Is memecoin mania returning? What to expect as Shiba Inu mirrors early 2024 pattern

- Memecoin supercycle narratives are heating up as speculative capital flows into high-beta assets.

- SHIB has historically displayed parabolic rallies, driven by speculative interest and liquidity surges.

The memecoin market continues to outperform as major altcoins struggle under Bitcoin’s [BTC] dominance, with memecoins registering a 6% increase in market capitalization amid BTC’s consolidation.

Shiba Inu [SHIB], a high-beta asset in the sector, has historically exhibited parabolic expansions during Bitcoin’s range-bound phases, thriving on speculative capital inflows.

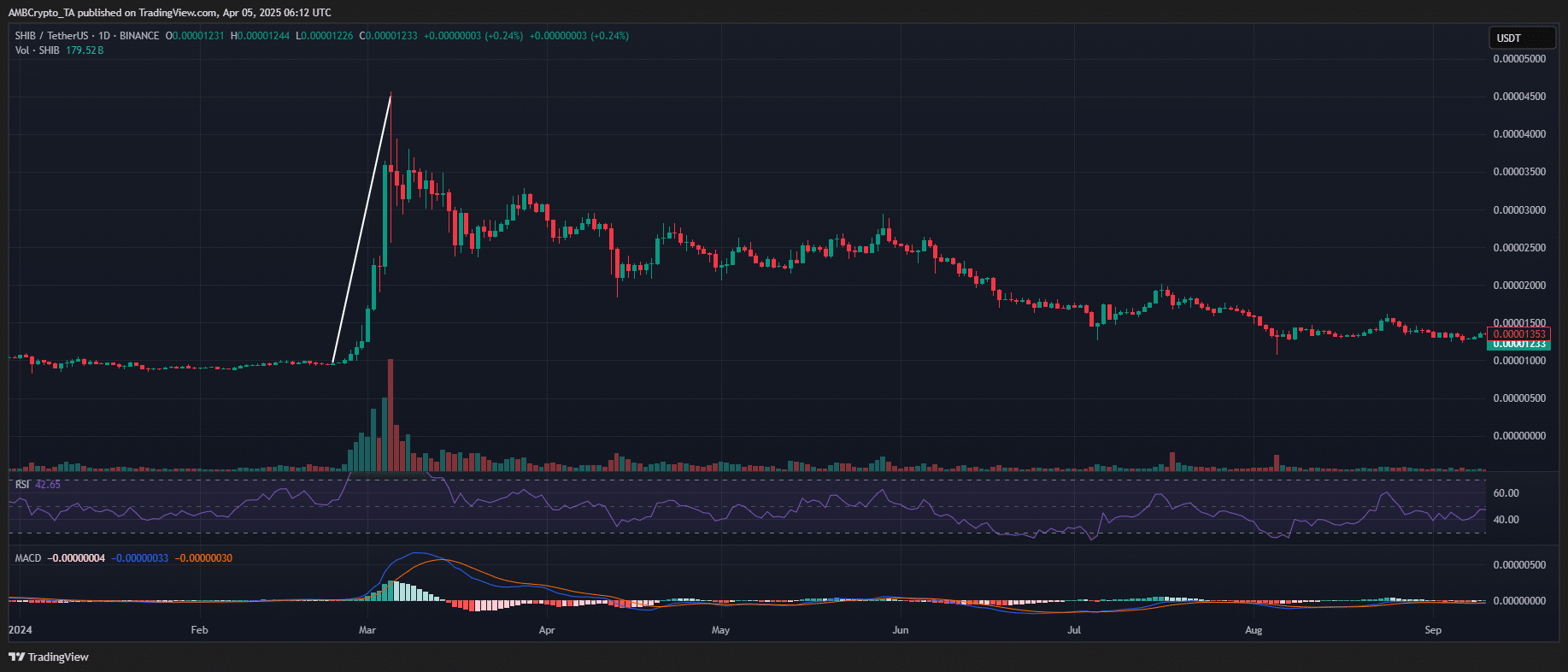

Notably, in early March 2024, SHIB printed three consecutive higher highs, each delivering a 30%+ intraday surge, following a breakout from a prolonged accumulation phase.

Meanwhile, persistent bid liquidity and sustained bullish sentiment around Bitcoin during that cycle preserved its structural range, preventing a broader market correction and allowing capital to rotate into higher-volatility assets.

This divergence highlighted memecoins’ tendency to decouple from broader market flows. Hence, positioning them as speculative assets during risk-on market cycles.

A similar setup is now emerging. The recent 6% uptick in memecoin market capitalization aligns with Bitcoin dominance approaching an overheated threshold, while high-cap altcoins remain under pressure.

