Korean crypto exchanges drive January’s altcoin trades

- Korean exchange Upbit had an 87% altcoin dominance in its overall trading volume in January.

- Investors also exhibited interest in Bitcoin and Ethereum.

The South Korean market has exhibited strong demand for cryptocurrencies over the years and has quite often been the primary driver behind the rising trading volume of altcoins.

Korean exchanges push altcoin volumes up

According to on-chain analyst and CEO of CryptoQuant Ki Young Ju, the country’s largest exchange, Upbit, had an 87% altcoin dominance in its overall trading volume in January.

A closer examination found that altcoins accounted for a sizable share of trading volumes in 2023 as well.

In comparison, Coinbase, the largest crypto trading platform in the U.S., had just 45% of its trading activity dominated by altcoins.

For the uninitiated, the Korean market is mostly made up of retail investors due to regulations against institutional investors.

On the other hand, Coinbase is considered to be the gateway for institutional investors to purchase cryptos. Most of their focus has historically revolved around Bitcoin [BTC] and Ethereum [ETH].

As a result, these two leading assets controlled a sizable portion of the volume pie.

Korean investors show interest in Bitcoin, Ethereum

Historically, Korean exchanges have witnessed higher prices of popular tokens as compared to foreign exchanges. This phenomenon is called Kimchi Premium and is driven by a high demand for cryptos in the country.

However, the appetite wasn’t limited to altcoins. Of late, Korean retail investors have also shown a willingness to buy Bitcoins.

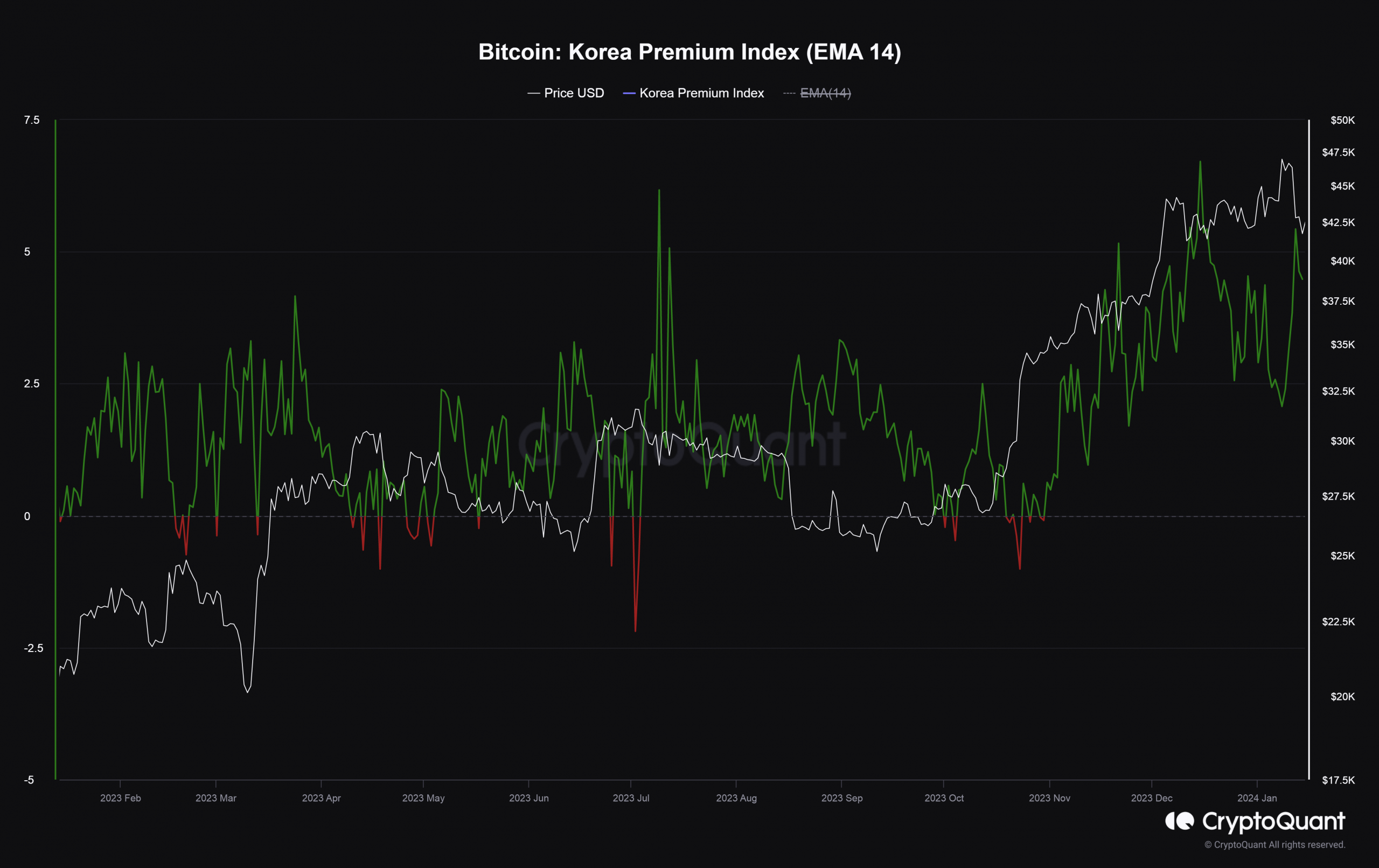

According to AMBCrypto’s analysis of CryptoQuant data, the index, which measures the percent difference between the market price of Bitcoin on Korean exchanges and other exchanges, surged dramatically.

This implied that more investors were willing to pay a premium for the purchase.

A similar trend was observed for Ethereum’s demand in the Korean market.

Korean crypto market punches above its weight

According to data highlighted by Ki Young Ju, trading volume on Korean exchanges was roughly 31% of Binance’s, the world’s largest crypto trading platform. This is despite Korean exchanges having just 12% of the global influence.