All the reasons why XRP may be heading for a price slump

- A spot XRP ETF could appear in the next few months.

- XRP was overbought but shorts risk liquidation still.

Like many altcoins, the price of Ripple [XRP] went in the upward direction after the SEC approved the spot Bitcoin [BTC] ETFs. On the 11th of January XRP crossed $0.60. This was the first time XRP surpassed the zone since the 3rd of January.

However, AMBCrypto found out that XRP’s run seemed to be much more than the influence of other altcoins. This was because of the information Eleanor Terrett shared on the 9th of January.

According to Terrett, who is a journalist at FoxBusiness, an XRP spot ETF could be live in a few months.

She based her premise on the notion that XRP, alongside, its underlying firm Ripple, has been getting regulatory clarity in the U.S.

Based on my conversations with industry around this today, there's definitely differing views on whether or not the @SECGov would approve a single-product $XRP spot ETF.

Bulls argue that XRP is the only digital asset that has received any kind of "regulatory clarity" from the… https://t.co/DcQTuNaKiZ

— Eleanor Terrett (@EleanorTerrett) January 9, 2024

Longs pay shorts to keep the tab open

Should this happen, XRP might get the same bullish sentiment Bitcoin has enjoyed of late. Regardless of the outcome of the potential ETF, traders seem to be bullish on the price action.

At press time, XRP’s Funding Rate was 0.01%. If the Funding Rate is negative, it means the perp price is trading at a discount compared to the index or spot price. In this instance, short pay a funding fee while longs receive payment.

However, the Funding Rate was positive as of this writing. This means that the perp price is trading at a premium when put side by side with the spot value.

In terms of the price, this position means XRP has the potential to be bearish in the short term. If the Funding Rate remains positive while the price consolidates, the token might key into the resistance.

AMBCrypto’s analysis of the 4-hour chart showed that the resistance was at $0.58. So, if the buying pressure gets less aggressive, the XRP price might drop to $0.58. However, the support at $0.56 might prevent the token from falling further.

This potential was supported by the Chaikin Money Flow (CMF) whose positive value had become extreme. The CMF reading implied that XRP was overbought. So, the price might close lower than it was on the 10th of January.

XRP bears should watch out as price eyes $0.65

However, indications from the MACD showed that the price might quickly recover if that happens. At press time, the MACD was in the positive region too. This suggests a bullish momentum for the cryptocurrency.

So, a move toward $0.65 is also an option for XRP in the short term.

Read Ripple’s [XRP] Price Prediction 2024-2025

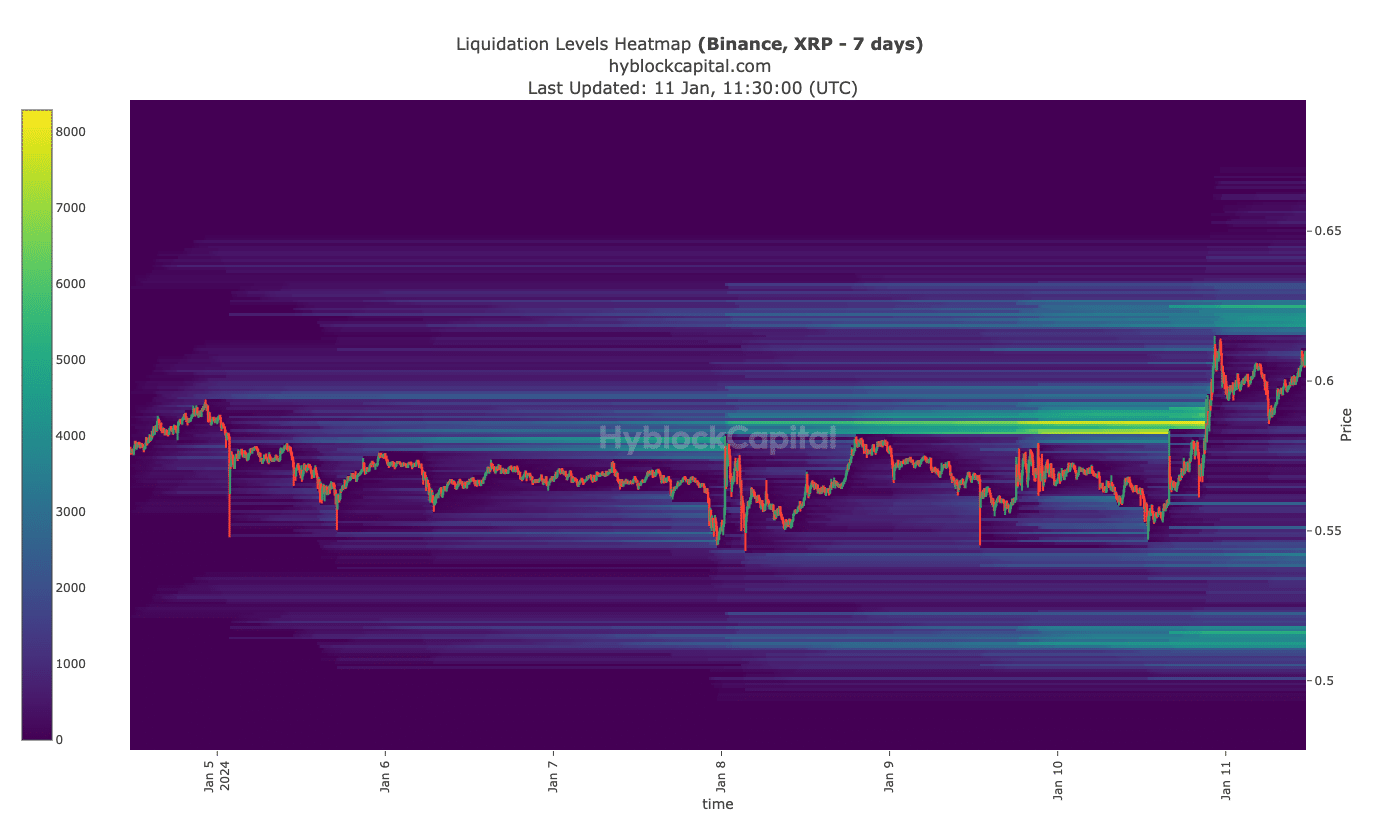

Furthermore, the Liquidation Heatmap showed that shorts targeting a drop to $0.58 need to be careful. This was because the Heatmap showed that there was a cluster of liquidity (colored yellow) around the price.

So, if a trader decides to open a short position with medium or high leverage, they could be liquidated.