Less CAKE on the menu? This is how PancakeSwap intends to make party bigger

- About 3.75% of CAKE’s circulating supply was burned in the latest round.

- Buoyed by whales’ accumulation, the token’s prospects looked bullish.

PancakeSwap removed more than seven million CAKE tokens out of circulation as part of its burn program, intended to add deflationary pressure on the coin. The tokens burned were worth $30 million in value.

? 7,038,341 $CAKE just burned – that’s $30M!

? Trading fees (Swap and Perpetual): 189k CAKE ($806k) +20%

? Prediction: 71k CAKE ($302k) +23%

?️ Lottery: 30k CAKE ($130k) -10%

? NFT Market, Profile & Factory: 566 CAKE ($2k) -26% pic.twitter.com/EB4qu8FVWV— PancakeSwap ? #Multichain (@PancakeSwap) February 20, 2023

According to CoinMarketCap, CAKE’s circulating supply stood at 187.32 million. This meant that 3.75% of the circulating supply was burnt in the latest round. This development was met with a favorable response from the investors as CAKE was up 1.80% at press time.

Read PancakeSwap’s [CAKE] Price Prediction 2023-2024

It’s a mixed bag on the network front

PancakeSwap recorded an uptick in some of its key performance indicators. Since dipping to a monthly low on 11 February, the protocol’s trading fees jumped 47% until press time, the data from Token Terminal revealed.

This growth was fueled by the increasing number of users on the decentralized exchange (DEX), which rose 21% over the last 1o days.

On the other hand, the DeFi protocol failed to show significant growth in its total value locked (TVL). The metric was yet to reach its pre-FTX levels.

In spite of the above downside, the DEX managed to storm into the list of top revenue-generating crypto participants. At the time of writing, its cumulative revenue in the last 30 days stood at $3.3 million, above chains like Polygon [MATIC] and BNB.

Whales are eating CAKE?

