Is XRP set for a 40% rise? Key levels to watch this week

- Metrics revealed that buying pressure was high on XRP.

- A few of the technical indicators suggested that XRP breaking out would be a challenge.

As the market condition turned bullish, Ripple [XRP] took advantage of it and pushed its price up.

In fact, the token’s price had reached a critical level, and a breakout above could result in a massive bull rally in the coming days.

XRP bulls getting ready

According to CoinMarketCap, XRP’s price has risen by more than 3% in the last seven days. In the last 24 hours, the token has witnessed a 1.5% rise in its value.

At the time of writing, the token was trading at $0.5231 with a market capitalization of over $28.9 billion. In the meantime, a bullish symmetrical triangle pattern formed on the token’s chart.

The pattern appeared in mid-April, and since then, the token’s price has consolidated inside it.

Thanks to the recent price increase, the token’s price was moving towards the upper trendline of the pattern, hinting at a possible breakout.

A successful breakout could result in a 40% rally, allowing XRP to reclaim its March high. But before it reaches that level, it must go above resistance zones at $0.55 and $0.6.

Is a breakout possible?

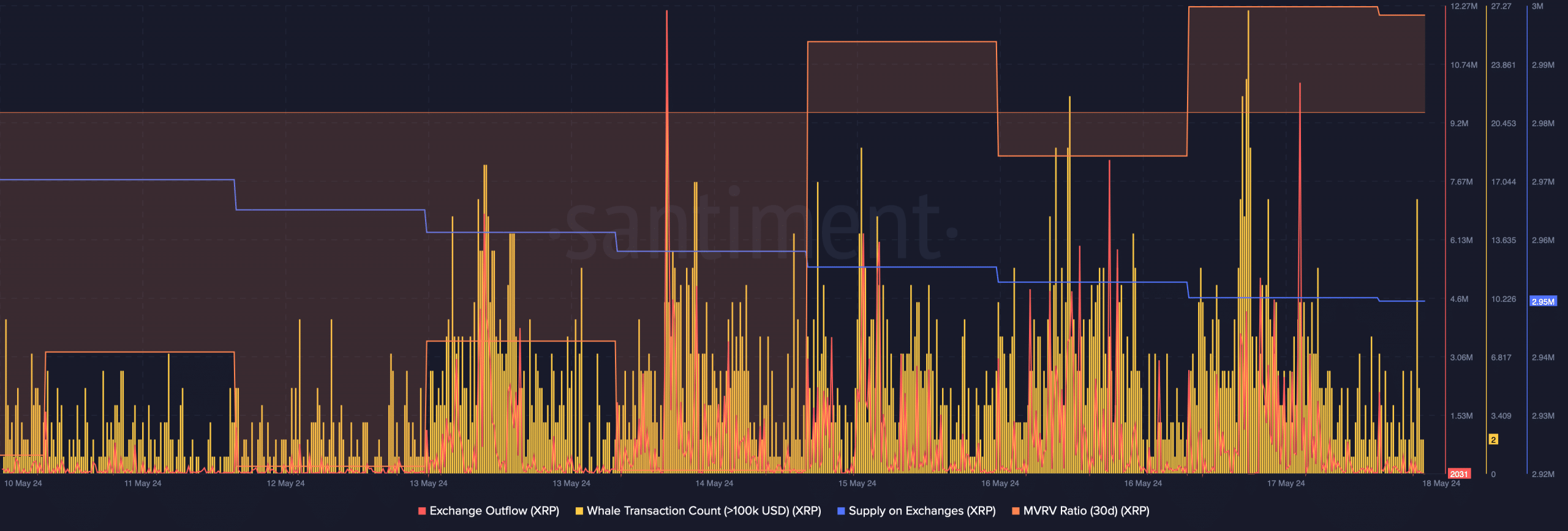

AMBCrypto then analyzed Santiment’s data to find whether metrics supported the possibility of a breakout. As per our analysis, buying pressure on XRP was high as its exchange outflow spiked.

Its Supply on Exchanges dropped, further proving that investors were buying.

Whale activity around the token was high, as evident from the rise in its whale transaction count. In fact, AMBCrypto reported earlier that whales accumulated XRP worth over $55 million.

However, the derivatives market metrics looked pretty bearish on the token. For instance, Coinglass data revealed that XRP’s long/short ratio dropped in the last 24 hours.

A decline in the metric suggests bearish sentiment in the market, where there is more interest in selling or shorting assets.

