Altcoin

Lido DAO investors begin profit booking, but here’s the issue

Lido DAO has been making its investors very happy. It has been trending among the best-performing assets as of July 2022.

The token LDO, mirroring the sentiment of the market, has been performing extremely well in the market.

However, the question in the play revolves around the impact of this sentiment on the network and token.

Lido DAO skyrockets

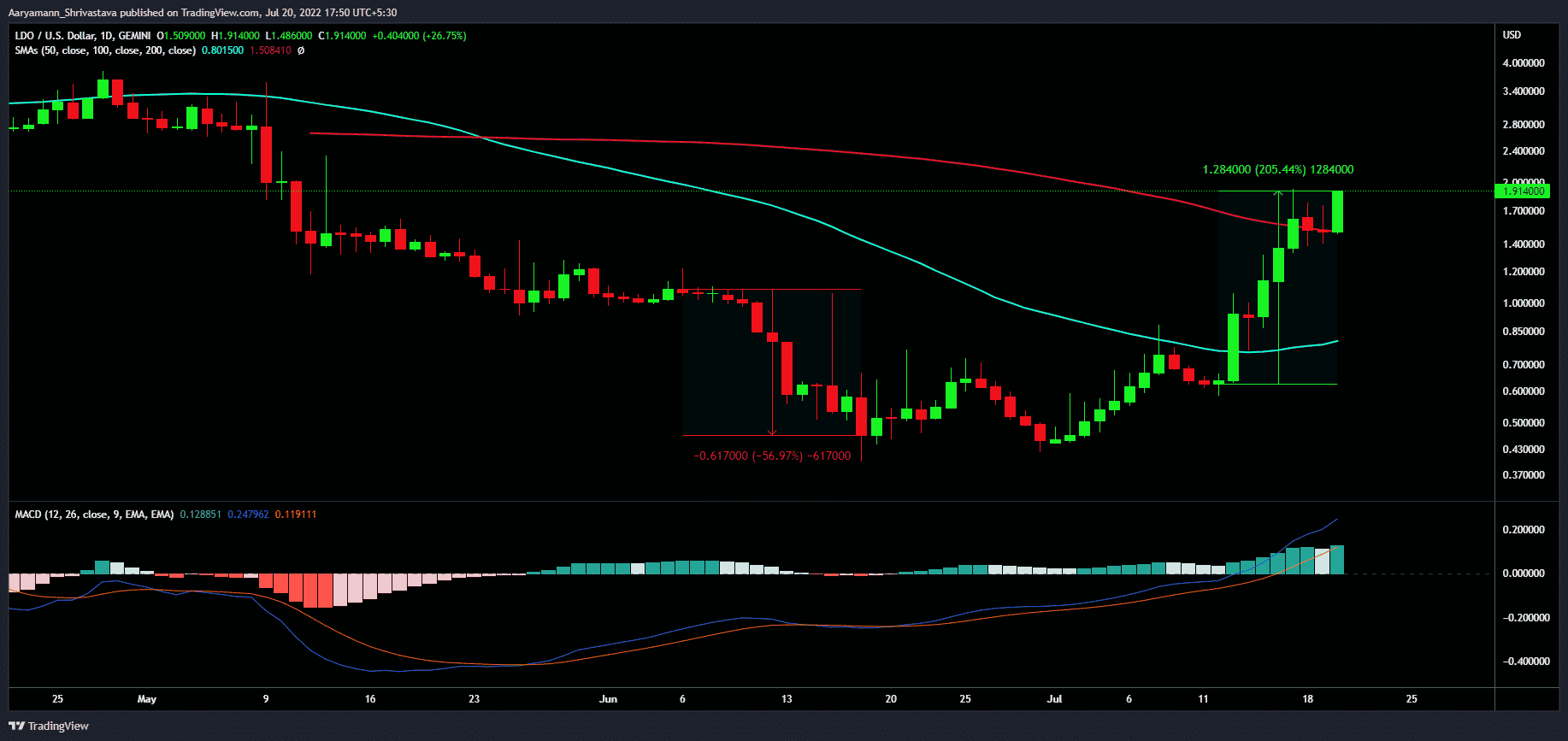

The native token of the liquid staking protocol, LDO, had a rather phenomenal week. The token registered a 205.44% rally, with almost 26% of it coming in the last 24 hours of press time alone.

Additionally, LDO has been one of the only few cryptocurrencies to recover its June losses.

In fact, the month-to-date rally of 324% also helped the altcoin invalidate almost all the decline it noted after the May crash.

Lido DAO price action | Source: TradingView – AMBCrypto

It is here to be noted that LDO had a lot of investors suffering losses.

Furthermore, as per last month’s reporting of the same, over 91.4% of LDO holders were in losses. However, at the time of writing, about 22% of them had returned to the state of profit.

The curious case of selling LDO

Naturally, those who were only witnessing recovery are going to make sure they don’t lose their profits again.

This drove investors’ confidence and motivated them to sell the token.

This can also be substantiated upon looking at the on-chain data of the last 24 hours. Approximately 10.9 million LDO worth $19.62 million or more were sold off by investors.

Lido DAO balance on exchanges | Source: Santiment – AMBCrypto

Well, this was bound to happen sooner or later- for the first time in the history of LDO, over $24 million worth of LDO across the network has been in profit.

This value has been determined by the total movement of the LDO tokens and the difference in price between their purchase cost and current value.

Lido DAO network wide profits | Source: Santiment – AMBCrypto

Additionally, while a lot of the investors sold, many others also moved around the supply that they held. Thus, resulting in a 176% rise in the rate at which LDO changed hands.

Such high velocity verifies that although a portion of LDO HODLers sold their holdings, many others held on to support the active rally.

Lido DAO velocity | Source: Santiment – AMBCrypto

Since the altcoin has already reclaimed the 50-day (blue) Simple Moving Average (SMA) and the 100-day SMA (red) as support, it might be able to rally ahead of $2 (ref. Lido DAO price action image).

The recent selling will have no significant impact on the price action either, provided investors do not repeat this instance anytime soon.