Is now the best time to invest in Bitcoin? SEC’s latest call says so!

- The SEC has approved the first leveraged MicroStrategy ETF

- Market indicators suggested an upward move for Bitcoin

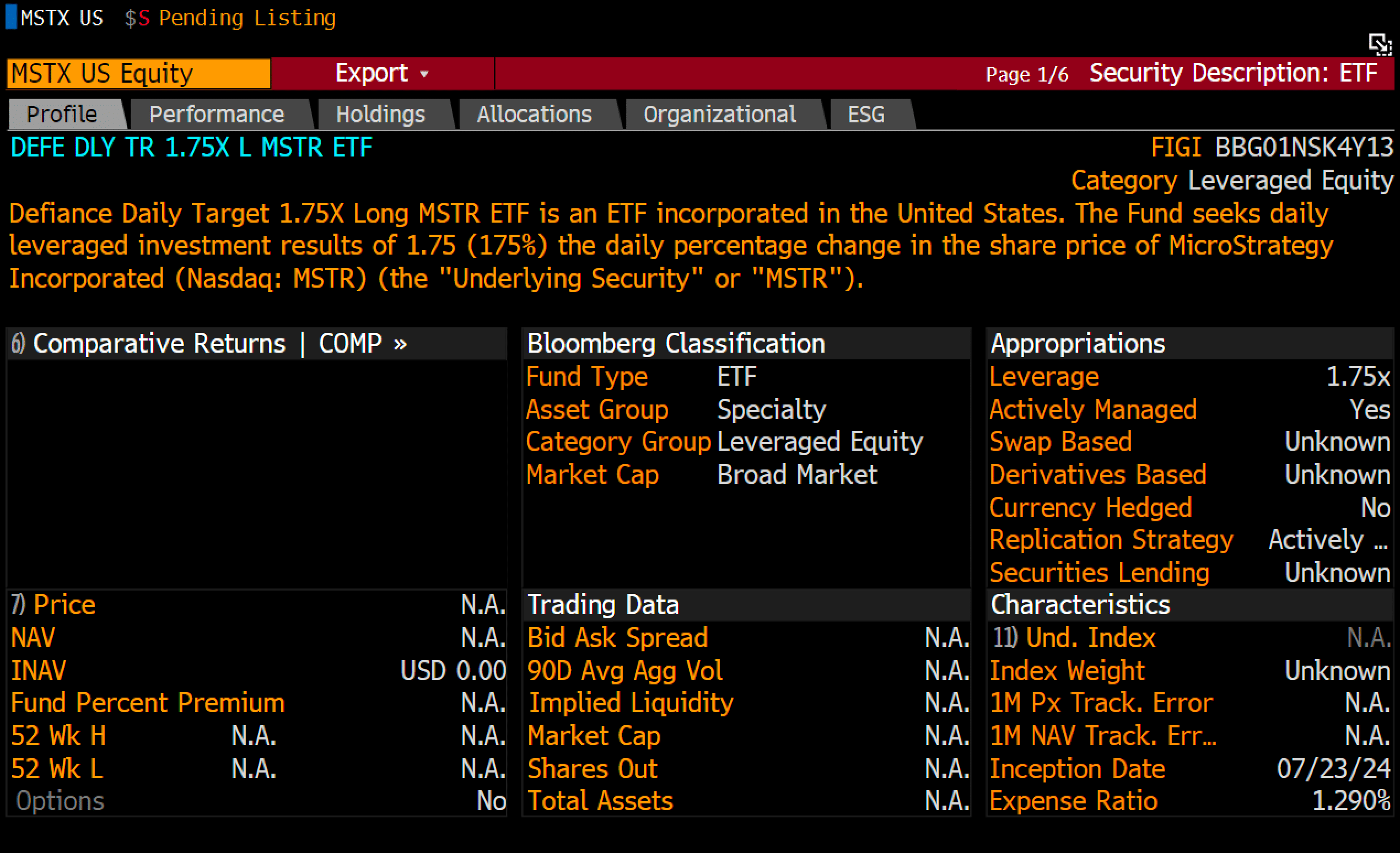

The SEC is in the news today after it approved the first leveraged MicroStrategy ETF, launched by Defiance as a 1.75x fund ($MSTX). This update was first shared by Bloomberg’s ETF Analyst Eric Balchunas on X.

