Is Shiba Inu about to fall off the Top 20 list?

- Wrapped Bitcoin flipped Shiba Inu and became the 18th-most valuable cryptocurrency in market value.

- Although the market is not exactly bullish on SHIB, buyers seemed committed to changing the notion.

According to CoinMarketCap, at press time, Shiba Inu [SHIB] had fallen to number 19 on the market cap standings. The memecoin primarily dropped because Wrapped Bitcoin [WBTC] was able to gain 2.42% in the last seven days, and its market cap jumped to 4.43 billion in this period.

Read Shiba Inu’s [SHIB] Price Prediction 2023-2024

SHIB, on the other hand, boasted a 1.83% increase, but its market cap was lower at $4.40 billion at the time of publication. Typically, the market cap is a function of a cryptocurrency’s value and circulating supply.

Expanding ecosystem, disappointing token

2023 has not been the best year for the memecoin. On a Year-To-Date (YTD) basis, SHIB has decreased by 12.75%.

However, this performance has been sort of surprising because of the optimism surrounding Shiba Inu earlier in the year. One reason for the good cheer was Shibarium.

Shibarium is the layer-2 network of the Shibarium ecosystem, built on the Ethereum [ETH] network. While the ecosystem has gone live, the surrounding hype did not meet expectations and SHIB’s price gained almost nothing from the launch.

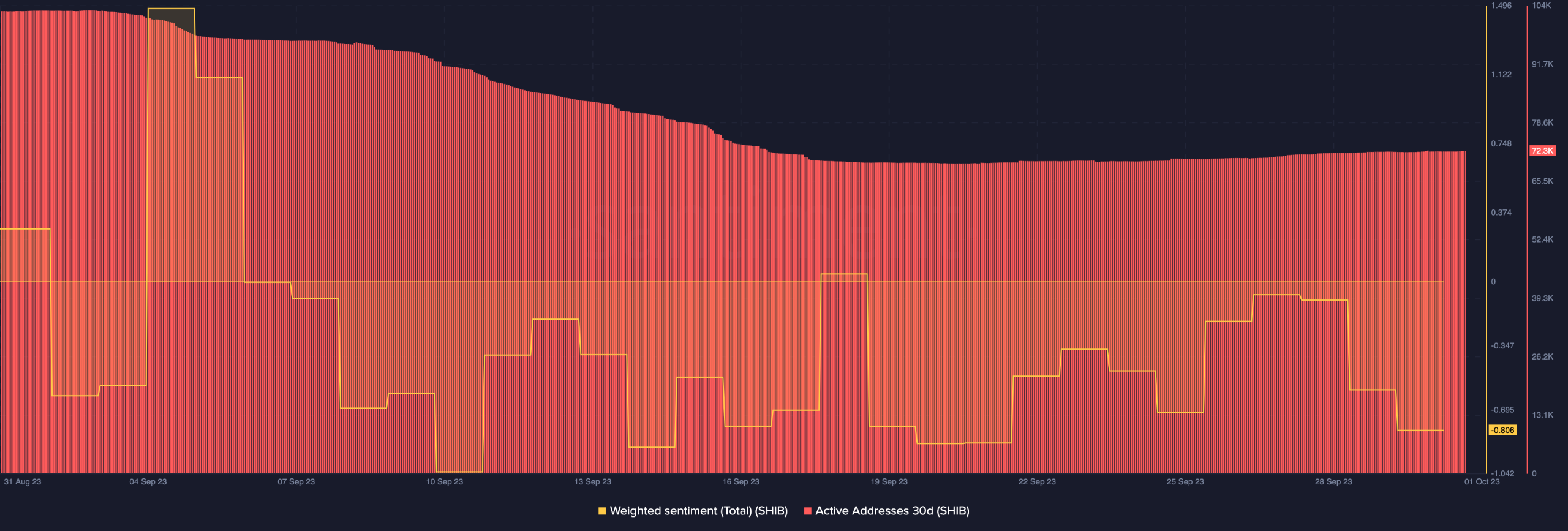

Furthermore, it was unlikely that Shiba Inu would recover from the downturn soon, and market players seemed to share a similar view. According to Santiment, SHIB’s weighed sentiment within the last 30 days had dropped to -0.806 at press time.

