Solana could drop by 37% – THESE levels explain why and how

- SOL could drop by 37% to reach the next support at $77 if it fails to hold the $118 level.

- Traders have built $127 million worth of short bets, hoping the price won’t rise above $128.

Solana [SOL] appears to be weakening amid market uncertainty. The asset has already lost over 56% of its value from its peak in January 2025 and is now poised for a significant price decline due to bearish market sentiment.

Amid the ongoing market slump, SOL has recorded a 2% price drop in the past 24 hours and was trading near $123.50 at the time of writing.

Solana price analysis and key levels

Following its recent price decline, Solana has reached a critical level that may determine its next move.

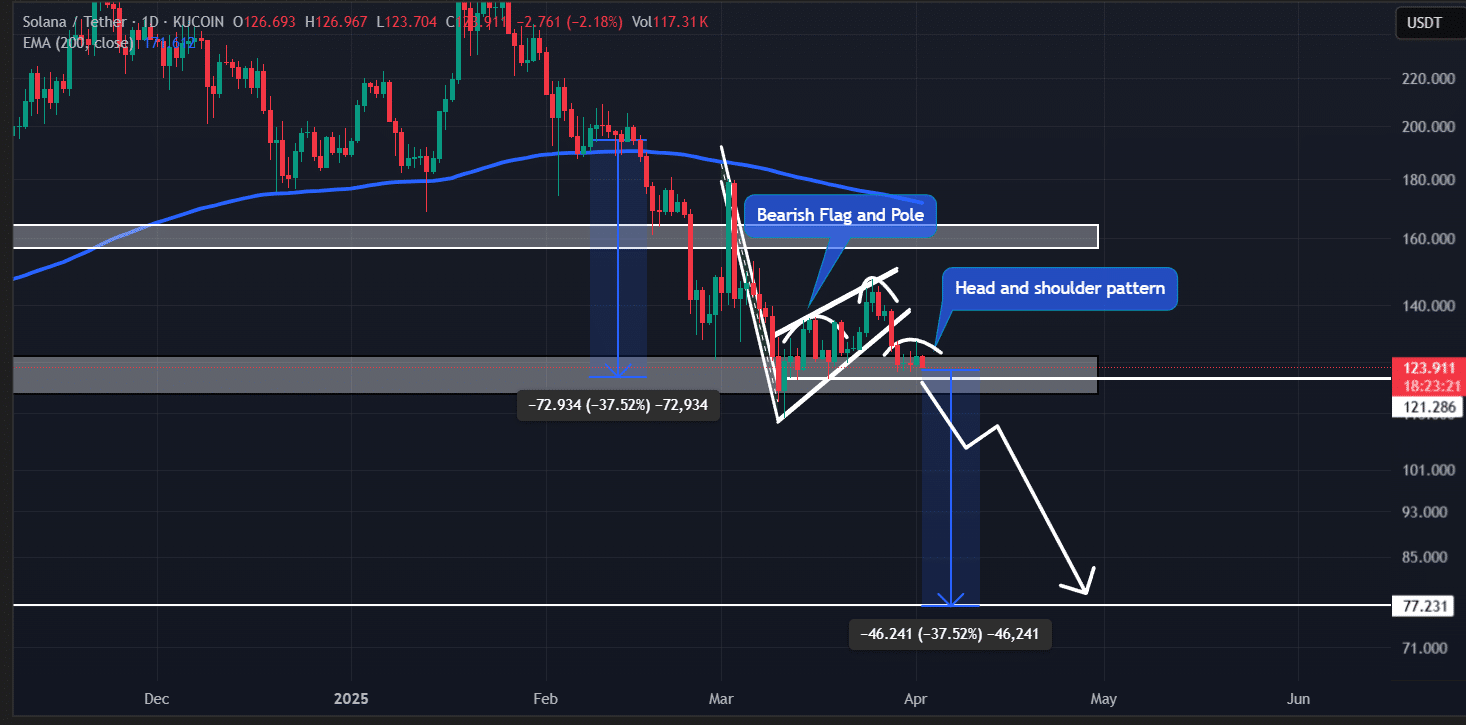

According to expert technical analysis, SOL has broken out of a bearish flag-and-pole price action pattern and has successfully retested the breakdown level.

During this retest, SOL also formed a bearish head-and-shoulders pattern with a neckline at $118—a pivotal level that has held significance for an extended period.

Considering recent price action and the prevailing bearish sentiment, Solana faces critical levels ahead.

If SOL continues its decline and closes a daily candle below the $118 level, it could drop significantly—by 37% —to test the next support at $77.

The $112 level has historically acted as a strong support, often leading to price reversals. However, given the heavily bearish sentiment, this reversal may be less likely.

On the other hand, if SOL maintains its position above the $118 level, there is potential for a rebound, with history suggesting a recovery might follow.

At press time, SOL was trading below the 200 Exponential Moving Average (EMA) on the daily chart, reflecting a bearish trend and continued weak price action.

