Is Polygon losing its grip in the DeFi space? Arbitrum has the answer

- Arbitrum outperformed Polygon in the dApp space.

- A decline was observed in Polygon’s overall dApp activity and TVL.

According to recent data provided by Delphi Digital, it was observed that Arbitrum overtook Polygon in terms of Gains Network usage. Well, Gains Network, is a decentralized leverage trading platform.

As dApps continue to get drawn to various L2s, it could impact the overall dominance of Polygon in the DeFi space.

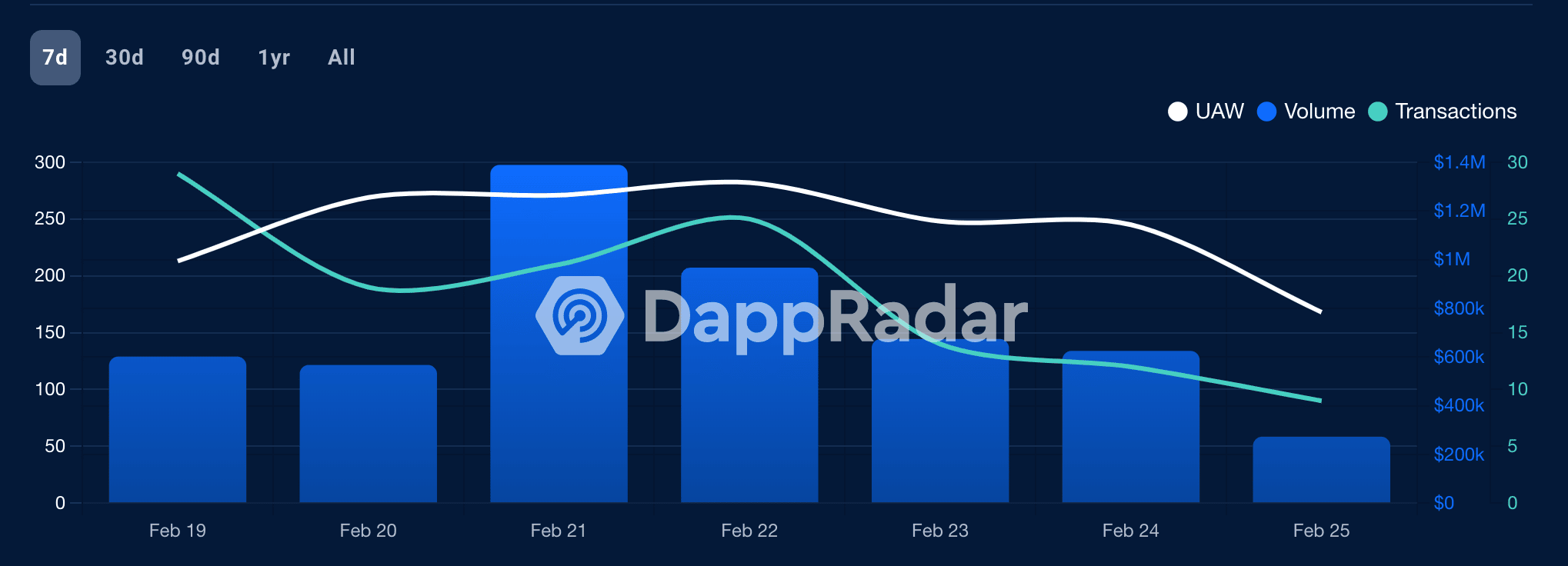

According to Dapp Radars data, the volume of the Gains Network fell by 32.79% over the last week. This was a direct result of a decline in daily active wallets which also decreased by 16.32% in the same period.

Read MATIC’s Price Prediction 2023-2024

Other dApps such as Balancer and Meshwap too registered a decline in activity.