Though initially intended as a 2x ETF, the SEC’s restrictions limit its leverage. This ETF will be highly volatile, similar to a 13x SPY ETF, surpassing even the $MSOX (2x weed ETF) in risk.

Defiance has beaten Tuttle to market with this product, although Tuttle is also attempting a 2x MicroStrategy ETF.

The market for highly volatile ETFs is strong, evident from the $5 billion Nvidia 2x ETF. This approval may be a sign of greater buying pressure and bullish sentiment for Bitcoin.

USD cycles, treasury, & BTC bull markets

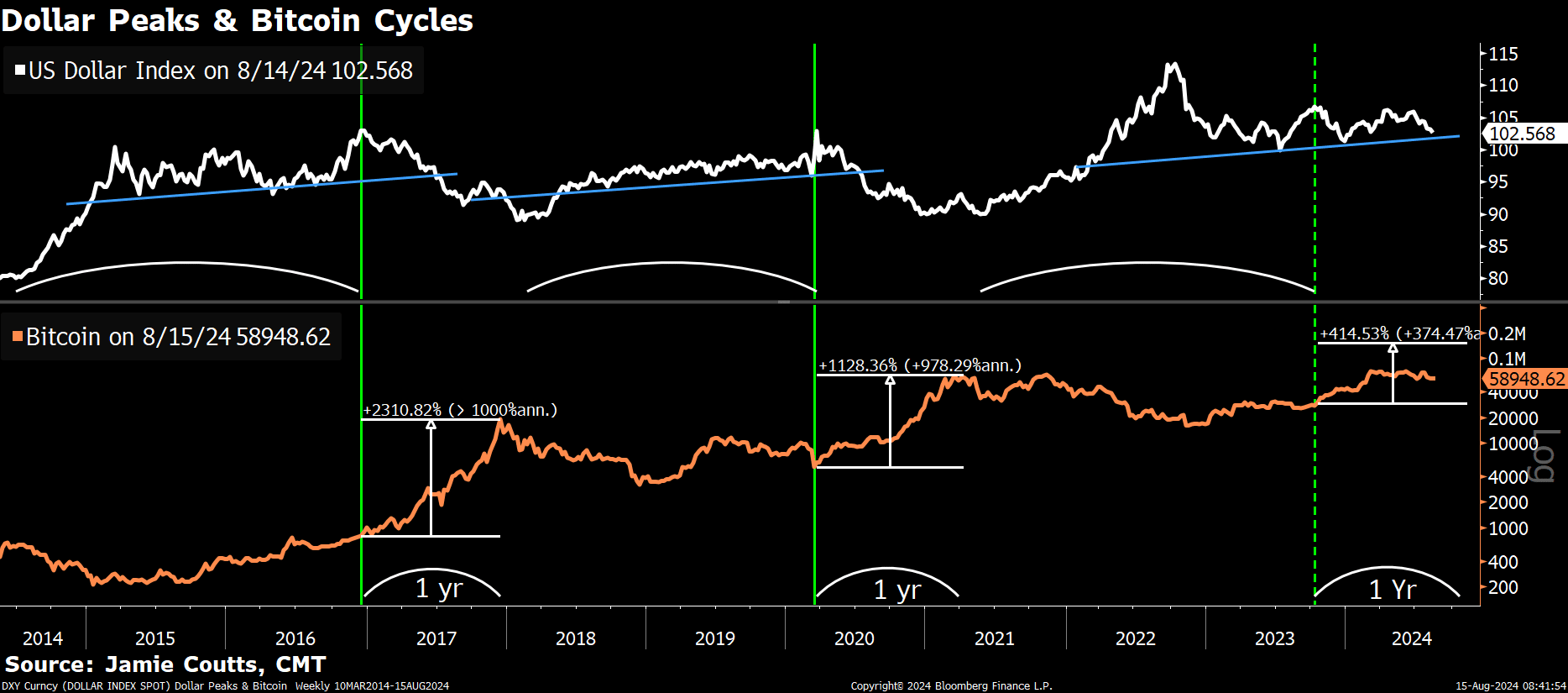

Bitcoin [BTC] tends to rise most sharply when the U.S dollar ($DXY) weakens. The Federal Reserve’s actions and increased global liquidity are likely causing the DXY to decline.