$127 million of bearish bet

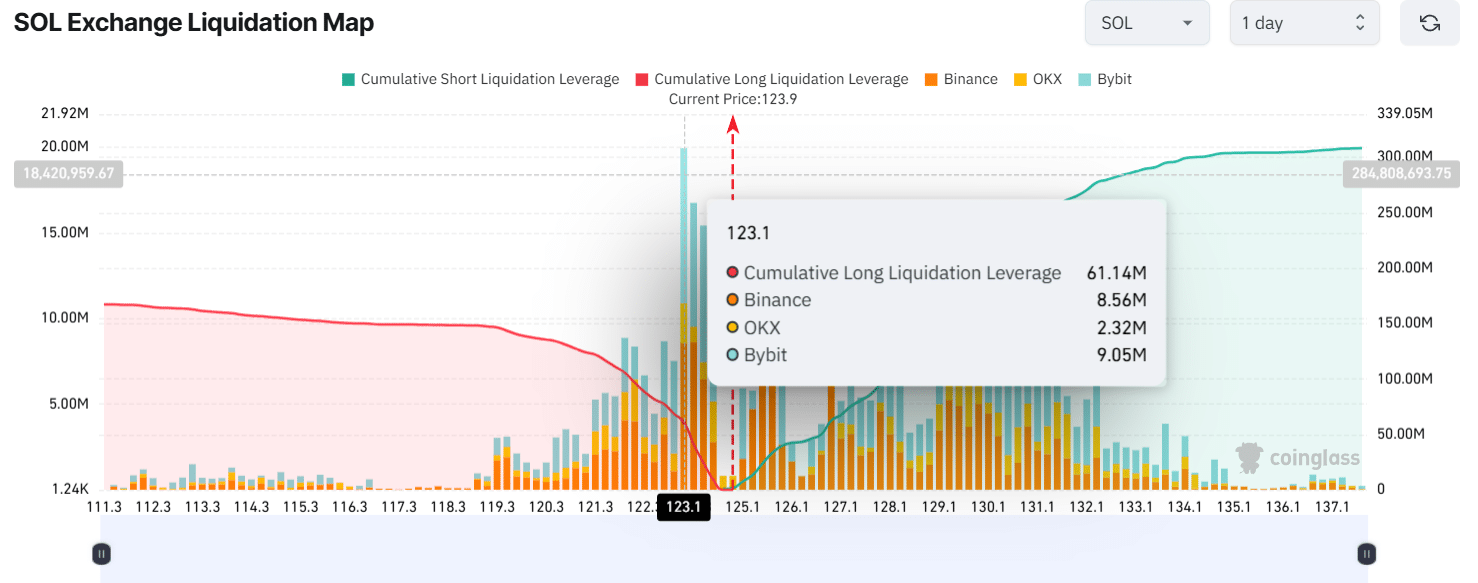

Looking at the market sentiment, traders appear to be following the trend and are strongly betting on the bearish side, as reported by the on-chain analytics firm Coinglass.

Data revealed that traders were over-leveraged at the $123 level on the lower side and $128.3 on the upper side, holding $45.60 million and $127 million worth of long and short positions, respectively.

This significant bet on the short side defines traders’ bearish outlook, as they are more than double the amount of long positions.

Whales’ recent activity

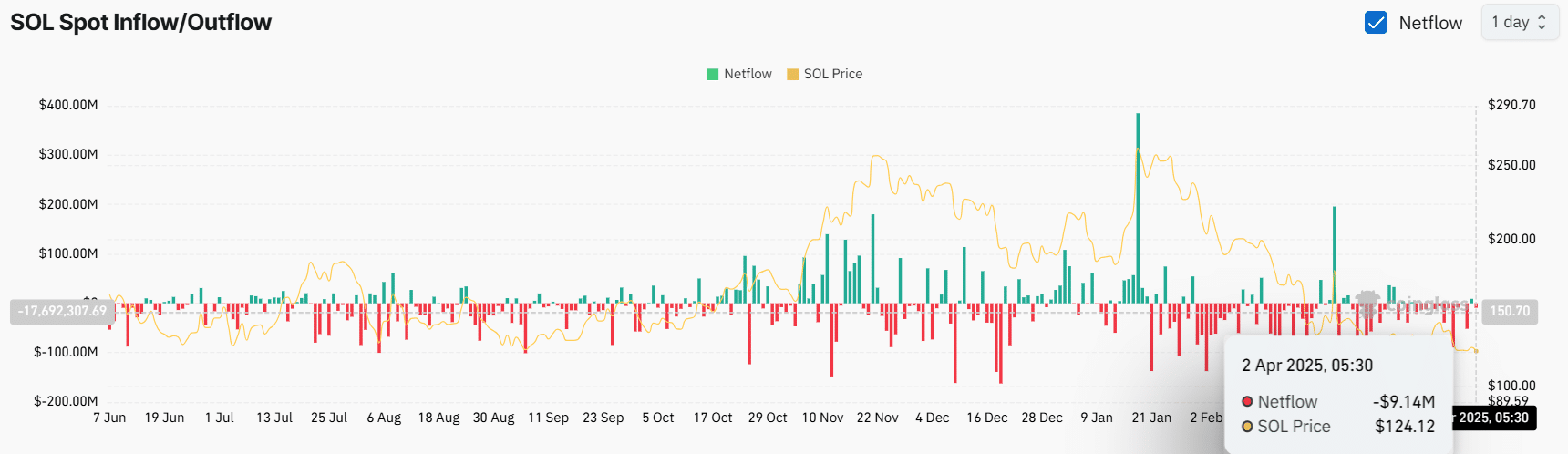

In the meantime, whales see this as an ideal opportunity and are accumulating tokens.

According to Coinglass’s spot inflow/outflow metrics, exchanges have witnessed an outflow of $9.15 million worth of SOL in the past 24 hours. This indicates potential accumulation, which could help SOL maintain this level.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)