Ripple

Is XRP no longer a token worthy of HODLing

While XRP struggles to balance, some key holders have decided to…

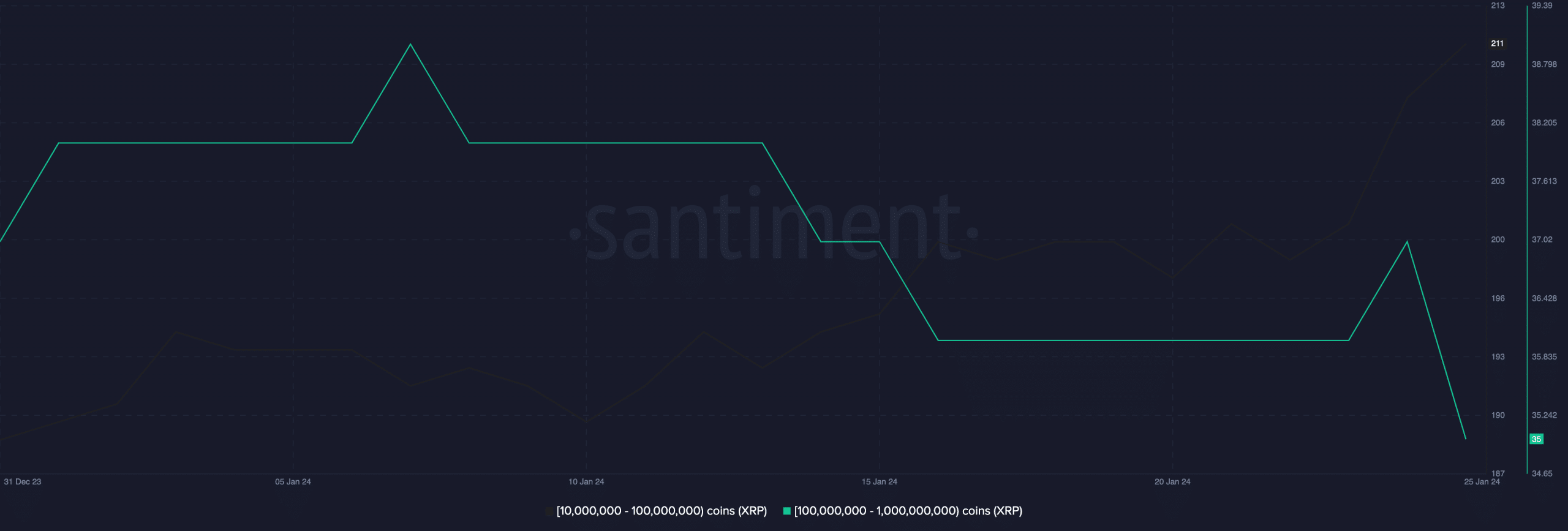

- The number of addresses holding 100 million to 1 billion XRPs dropped.

- Shorts could be more profitable than longs for the time being.

Though Ripple [XRP] has held its ground as a top 10 cryptocurrency per market cap, its performance of late has made large investors question its long-term potential. But questions are not the only thing flying.

According to AMBCrypto’s analysis of the XRP Ledger (XRPL), the number of addresses that own 100 million of 1 billion tokens between the 24th and the 25th of January dropped.

Trouble in XRP’s domain

This decline suggests that some whales no longer trust XRP to keep holding it. Hence, the next thing to do was to liquidate the assets.

The decision to exit the XRP market could be linked to its price action. At press time, XRP’s price was $0.50, indicating that it had lost 19.18% of its value in the last 30 days.

But XRP’s troubles did not begin a few weeks back. Last year, XRP jumped and almost hit $1 after Ripple’s win over the SEC. So, the recent decline meant that the token had shredded almost 50% of its value since that time.

XRP’s performance also forced a reaction from Bitcoin [BTC] maximalist Max Keiser. On the 23rd of January, Keiser, who is highly critical of altcoins, said that XRP is “centralized garbage.”

Despite the price decline, the sentiment around the cryptocurrency remained positive. AMBCrypto was able to deduce this by evaluating the Weighted Sentiment Metric.

At press time, the Weighted Sentiment had risen to 0.71. This metric measures the unique social volume connected to a project. If it’s negative, it means most of the comments about the asset are bearish.

But since the Weighted Sentiment was positive, it implies that the average commentary relating to XRP preached optimism.

Lower lows or nothing

However, it is important to note that the bullish sentiment participants have is no guarantee that XRP’s price will recover soon. While it can, it would take more than the perception around the market.

This led us to check the Liquidation Levels. We also examined the Cumulative Liquidation Levels Delta (CLLD).

Liquidation Levels are estimated points that might initiate the automatic closure of existing positions. According to data from Hyblock Capital, there were several liquidity clusters from $0.51 and above.

So, if traders were to open long positions with high leverage, they could get easily liquidated. However, shorts that target between $0.48 and $0.49 had a low risk of liquidation.

Realistic or not, here’s XRP’s market cap in BTC terms

In the meantime, the CLLD had spiked in the negative direction. In this instance, shorts that are late to capitalize on the price decline could be liquidated.

So, while XRP could drop as low as $0.48, it might not take a long while before the price recovers.