Is Solana ready to bounce back, or is Q2 echoing its Q1 slump?

- Solana’s sharp decline in Q1 has raised concerns about the asset’s future direction.

- Without a clear catalyst for recovery, further downside could be on the table.

Solana [SOL] kicked off 2025 with a tough Q1, dropping 34% and losing $100B in market cap, wiping out all the gains from the pre-election hype.

Now, back to its September 2024 low, will Q2 be any different, or is the risk of high-stakes sell-offs still too strong?

Risk of capitulation grows as FOMO fades

Solana, like many high-cap assets, has struggled due to a combination of macro and microeconomic factors. However, its Q1 downturn stands out as one of the most severe among major assets.

From a technical perspective, Solana’s 1D price chart lacks clear support levels. Without strong bullish demand at key levels, the asset faces a high risk of further declines, especially if HODLing sentiment weakens.

At the time of writing, Solana’s has reached a two-year high, with only 32% of the supply in profit. This imbalance increases the likelihood of a sell-off, as underwater holders may be more inclined to capitulate.

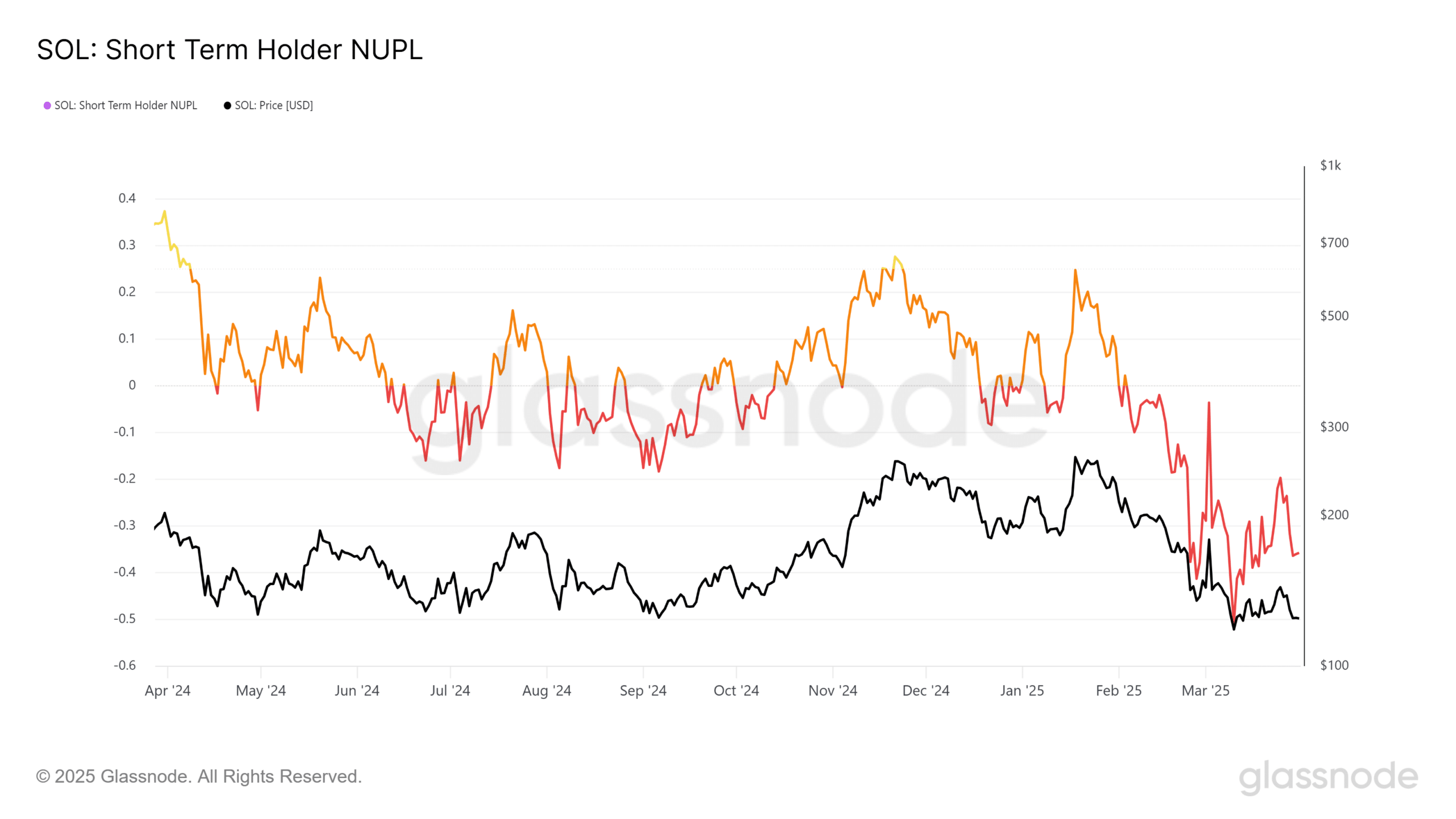

The Net Unrealized Profit and Loss (NUPL) metric indicates that Short-Term Holders (STH) have entered a capitulation phase. This could trigger a wave of sell-offs.

