Lido facing a drought? Lack of liquidity suggests…

- Lido’s stETH’s liquidity was low compared to ETH.

- Activity on the Lido protocol declined as prices took a hit.

Lido [LDO] has been at the top of its game despite the DeFi sector’s TVL declining significantly over the last few months. The protocol has successfully capitalized on the growing interest in the Liquid Staking Derivative space.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Low on liquidity

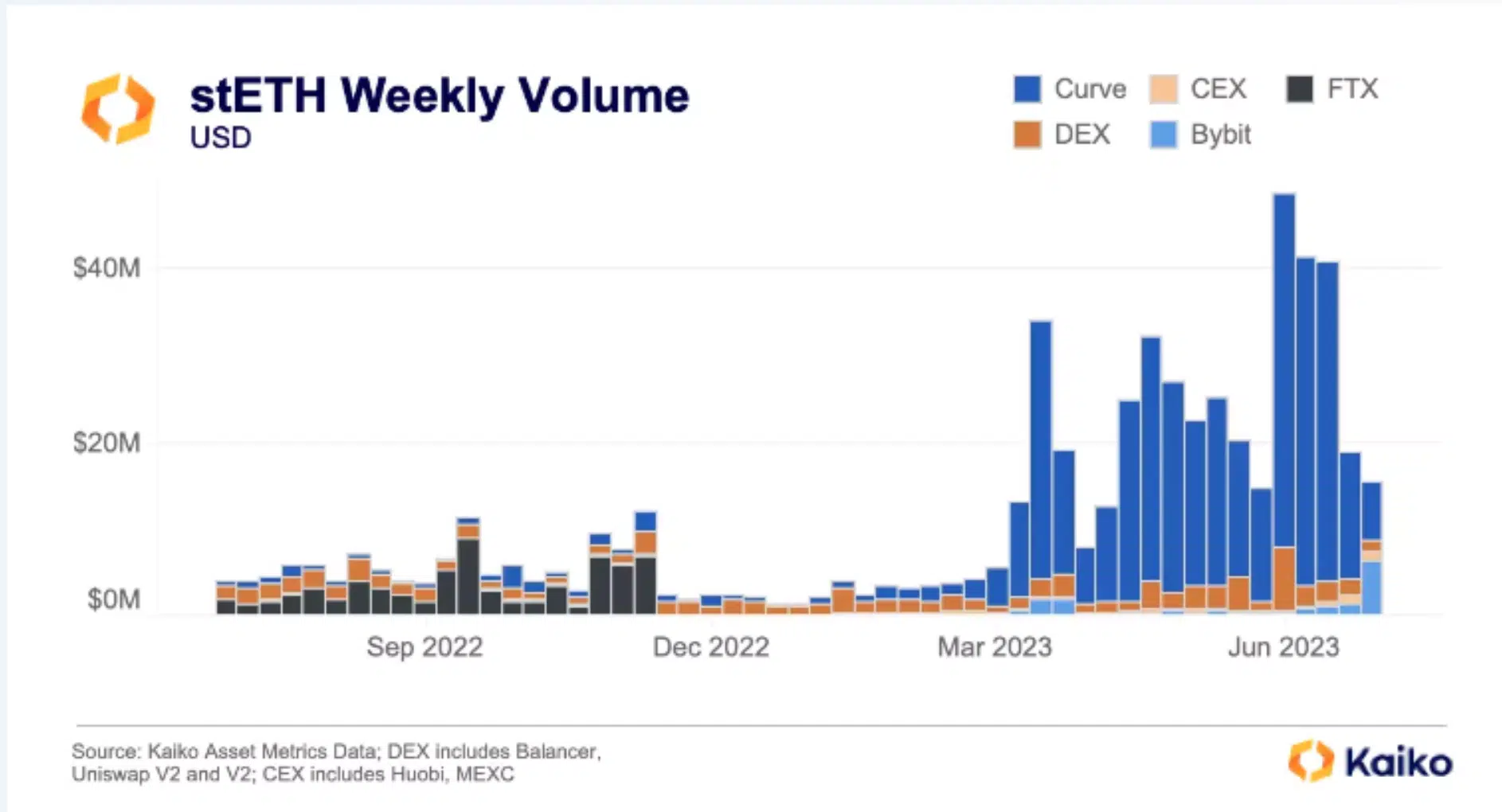

However, staked ETH’s [stETH] low liquidity could cause problems for the protocol in the future. According to Kaiko’s data, although СЕХ volumes are on the rise, the off-chain liquidity of stETH is notably inadequate.

Despite being the seventh largest token in terms of market capitalization, stETH’s liquidity failed to compare to ETH. Merely $185,000 worth of bids were found within a 0.5% range of the mid-price across all exchanges.

At press time, stETH was 400 times less liquid than ETH. If the low liquidity problem isn’t solved soon, it could cause problems for Lido in the future.

