Is sticking to XRP the key to long-term gains?

- An analyst opined that investors should consider holding XRP.

- XRP’s price action tilted toward the bearish area but network activity improved.

As investors constantly seek strategies to maximize their long-term gains, crypto analyst Michaël van de Poppe has opined that participants should look no further than Ripple [XRP]. According to Poppe, investors can gain from XRP by using the Dollar Cost Averaging (DCA) strategy.

Read Ripple’s [XRP] Price Prediction 2023-2024

The DCA strategy is the practice of investing certain amounts of money in set increments instead of allocating a whole sum at once. Before his latest tweet, Poppe has regularly opened up about his bullish stance on XRP since the token partially won against the U.S. SEC

A token for the future, not the present?

Despite facing regulatory challenges and market fluctuations, XRP remained a prominent player in the crypto space, rising as high as 49.22% in the last 30 days. However, the rumors that the SEC could appeal the case have drawn attention from skeptics.

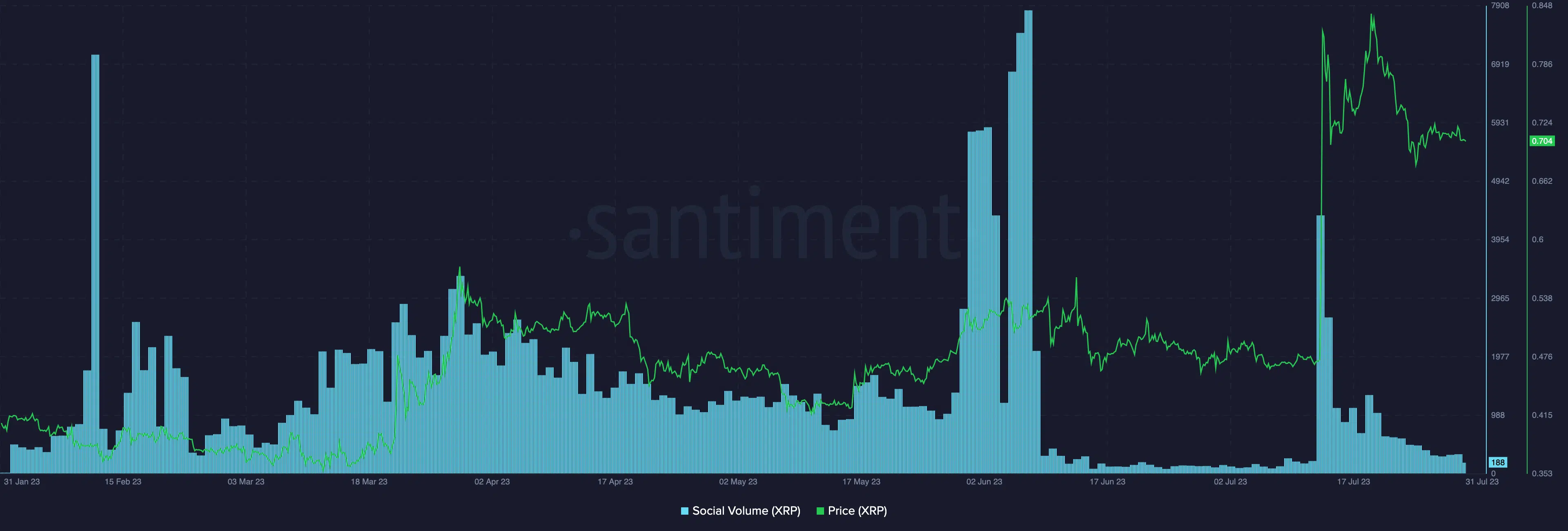

As a result of this sentiment, XRP’s social volume fell to 188. Social volume measures the number of search terms connected to an asset. So, the decrease in XRP’s social volume means that mentions about the asset were less than it was a few weeks back.

As per the price action, the Bollinger Bands (BB) showed that XRP exhibited a high level of volatility. So, in the short term, XRP’s price could swing between highs and lows.