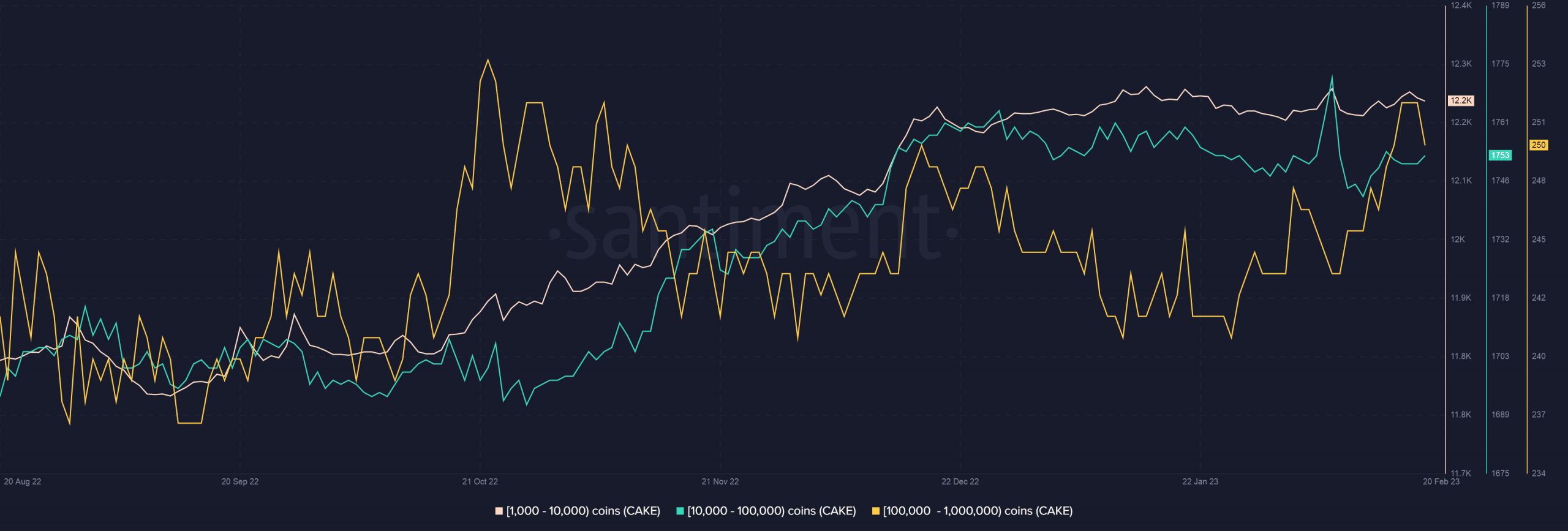

Small and big whales showed interest in CAKE. As per Santiment, the number of addresses holding between 1000 to 1 million tokens saw a significant increase in the month of February. The accumulation by large addresses was a bullish signal for CAKE’s price.

How much are 1,10,100 CAKEs worth today?

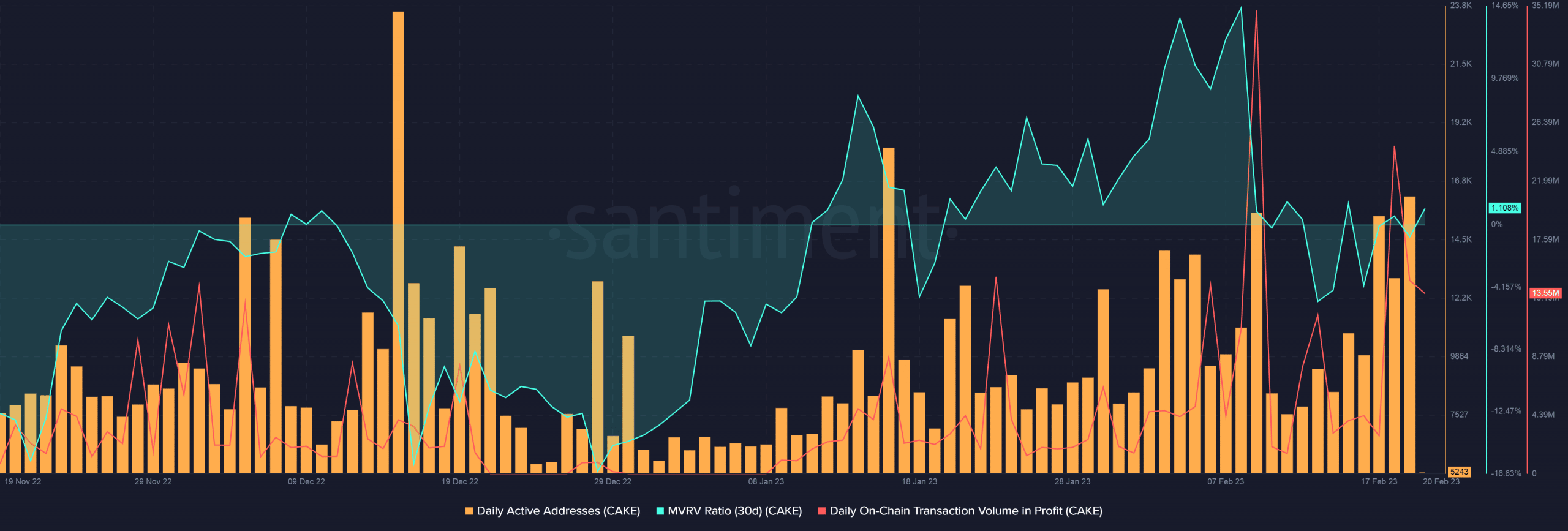

The token found support from retail investors as well. The daily active addresses more than doubled in the last 10 days.

The 30-day MVRV ratio entered the positive zone at the time of writing, implying that most holders would make profits if they sold their tokens at the current price. This was corroborated by the sharp increase in the daily transaction volume in profit.

CAKE’s price grew by more than 10% over the previous week. With a spurt in accumulation activity, investors can expect further gains in the days to come.

![Algorand [ALGO]](https://ambcrypto.com/wp-content/uploads/2025/05/EE821387-E6C9-4C21-A2AC-84C983248D2F-400x240.webp)