Is this the early phase of a memecoin supercycle? If so, will SHIB once again exhibit explosive upside volatility?

Catalyst for a memecoin supercycle?

Interestingly, SHIB’s exchange reserves across both spot and derivatives markets have plunged to a four-year low, signaling a tightening supply dynamic.

Simultaneously, an AMBCrypto report reveals that 80% of SHIB’s total supply is now under long-term holder (LTH) control, indicating strong accumulation and reduced sell-side liquidity.

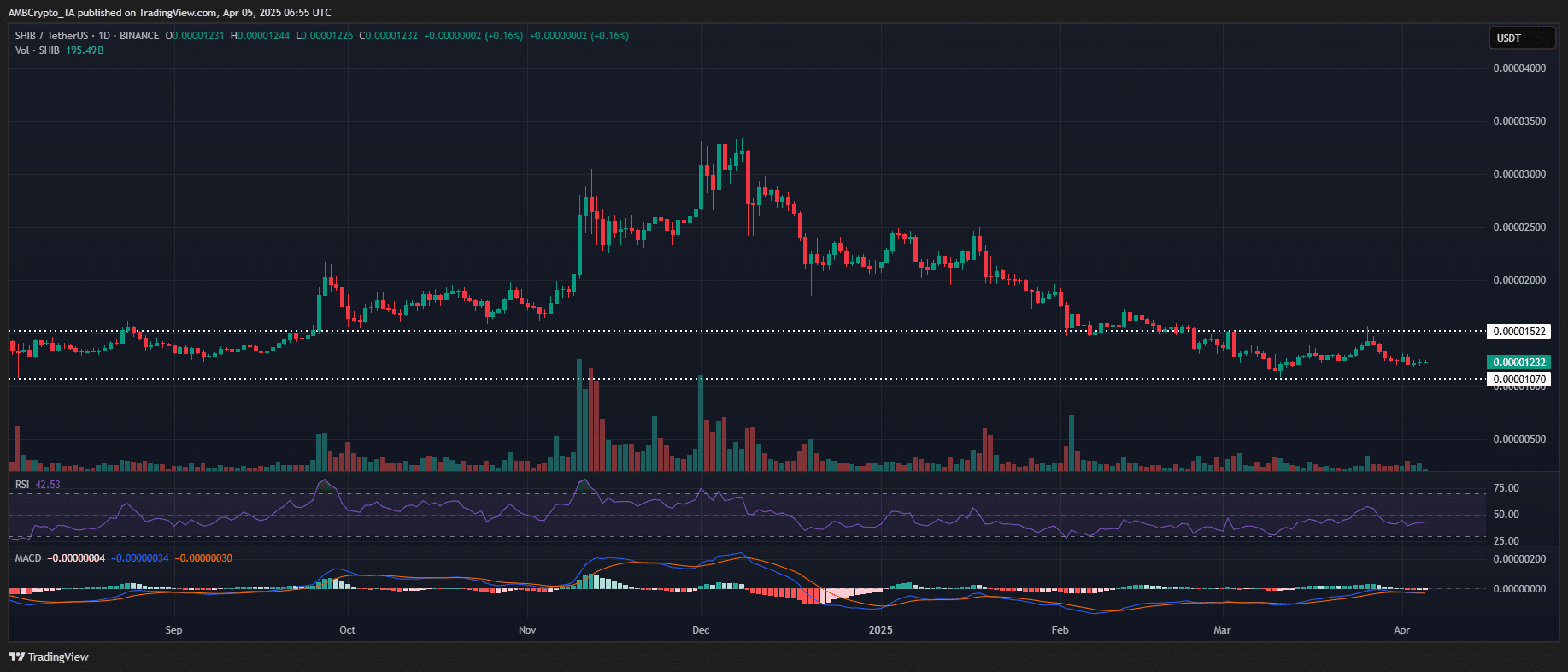

In fact, on the daily timeframe, SHIB has been in a month-long consolidation around $0.00001230, establishing a range-bound accumulation zone.

Notably, high-cap memecoins are also exhibiting similar range-bound structures, suggesting a ‘sector-wide’ liquidity reaccumulation phase.

Supporting this narrative, Coinglass data reveals that SHIB’s liquidity profile and market structure resemble early 2024 conditions, signaling Q2 upside potential.

However, to distinguish sustainable momentum from short-term “hype,” consistent monitoring of liquidity flows, open interest, and exchange reserves will be critical.

For now, both on-chain analytics and market structure dynamics suggest that memecoins are primed for a supercycle, outperforming traditional altcoins.

With tightening supply, increasing LTH dominance, and rising speculative inflows, the memecoin sector remains the high-volatility play to watch in Q2 2025.

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)