But looking at the Moving Average Convergence Divergence (MACD), XPR might most likely trend downwards. At press time, the MACD was -0.0124. Negative MACD values indicate that the 12-day EMA had outpaced the 26-day EMA.

This is a sign that the downward momentum is increasing. Besides the MACD, the Money Flow Index (MFI) decreased to 42.20. This indicates a fall in liquidity and the XRP price could be about to fall again.

Active addresses rise, circulation falls

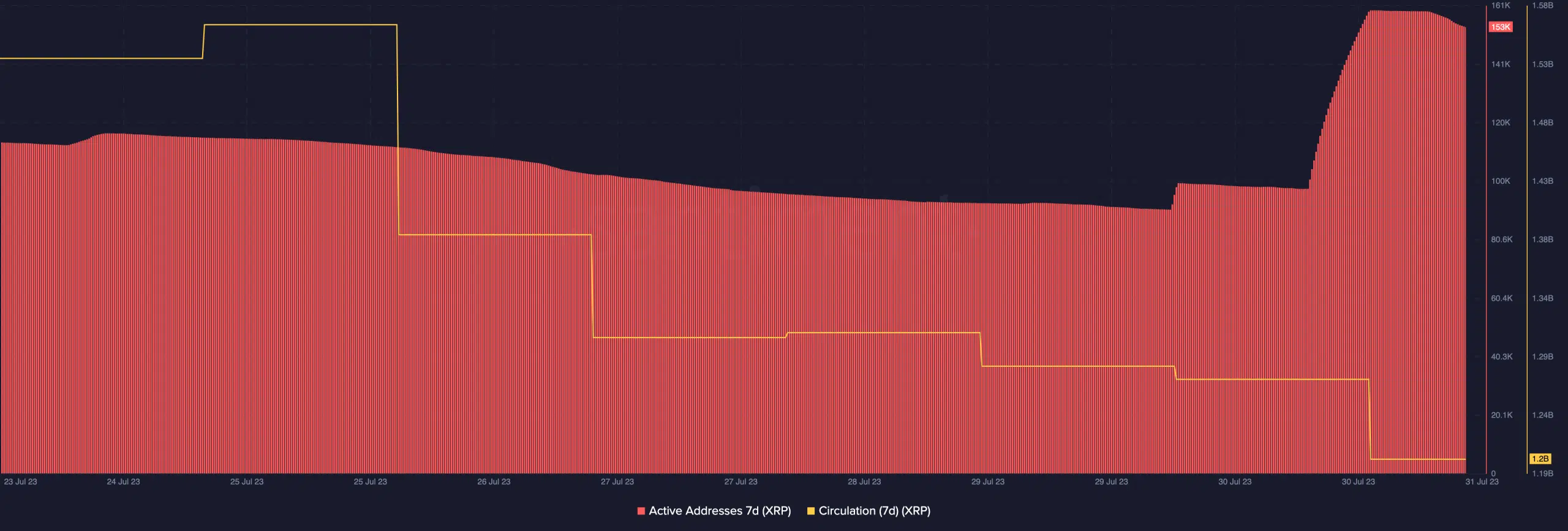

Meanwhile, Santiment data revealed that the XRP seven-day active addresses increased to 153,000. Active addresses show the number of unique addresses involved in the transfer of assets on a daily basis.

When the metric decreases, it means interaction with the token has decreased. Therefore, the hike in active addresses implies that speculation around the token was at a high level.

Is your portfolio green? Check the Ripple Profit Calculator

Despite the increase in active addresses, XRP’s seven-day circulation fell to 1.2 billion. Circulation shows the number of unique tokens used within a specific period. Conventionally, the decline in circulation means that participants have refrained from engaging XRP in transactions.

In conclusion, deciding whether to stick to XRP for long-term gains requires careful consideration and various factors including the potential use cases, regulations, and market conditions. Whether Poppe’s opinion would become reality or not, time will tell.