Kraken begins Bitcoin (BTC) & Bitcoin Cash (BCH) distribution to Mt Gox creditors

- The long wait for Mt Gox creditors seems to finally come to an end as Kraken begins repayment

- The exchange is set to pay creditors $3 billion worth of Bitcoin

Right when Bitcoin (BTC) and the rest of the crypto market showed signs of recovering, another impediment has now stood in its way to the top. In a much awaited move, Kraken – a leading crypto exchange – has reportedly started distributing Bitcoin (BTC) and Bitcoin Cash (BCH) to Mt. Gox creditors.

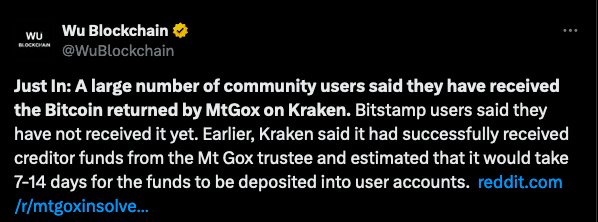

While the exchange itself has not confirmed the action, several crypto netizens have confirmed receiving their crypto in their Kraken exchange. The distribution puts an end to the 10-year wait for several early Bitcoin investors who have been waiting to get their money back from the once biggest BTC exchange in the world.

The bankrupt exchange has been on the move to repay nearly $9 billion worth of Bitcoin to its creditors. And, crypto exchange Kraken is set to repay 48,641 BTC, nearly $3 billion worth of BTC from the $9B pot.

Bitcoin (BTC) unbothered by Mt Gox

Notably, BTC’s price has not recorded any drastic change since the news of Mt Gox repayment broke, contrary to popular belief of the cryptoverse these past few weeks. According to CoinMarketCap, Bitcoin was trading at $65,804.18 with a trading volume of $35.38B. The market cap of the king coin was at $1.3T with the coin recording a slight change of over 2% in the past 24 hours.

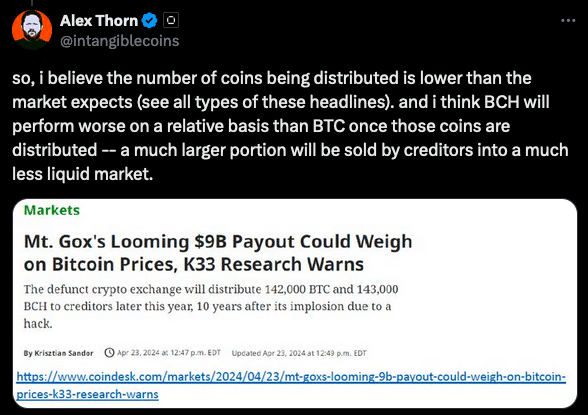

However, the case does not seem to be the same for Bitcoin Cash (BCH). The coin has lost over 7% of its value in the past 24 hours and was trading at $364.89, at press time. This reinforces the prediction made by Alex Thorn – Galaxy Digital’s Head of Firmwide Research.

Thorn had stated that BCH would be at the losing end of the repayment program. He pointed out that the BCH reserves came from Mt Gox’s claim from the fork, and not the creditors purchasing the coin themselves. Additionally, the coin had low liquidity compared to Bitcoin.

Source: X