Analysis

Lido: Can the $1.7 hurdle present extra shorting gains?

So far in Q3, Lido sellers have exerted market dominance. Recently, the $1.7 hurdle has offered market re-entries for sellers.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Lido’s further upside beyond $1.7 has been blocked since mid-August.

- Open Interest rates have been on a steady decline in Q3 2023.

Bulls haven’t held absolute market control since mid-August’s massive drop. For Lido [LDO], sellers have reigned as early as mid-July, meaning shorting the asset yielded impressive gains. According to TradingView, LDO was down 25% in Q3 as of press time level of $1.53.

Is your portfolio green? Check out the LDO Profit Calculator

Can sellers benefit again?

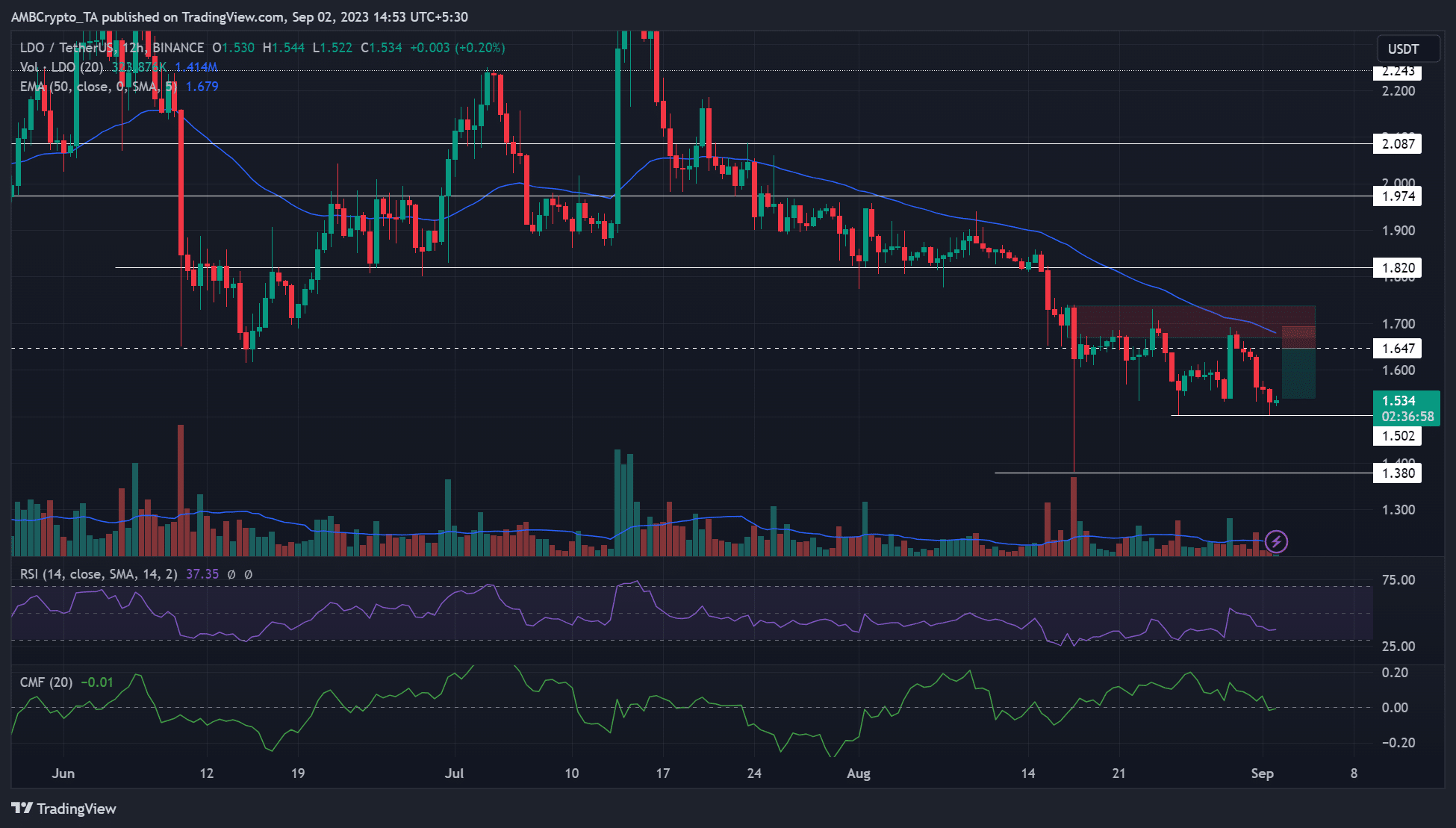

Lido’s 12-hour chart was bearish as of press time. LDO made lower lows and lower highs since mid-July, cementing a higher timeframe bearish bias. It means shorting could be more profitable than going long on the altcoin.

The extra price dump in August left a bearish order block (OB) of $1.67 – $1.74 (red). The bearish OB has been a sticky resistance in the last two weeks, presenting Lido sellers with shorting opportunities.

The dynamic 50-EMA (Exponential Moving Average) recently stretched into the above bearish OB, further cementing a crucial roadblock in the next few days. So, another price rejection at the level could offer extra shorting gains with an entry at $1.65, take-profit at $1.54, and exit at $1.7.

However, a move beyond $1.7 and a subsequent close above the bearish OB will invalidate the short idea. Such a move will flip the higher timeframe structure to bullish, giving bulls a little leverage.

Meanwhile, the RSI was negative as CMF went southwards, demonstrating selling pressure loomed large and capital inflows dropped.

Open Interest rates declined in Q3

According to Coinglass, Lido’s Open Interest rates have dropped from >$70 million in July to below $40 million at publication. The decline underscores a steady drop in demand for Lido in the derivatives segment – a long-term bearish bias.

How much are 1,10,100 LDOs worth today?

However, the liquidations data showed more short positions were wrecked in the last 12 hours before press time. If the mild buying pressure builds, Lido could rise to the hurdle.

So, the sellers can wait for the move up to $1.7 and track Bitcoin’s [BTC] movement before shorting the asset.