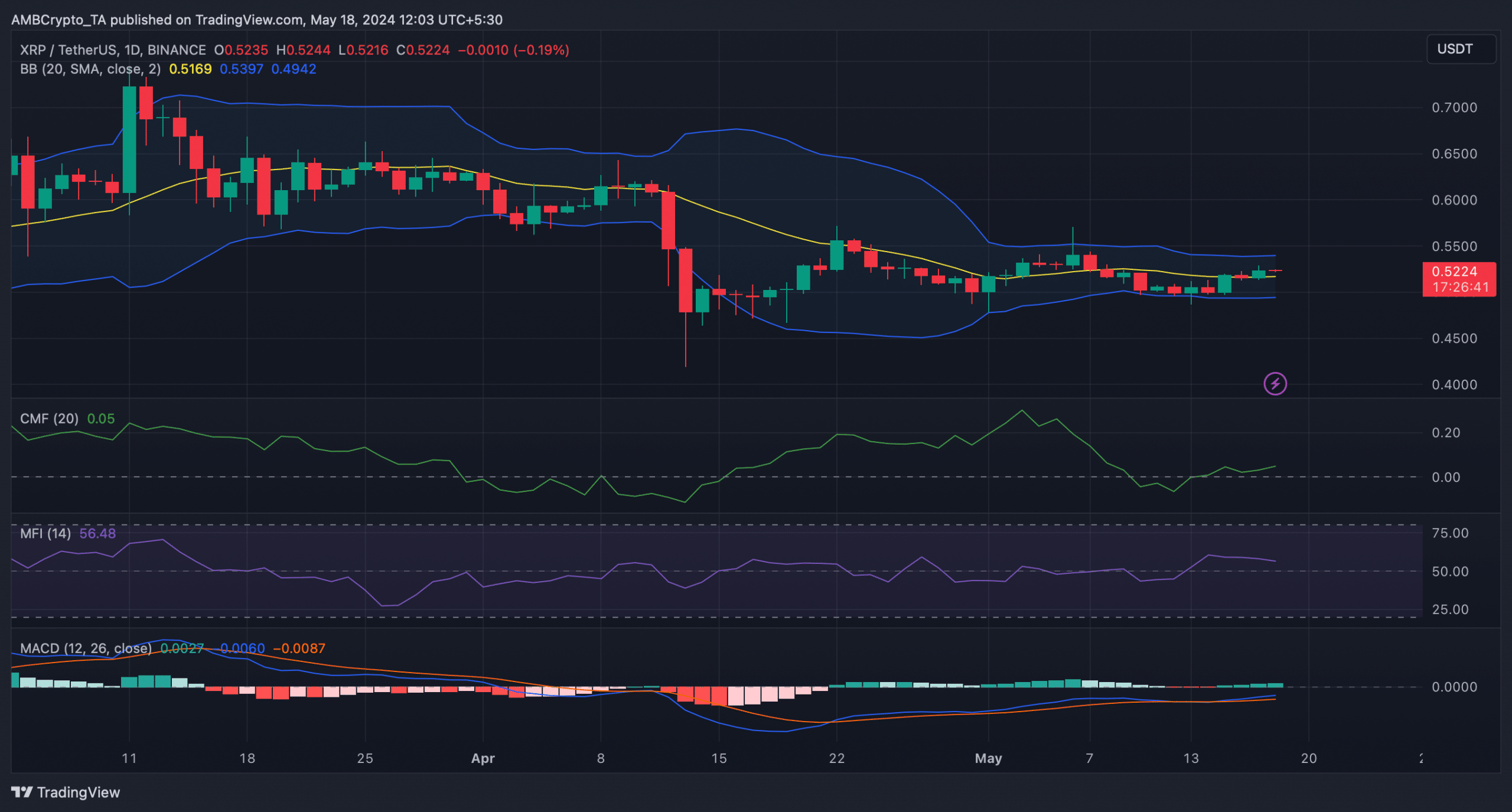

AMBCrypto then analyzed XRP’s daily chart to better understand whether a bullish breakout is possible.

We found that the token’s Chaikin Money Flow (CMF) registered an uptick and was headed further away from the neural mark.

The technical indicator MACD also displayed a bullish advantage in the market, indicating that the chances of XRP breaking out of the pattern were high.

Read Ripple’s [XRP] Price Prediction 2024-25

However, a few of the other indicators told a different story. For instance, the Money Flow Index (MFI) chose to move southward.

Additionally, the Bollinger Bands revealed that the token’s price was in a less volatile zone, suggesting that the possibility of an unprecedented bull rally was slim.