The DXY has now hit equal highs, indicating a potential reversal. As the DXY drops, Bitcoin is expected to climb higher, potentially surpassing its all-time high on the charts.

Treasury market volatility is a crucial yet often overlooked factor in shaping risk asset strategies. It’s a major concern for Federal Reserve Chair Jerome Powell and his team.

To prevent market instability, they aim to reduce treasury volatility. As a result, this suppressed volatility may shift to Bitcoin, potentially driving its price higher.

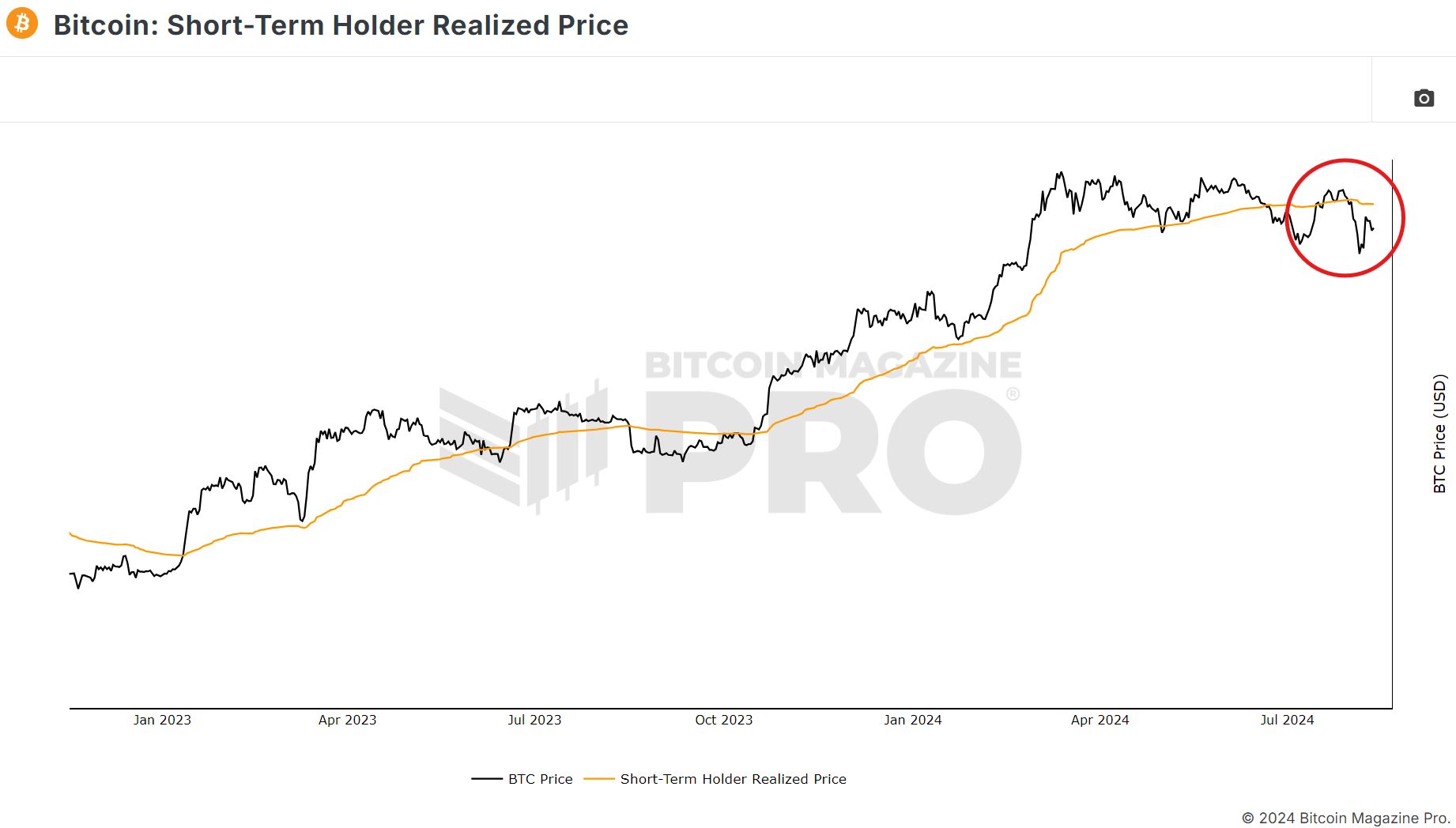

Bitcoin is demonstrating strong momentum too, breaking above the Short-Term Holder Realized Price of approximately $65K.

