Lever: World’s first AMM-based decentralized margin trading platform

Since exploding in 2020, Decentralized Finance (or DeFi) has been gaining great attention and popularity, which can often be seen in mainstream media’s headlines. With the exponential growth, DeFi has recorded a total value locked (TVL) of $41.29 Billion with lending and DEX products taking up almost 90%.

Lending and trading are two of the pillar businesses in the current DeFi space with the most TVL. However, they are practically isolated from each other, leading to extremely low capital efficiency. Rare lending protocols support sport or even margin trading and most DEXes don’t provide loans. Also, even though users get transferable and tradable deposit certificates after depositing in lending protocols, there are few platforms to actually facilitate the financial use of them.

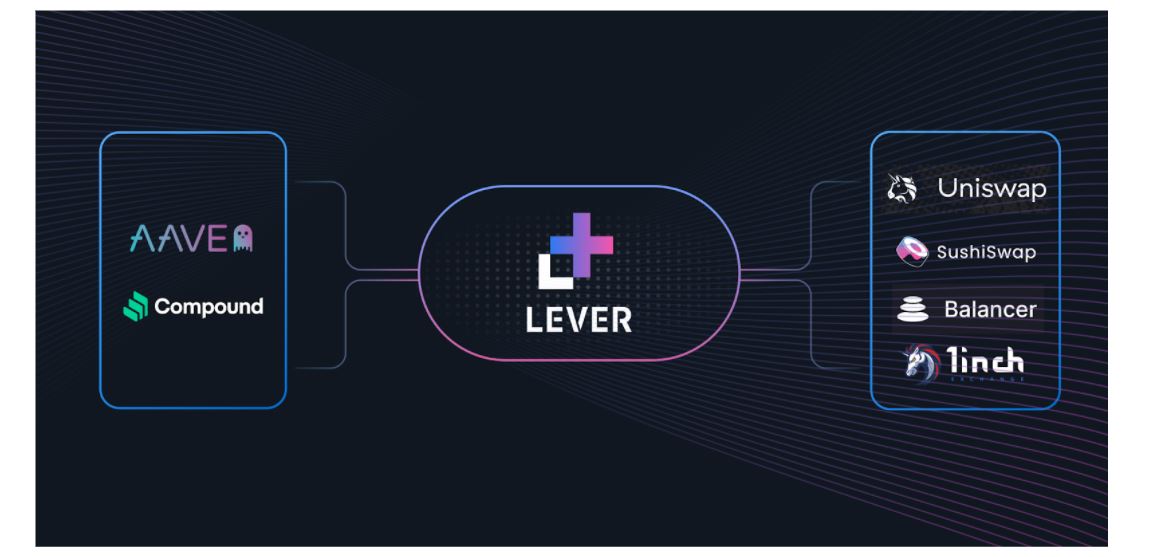

Therefore, Lever is developed to bridge the gap between lending protocols and DEXes, increasing capital efficiency in DeFi.

Market Problems

As mentioned above, according to our observation, the problems in DeFi mainly lays in the following aspects:

- At present, it is almost impossible for users to perform margin trading in a DEX, regardless of long or short positions on an asset. The only way to do so is to take out loans from a lending platform then manually transfer the fund to the DEX to operate, making efficient position management unavailable.

- The lack of direct trading scenario in lending products. The activities of borrowing and trading of assets often happen in two separate places, one in lending platforms while the other on in DEXes. Users will have to go through a strenuous process of taking out loans from lending platforms first then to trade on their preferred exchanges.

- Inefficient utilization of deposited funds. Users get tokenized deposit certificates after making deposits in lending protocols, such as aTokens from AAVE and cTokens from Compound. These tokens represent the value of their underlying assets, but can rarely be reutilized for investment or trading.

- Rare DeFi products provide efficient and user-friendly margin trading services. Margin trading can effectively amplify traders’ gains. It’s popular in the traditional finance market and also has a huge demand in the DeFi space. Though there are a few protocols that offer this service, their liquidity is not enough.

Welcome to LEVER

Lever is essentially an open-source margin trading platform where you can lend, borrow and perform leveraged trading to either buy long/sell short an asset in just one place.

For lenders/borrowers, you can lend your idle crypto assets (including your deposit certificates from other lending protocols) to earn interest or use them as collateral to take out loans.

And for traders, after making a margin deposit in the margin pool, you will be able to open either long or short positions in a supported asset in Lever with up to 3X leverage. The platform makes use of external AMMs like Uniswap to provide surplus liquidity for margin traders to open positions of any size.

Using Lever, you can comfortably leverage your available capital for larger gains.

Lever’s Solution and Features

- Quick & Convenient Trading. Lever manages to bridge the gap in lending platforms and DEXes. Borrowing and trading are now seamlessly integrated within Lever. Traders can easily borrow and trade assets in just one place. Lever also offers a visualized operation interface for position management.

- Margin Trading and Enormous Liquidity. Thanks to Lever’s powerful margin pool, traders can easily open leveraged positions to either long or short an asset. In addition to WBTC and ETH, many DEFI and ERC20 assets like SNX, UNI, and AAVE now can be shorted at Lever. Furthermore, by relying on AMMs like Uniswap, Lever can provide enough liquidity and reduce slippage for positions of any size.

- High Capital Efficiency — Other than native tokens, lenders can deposit AAVE’s aTokens and Compound’s cTokens to earn extra interest in Lever. This makes double interest possible, as lenders can first deposit their assets in AAVE/Compound, then use the aTokens/cTokens they receive to redeposit in Lever. Moreover, these tokens can also be used as collateral to take out loans.

The project is being managed by experienced experts in the field of Blockchain development. As the first AMM-based decentralized lending and margin trading platform, Lever serves as a pioneer to other decentralized exchanges. Also, the innovative features and benefits that come with using Lever, it is sure to lead DeFi to the next level and enrich the ecosystem.

Lever has already gone testnet live and will be ready for its mainnet launch and IDO soon. Join the Lever community for more updates:

Site: https://lever.network/

Twitter: https://twitter.com/LeverNetwork

Telegram: https://t.me/LeverNetwork

Medium: https://medium.com/@LeverNetwork

Disclaimer: This is a paid post and should not be treated as news/advice