SOL [Solana] is the new ADA [Cardano]? Decoding the possibilities

Remember the good old times when Solana was the hot blockchain making headlines and promising to be the Ethereum killer? The days when SOL was one of the fastest-growing cryptocurrencies. Times change and rather than maintain strong performance, SOL’s price action has lately been looking a lot like that of ADA.

SOL delivered quite an impressive rally in the first half of 2021 as its blockchain enjoyed robust growth and adoption. That growth was strong enough to support SOL’s upside even at times when the rest of the market was in the red. Unfortunately, Solana faced a lot of woes since then, especially with multiple technical challenges blocking its shine and casting a cloud of doubt among investors.

The bear market combined with the aforementioned factors has had a rough impact on SOL’s price action. It has been severely bearish ever since it peaked in November 2021, hence similarities with ADA, another cryptocurrency that has been heavily bearish.

SOL managed to rally from a weekly low of $40.33 to $45 at press time. This is a small price gain relative to the gains that some of its rivals have achieved during the weekend rally. This highlights SOL’s low upside which has been the case for the last few months.

The slight uptick during the weekend reflects an RSI bounce-back just above the oversold zone. The MFI registered slight accumulation which aligns with the weak bullish action. SOL currently lacks directional strength as highlighted by the MFI.

Will SOL shine again?

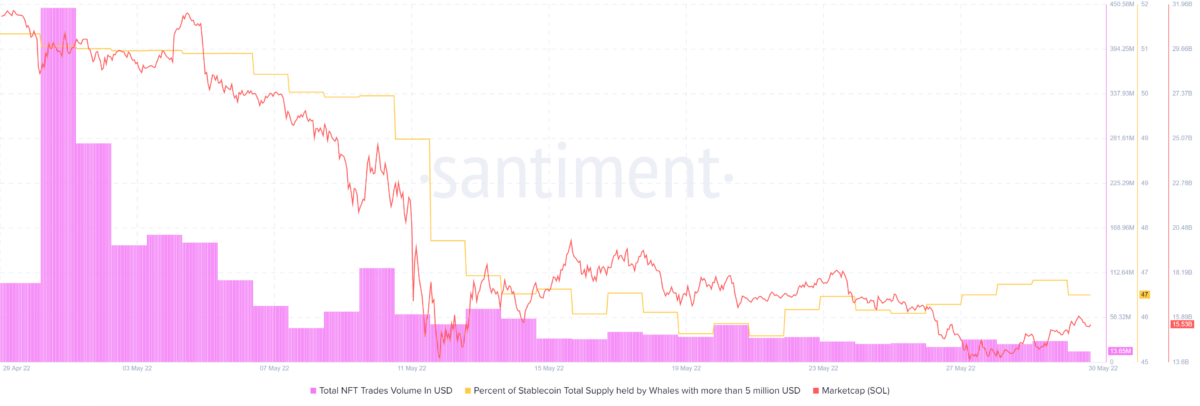

SOL has certainly seen brighter days but the latest events may have dimmed its spark. However, it looks like the worst might be over for SOL as indicated by some of its on-chain metrics. Consider this- the supply held by whales metric registered outflows in April and the first two weeks of May. However, it seems to have bottomed out between 19 and 23 May, after which it registered significant inflows.

It, however, seems that the whale accumulation did not yield any significant upside. This outcome suggests that most of the accumulation was canceled out by retail sell-offs. The supply held by whales registered some outflows in the last between 29 and 30 May, explaining why the price failed to achieve a significant upside. SOL’s market cap also experienced slight outflows during the same period.

Moreover, supply dynamics clearly contributed to SOL’s price action this weekend. However, Solana is still growing and improving from its challenges. SOL will likely regain favor with investors in the future. The accumulation near the lower price levels is a sign that there are still healthy levels of investors’ interest.