Land ahoy! Unraveling how Asia can be the next big place for crypto adoption

Accenture recently carried out a survey studying digital asset portfolios of Asian investors. Accenture research suggests that cryptocurrencies will see a huge growth in the future among elite Asian investors. More than 50% of wealthy investors already hold cryptocurrencies and another 21% are likely to add them by year end.

The report titled “Digital Assets: Unclaimed Territory” surveyed 3,200 clients across Asian markets. It was conducted during December 2021 and January 2022 in major Asian economic hubs: India, China, Japan and others.

An important note here is that the survey was taken in a better macro landscape as compared to today. The Russian invasion and Fed policies have greatly hampered risk markets across the world. The crypto market has also suffered all the same in this dubious economic landscape.

What does it say?

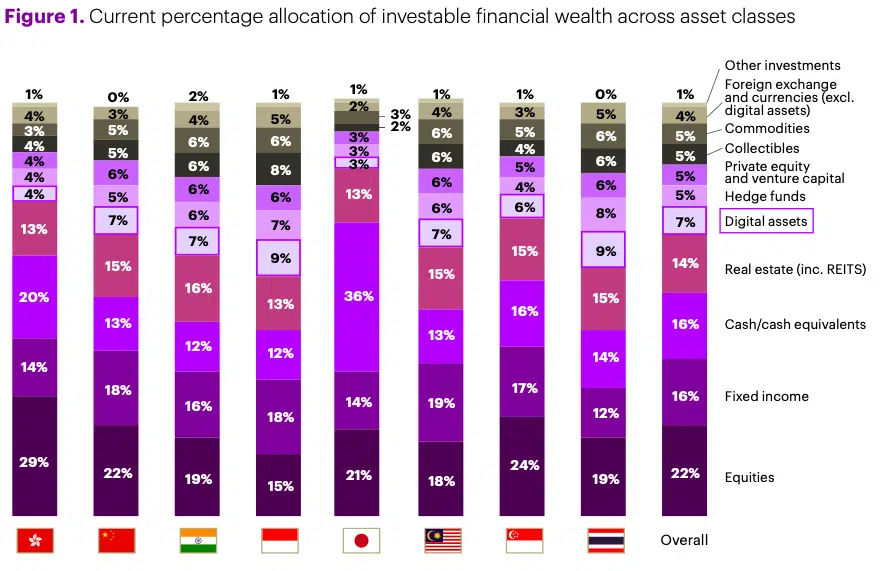

On average, investors allocate over seven percent of their portfolios to digital assets (cryptocurrencies, crypto funds, security tokens and asset-backed tokens). Younger investors are more exposed to digital assets but the trend is similar across markets, wealth bands and genders.

Digital assets represent a $54 billion revenue stream for wealth management firms which is being neglected. Transaction fees alone represent $40 billion of this revenue with the rest shared between advisory fees and custody fees. The report suggests that around two-thirds of such firms have no plans to offer digital asset proposition.

There is an indication that many investors are still facing obstacles with engaging in cryptocurrencies. This can be contributed to a lack of regulatory clarity in many markets. China, in particular, has taken a huge stance to curb the use of cryptocurrencies. Other obstacles include changing the advisory process and other operational constraints.

Let’s hear it from them

One of the major factors here is also the price volatility in the crypto market. Take case of Bitcoin which has dropped down to a near $30,000 recently after peaking at $68,000 in November. One executive even believes digital assets aren’t profitable and was quotes saying that.

“I don’t think digital assets are a very profitable business. It may be possible to use it in online securities for mass rather than for the wealthy,” one executive says.