If the broader market fails to recover soon, Solana’s network may experience significant liquidity outflows.

Historically, Solana has only found a local bottom when it enters the hope/fear phase, where FOMO kicks in and market confidence returns. Without this shift, sell-side pressure could continue, and the risk of further declines remains.

Adding to the bearish outlook, the SOL/BTC pair has erased its mid-March gains, with a sharp weekly decline.

At press time, the MACD was on the verge of flipping bearish, signaling that SOL could soon test its $115 support.

Can Solana turn it around in Q2?

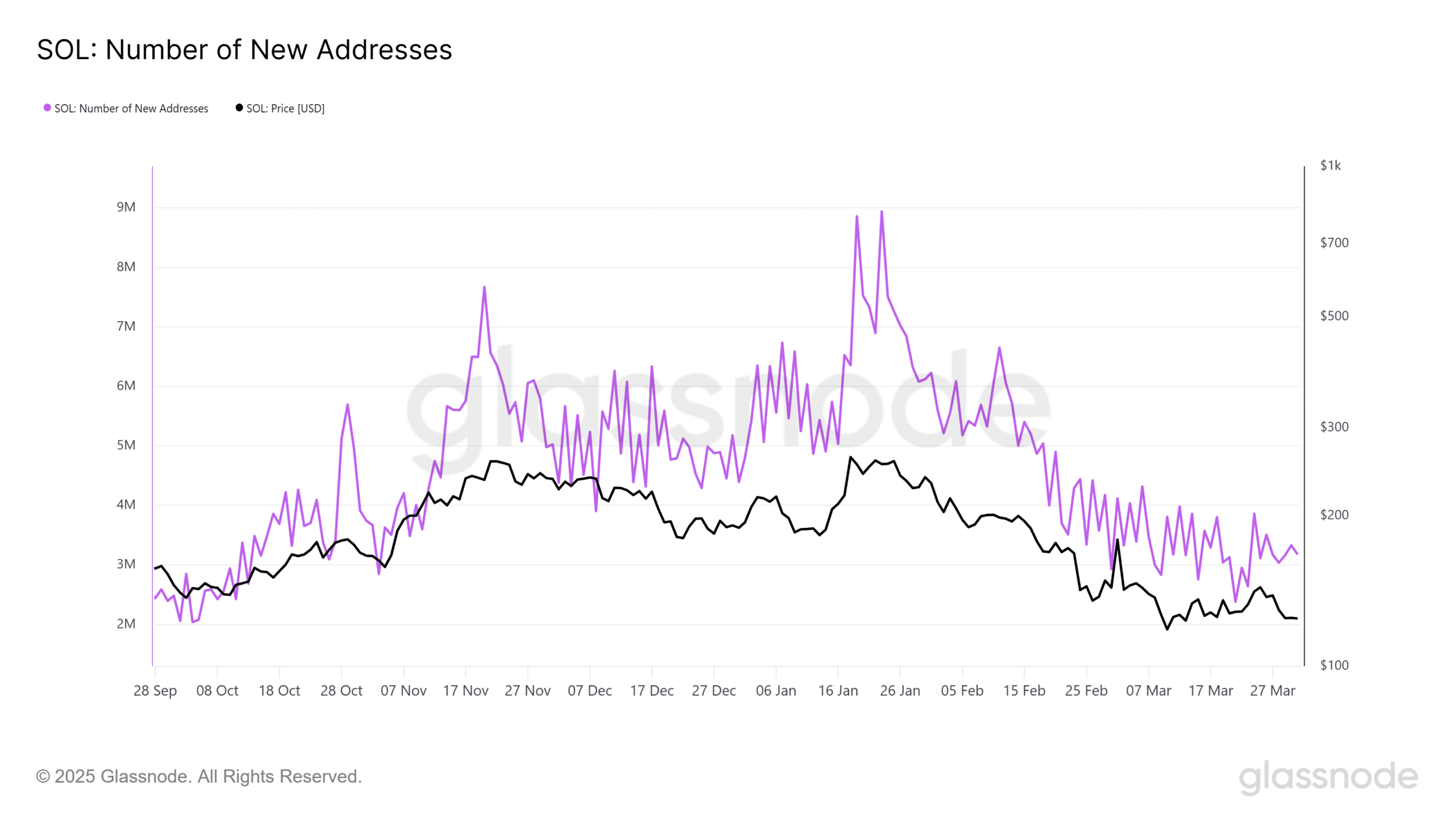

Solana started Q1 strong, with new addresses surging to 8 million by mid-January, but momentum has sharply declined, and the count has dropped to a six-month low of just 312k.

Earlier in the quarter, Solana saw impressive spikes in staking and DEX volume, signaling healthy investor engagement. However, both metrics have since fallen significantly, dropping well below their pre-election highs.

With rising capitulation fears and a lack of spot accumulation, Solana is at risk of losing the $115 support.

Unless there’s a shift in sentiment or a catalyst to spark demand, expecting a bullish Q2 seems increasingly too far- fetched.