Is there enough momentum for UNI, COMP, MKR, and AAVE?

At this time around last year, the crypto-industry was waking up to the meteoric rise of Decentralized Finance of DeFi. It began with Yearn Finance and the concept of yield farming opening the floodgates to DEXs, lending, and several other protocols built on a transparent structure, rivaling the ethos of traditional financial markets.

Needless to say, there were many loopholes in the whole system as several hacks and rug pulls have been witnessed during that time. And yet, the idea of DeFi is far from obsolete and market movers are eagerly awaiting another such rally. At press time, some of the market’s most popular DeFi assets were indicative of another surgery as the market established a bit of a recovery over the past 24 hours.

AAVE, MKR, UNI, COMP taking the ‘Active’ charge?

Source: Twitter

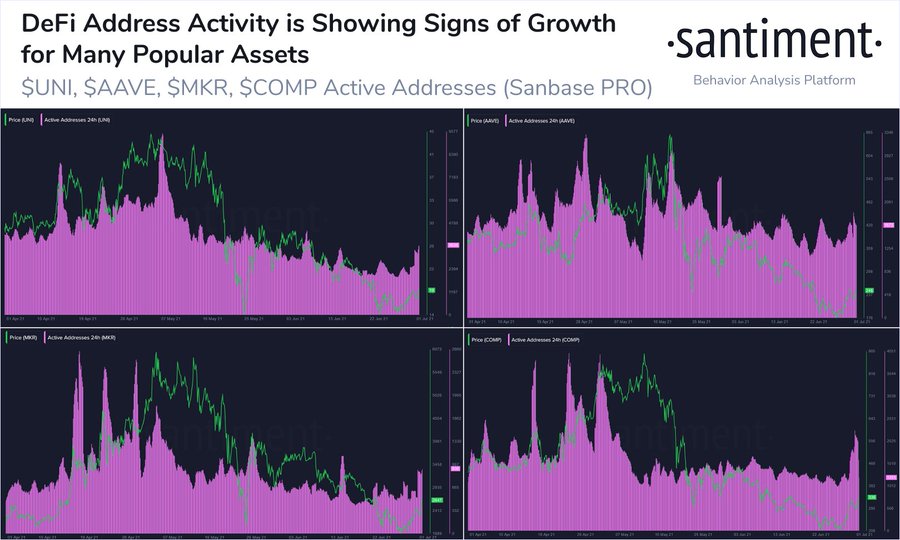

While the price action of the aforementioned assets was not exactly eye-catching, it is important to note that their on-chain fundamentals registered strong activity. According to Santiment, assets such as AAVE, MKR, UNISWAP, and COMP tokens witnessed a strong hike in active addresses over the last 24 hours.

While hype and speculation allowed several assets to rise up the rankings (Exhibit A: Dogecoin), over the past couple of years, strong on-chain performance has been key towards price appreciation since it brings legitimate adoption to the industry.

