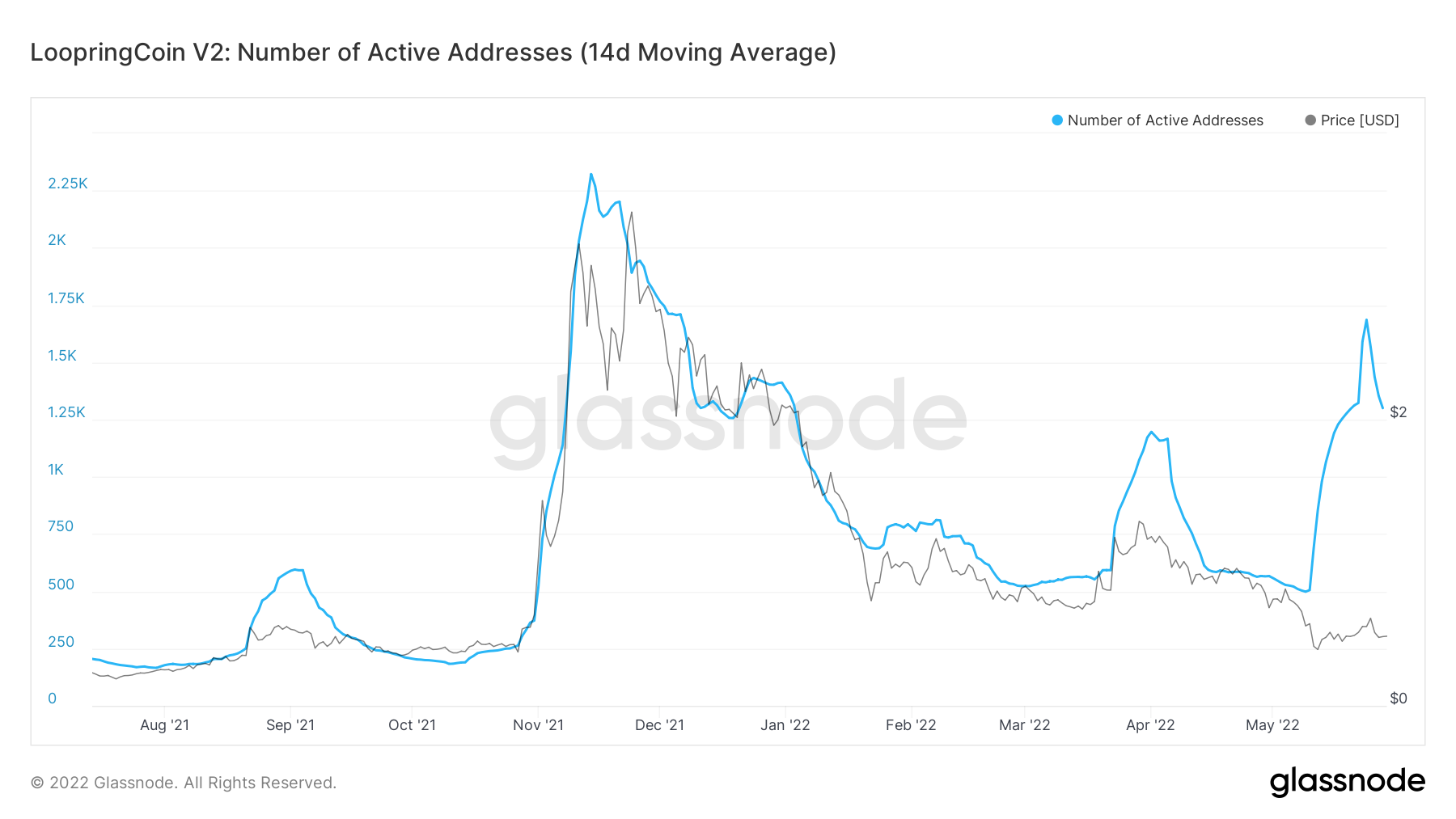

On-chain metrics for this token seem to suggest a slightly different picture. According to data from Glassnode, the 14-day moving average of the number of active addresses on the chain has seen a major rally despite the falling prices.

This is a metric that counts the number of unique addresses that were active in the network either as a sender or receiver. Only addresses that were active in successful transactions are counted – thus increase in activity there shows underlying hope for the future.