Effects on the ecosystem

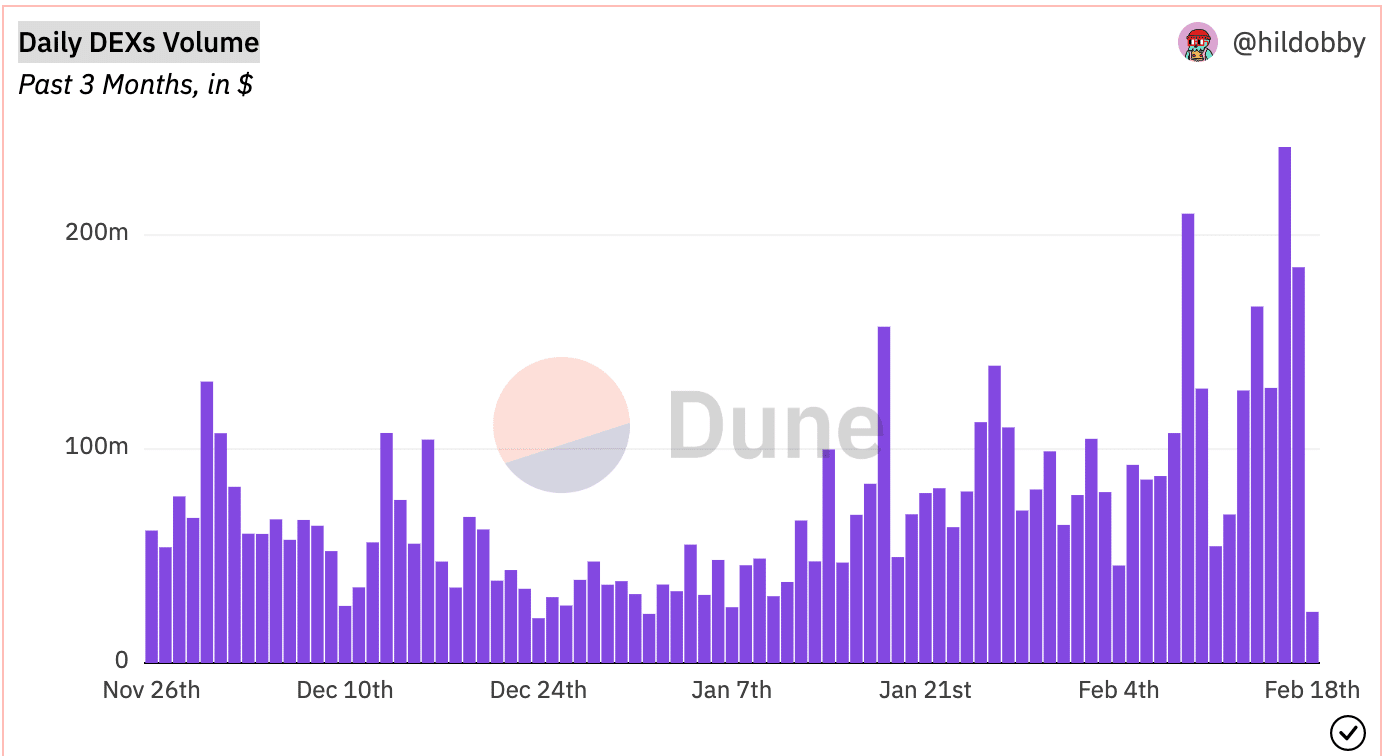

The overall DEX volume on Polygon started to go on a downward trajectory. It fell from $128.63 million to $23.9 million over the past few days, according to data provided by Dune Analytics.

Cumulatively, all of these factors impacted Polygon’s total value locked (TVL). Based on DeFiLlama’s data, the overall TVL of Polygon fell by 0.28% in the last 24 hours. At press time, it stood at $1.15 billion.

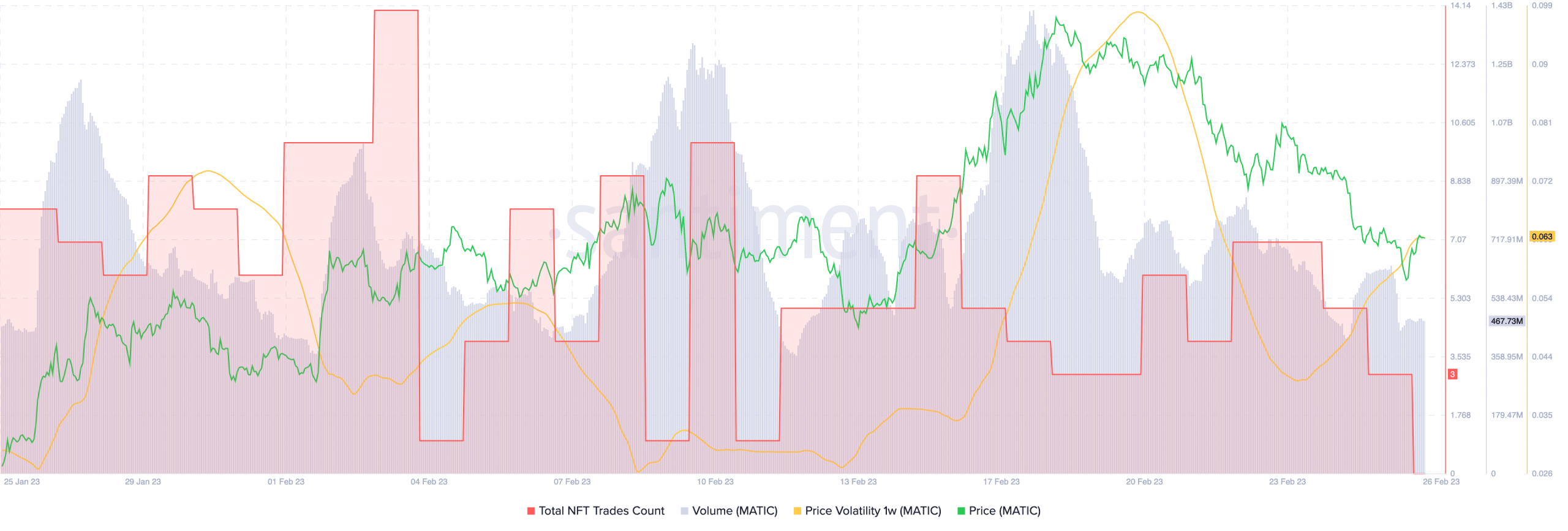

The decline in TVL suggested investors’ decreasing interest in the Polygon network which was further backed up by the falling number of NFT trades.

MATIC gets impacted

Consequently, Polygon’s token MATIC was also severely impacted. Its volume, over the past few days, fell from 1.4 billion to 463.73 million. This decline in volume correlated with a decline in MATIC’s price.

Is your portfolio green? Check out the Matic Profit Calculator

Due to this fluctuation in price, the volatility metric of MATIC increased. It’s well known that high volatility for MATIC would prevent many risk-averse investors to buy MATIC.

In conclusion, it remains to be seen whether the decline in Polygon’s activity is just a temporary setback. If the decline in interest and activity continues, it would have adverse effects on both the Polygon network and the MATIC token.