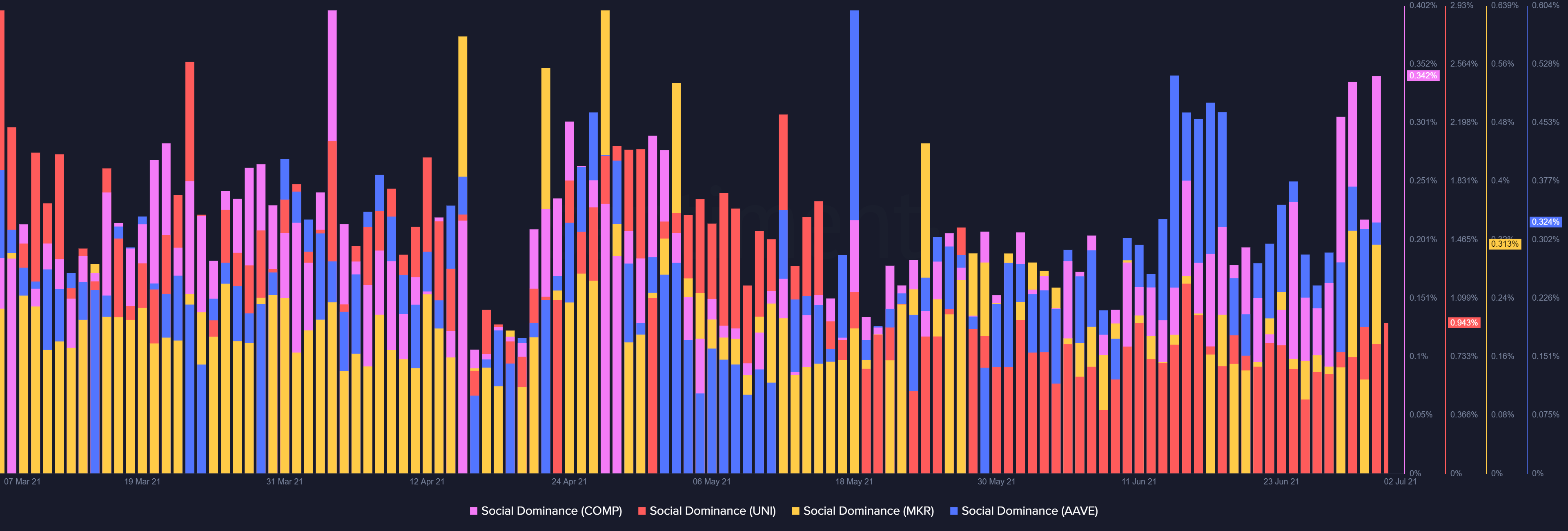

When observing the last 7 days’ Social Dominance, it can be found that all the assets collectively were indicative of a hike in interest as well, allowing the tokens to remain relevant in the space. While on-chain metrics remain essential, during such a bearish period, is there actually a chance for a DeFi season to enter the realm of possibility?

Can we break it down to utility?

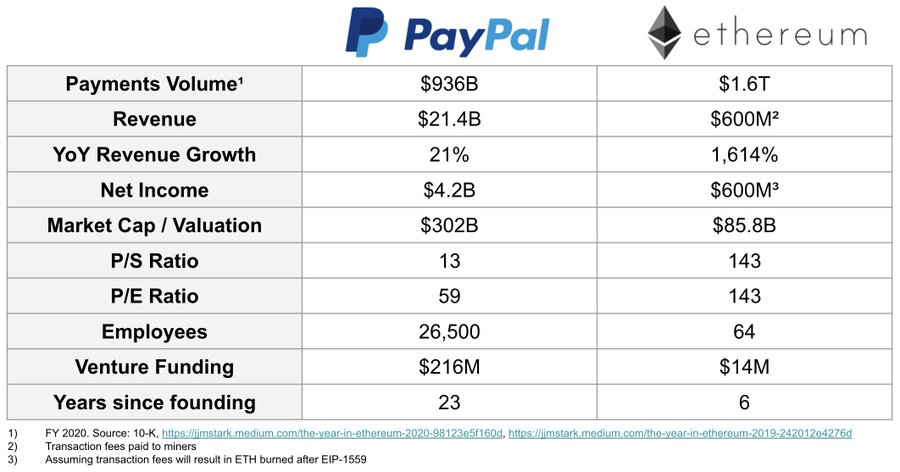

While DeFi may have its shortcomings, it is important to acknowledge that the value transferred on Ethereum over the past year has taken the likes of Paypal out of the water, and it is largely due to the transfer volumes associated with DeFi.

Source: Twitter

According to the attached chart, Ethereum has processed 1.7 times more than Paypal in payments volume with 0.2% of the transactions in 26% less time. The year-on-year revenue growth for Paypal is at 21% billion while Ethereum witnessed a whopping 1614% incline.

Source: Twitter

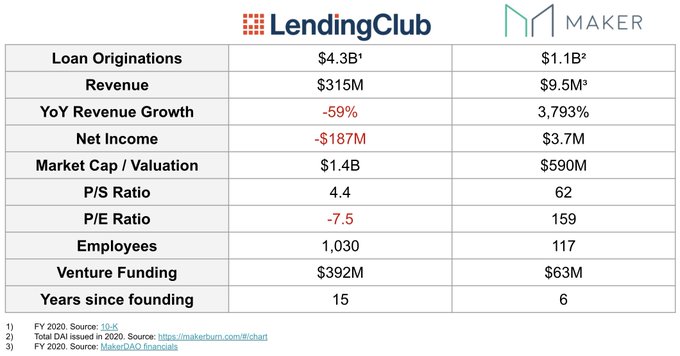

Taking an extremely DeFi-specific approach to lending, MakerDAO is presently more profitable after only 6 years of operation whereas LendingClub, an established financial institution, is still booking losses after 15 years in the business.

Hence, there are definitely some parts that the DeFi industry is doing right, so the possibility of a DeFi season cannot be dismissed, even though the crypto-market is still struggling to break the bears’ grip.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-5-1-400x240.webp)