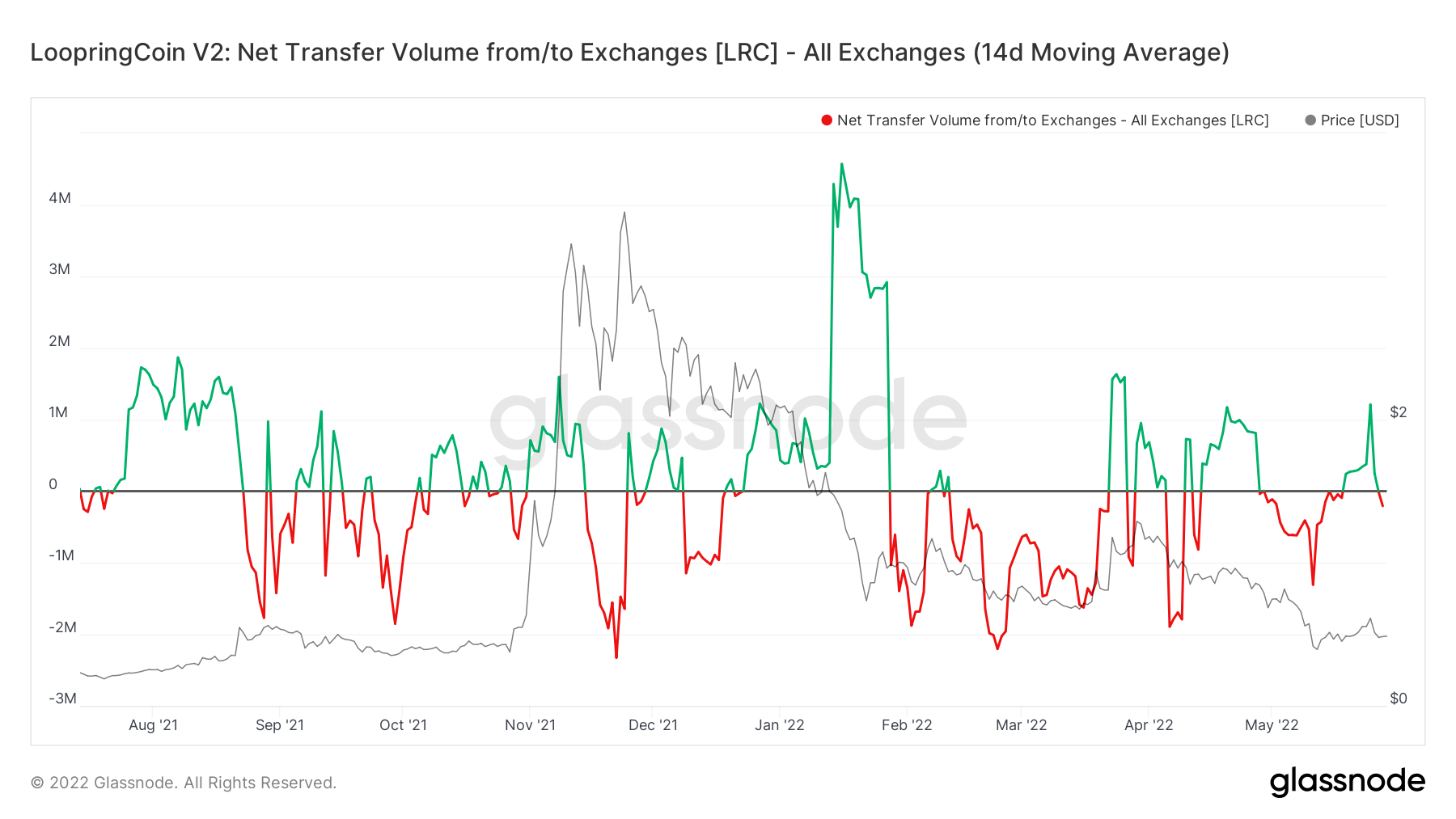

Along with that, Exchange Netflow Volume has also turned slightly negative, suggesting more coins are being pulled out of exchanges than the number entering exchanges – indicating HODLer activity on the chain.

There’s a caveat

However, don’t jump the gun just yet. There is one other concerning signal as well that investors and long traders need to be aware of. According to data from Coinglass, its recent minor bullish pullback saw major liquidations both on the short and long side. Liquidations on the long side during a minor recovery points to sell on highs strategy and that doesn’t bode too well for the immediate short term.

So considering Loopring’s use case – a zkRollup exchange and payment protocol built to help scale decentralize value transfers on Ethereum – its future seems promising.

And, its recent partnership with GameStop to create a Web3 Ethereum wallet that leverages Loopring’s zkRollup looks good too. Hence, a broad market recovery can generate good returns in LRC considering its oversold position right now