Is SEC giving Binance the side-eye? BNB has the answer

As regulatory activities begin to rally within the cryptocurrency space, the mantle of battling the Securities and Exchange Commission (SEC) has now been passed to Changpeng Zhao, the CEO of Binance.

On 6 June, it was reported that the SEC has launched an investigation into whether Binance Holdings Ltd, the owners of BNB tokens broke securities law when it offered the tokens for sale in an Initial Coin Offering (ICO) in 2017. The SEC seeks to determine whether the sale of the BNB tokens amounted to the sale of security required by law to be registered with the commission.

In a statement, Binance stated that “It would not be appropriate for us to comment on our ongoing conversations with regulators, which include education, assistance, and voluntary responses to information requests.” The company added that it works with authorities and will continue to meet all requirements set by regulators.

In light of this development and the possibility of a long-drawn legal battle between Binance and the SEC, how has the BNB token performed in the last 24 hours?

Look CZ, BNB holders are selling!

Down 8.56% in the last 24 hours, holders of the BNB token seem to be disposing of the coin. Trading volume in the last 24 hours was spotted at a high of 78.29% at the time of writing. With a decline in price, this only points to one thing; investors are selling off the BNB token in their numbers.

At $46.28b at press time, the market capitalization of the BNB token also saw about an 8% decline in the last 24 hours.

A look at movements on the price charts revealed that the token has been struggling to keep the bears away for the past 24 hours. Headed downwards, the Relative Strength Index (RSI) at press time, was spotted at the 37 region. Similarly, the Money Flow Index (MFI) was positioned below the 50 neutral regions at press time. With an MFI of 44 at the time of writing, the token was headed towards the oversold position.

On-chain analysis

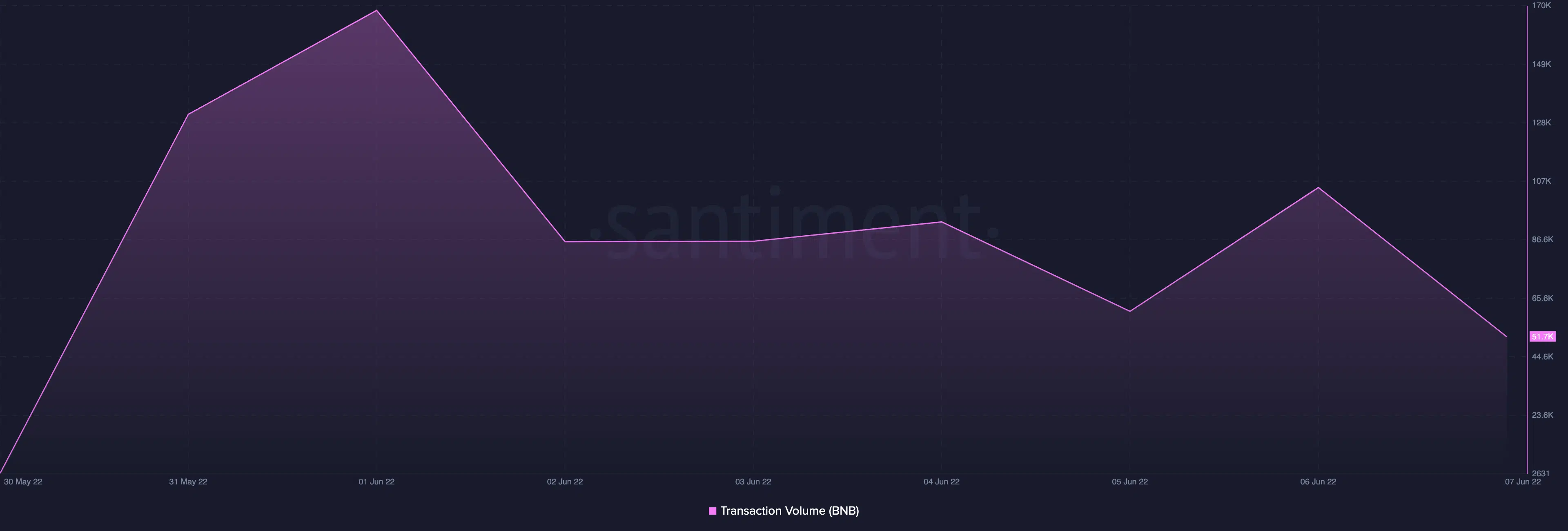

In the last 24 hours, transaction volume on the BNB network appeared to have been hit by a decline. At a high of 105.36k recorded on 6 June, a 50% decline has been registered in the last 24 hours.