The weighted sentiment metric considers the unique social volume pertaining to the perception the market has about a cryptocurrency. When the metric is positive, it means that participants are bullish on the asset.

However, SHIB’s negative sentiment suggested a bearish stance in the broader market at the time of writing.

Within the same period, activity on the Shiba Inu network decreased. Considering the chart above, active addresses as of 1 September numbered 103,600. At press time, it was 72,300.

The decrease means that market players have significantly refrained from interacting with the Shiba Inu network at press time. Hence, speculation around the SHIB token also reduced.

Buyers to the rescue?

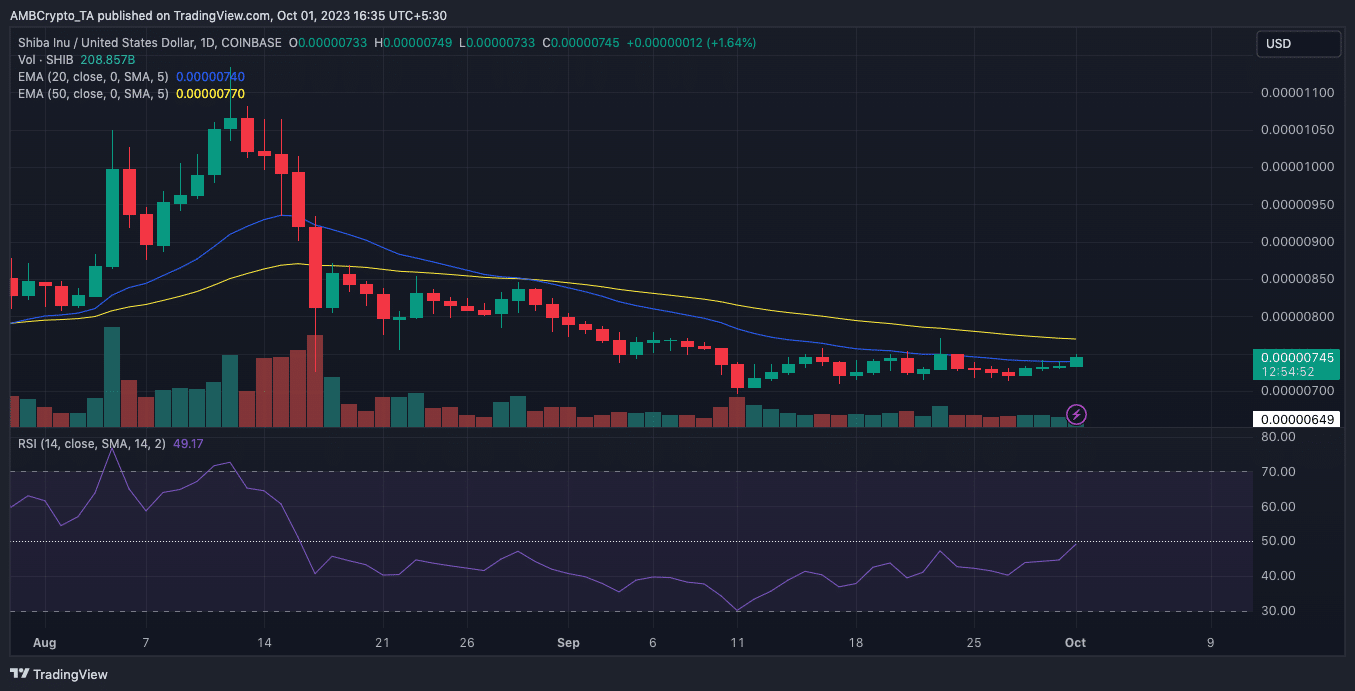

From the technical perspective, SHIB may either continue to consolidate or experience a downtrend. This was because of the Exponential Moving Average (EMA).

At the time of writing, the 20 EMA (blue) had crossed below the 50 EMA (yellow). This indicated a bearish bias, as it seemed that sellers have been in control since 30 August.

Is your portfolio green? Check out the SHIB Profit Calculator

However, the Relative Strength Index (RSI) was 49.17. This indicated a rising buying momentum. If the RSI crosses the 50.00 ceiling, then SHIB’s price might increase, and sellers could be put out of authority.

Considering the difference between WBTC and SHIB, a 10% price increase could be enough to get Shiba Inu back to the 18th position. Also, selling pressure has to be intense for the meme to fall to number 20.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)