If this level is reclaimed on the charts, it could serve as a foundation for Bitcoin to push towards the $70,000-mark and possibly beyond. This performance reinforces Bitcoin’s position as a top choice for crypto investment.

Leverage liquidations and RSI signal bullish sentiment

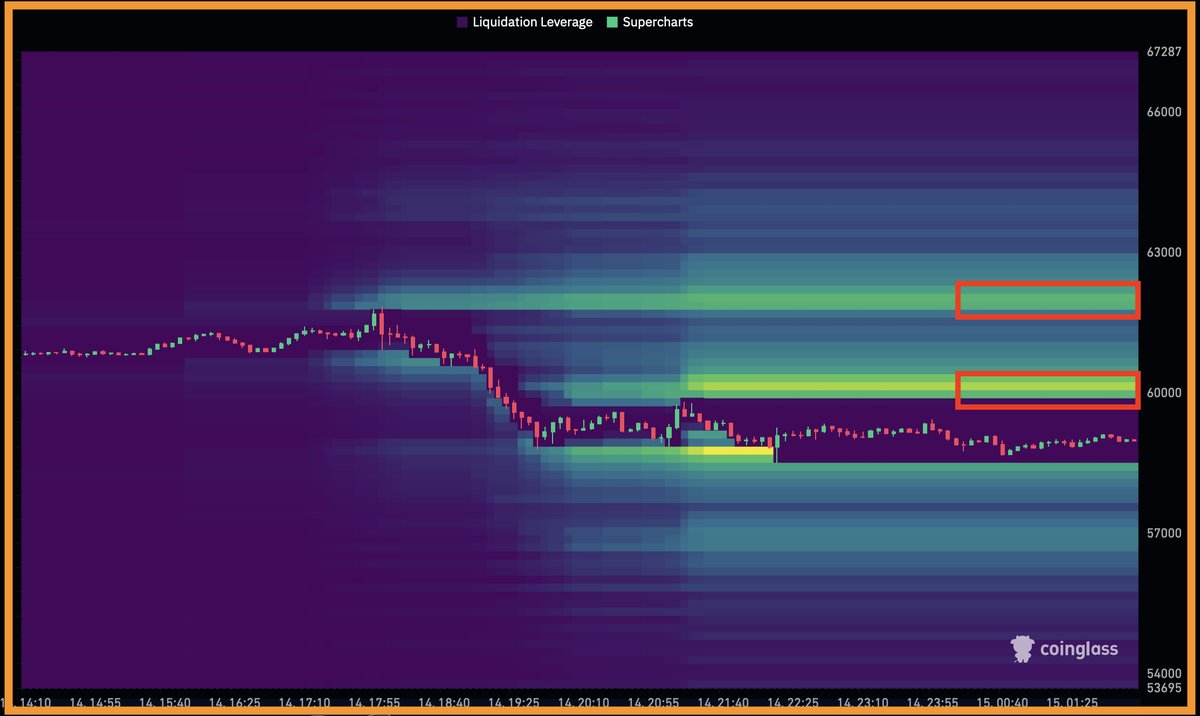

Leverage liquidation hunting is a key factor causing price movements across high timeframes.

Bitcoin could climb and hold above $60k to trigger liquidations, where $93 million is positioned between $60-60.4K, and another $75 million between $61.8-62.2K.

This could drive Bitcoin to surpass its previous all-time high of $74,000, potentially leading to even higher prices.

Finally, Bitcoin’s Stochastic RSI signaled that BTC will enter a “Rebound Zone” in the coming months. This is a key opportunity for traders and investors to accumulate Bitcoin before a potential surge in its price.

What this indicator also implies is a high likelihood of BTC hitting new highs, reinforcing the idea that now is a strategic time to invest in Bitcoin.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)