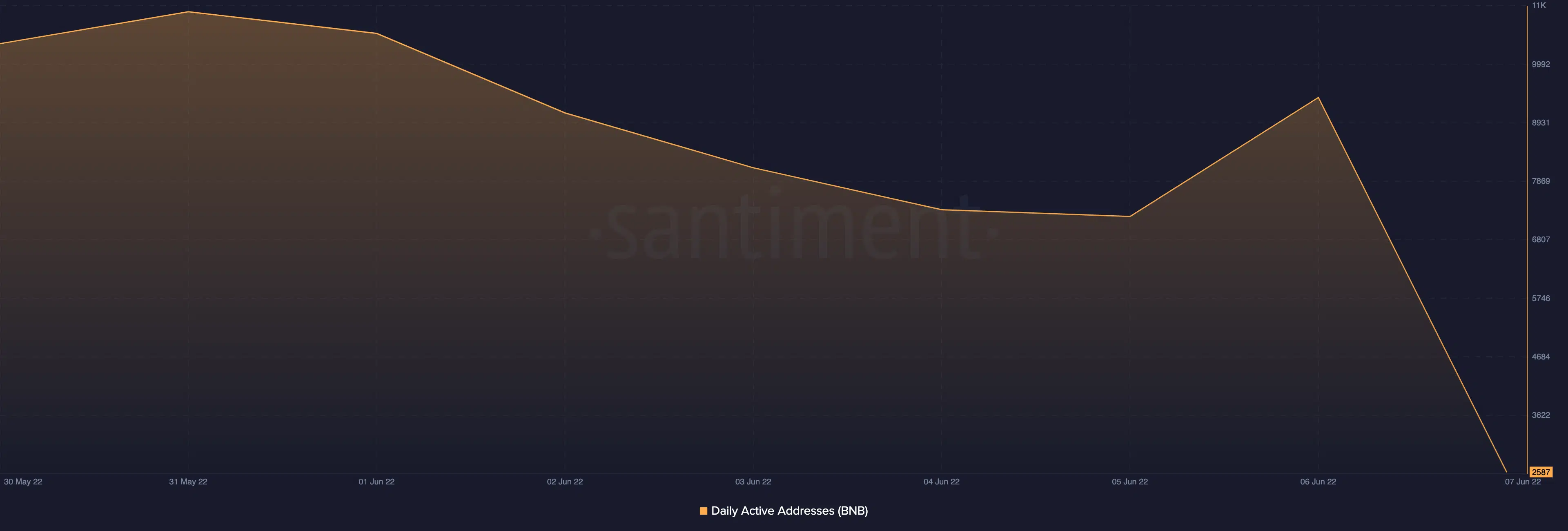

Daily active addresses on the network also saw a decline within the period under review. On Monday (6 June), a total of 9,388 addresses transacted the BNB token. However, at the time of press, this declined by 72% to be pegged at 2587.

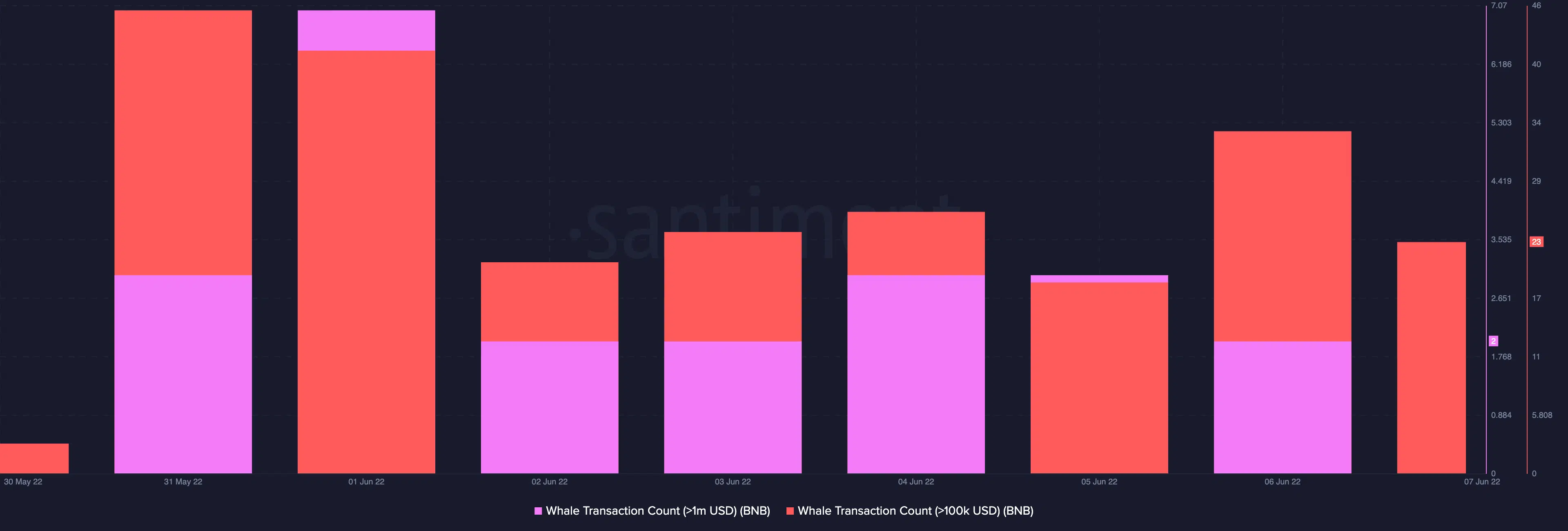

The whales also expressed their concerns over recent regulatory actions trailing the BNB token. Standing at 23 at press time, the count for whale transactions above $100k declined by 32% in the last 24 hours. Similarly, for whale transactions above $1m, no transaction had been recorded at press time.

Following the collapse of TerraLUNA’s UST, it appears regulators are taking a closer look at activities within the crypto space. On 6 June, a U.S. Crypto Bill was allegedly leaked. Whether this is real or not, there is no gainsaying in denying the fact that regulators are becoming increasingly interested in what is going on within the cryptocurrency ecosystem.