However, things were going well for both Lido and stETH, especially on DeFi protocols such as Pendle Finance. For context, Pendle Finance is a protocol that allows users to tokenize and sell future yields.

Pendle’s TVL has exceeded $130M, with @LidoFinance’s stETH pools making up 42% of this total.

Since the start of May, the stETH pools have grown by 167% in TVL, and remain the most actively traded yield asset with the highest volumes ? pic.twitter.com/YBUWrU04AR

— Pendle (@pendle_fi) July 10, 2023

Since the inception of the first stETH pool, Pendle Finance has provided support for a cumulative count of seven stETH pools, of which two have successfully reached their maturity period, demonstrating the efficacy of the technology.

Pendle Finance foresees more interest in Lido going forward as the crypto market gravitates more toward the LSD sector.

Not so active anymore

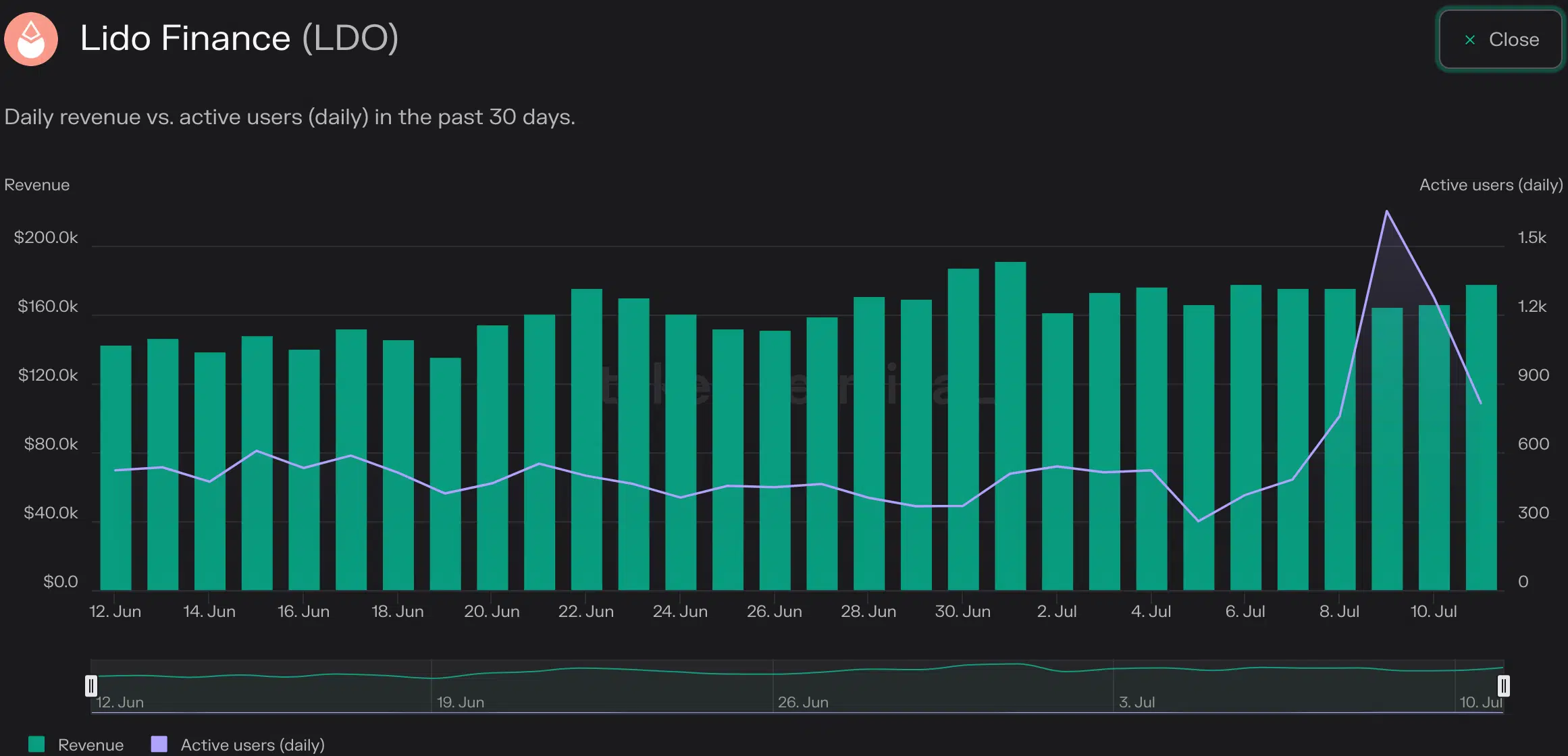

Despite stETH’s success on other DeFi protocols, the activity on Lido declined. In the last 24 hours, the number of active addresses on the Lido network fell by 36.4%, according to Token Terminal’s data.

But despite the decline in activity, the revenue generated by the protocol continued to grow.

Is your portfolio green? Check out the Lido Profit Calculator

Coming to LDO, the token’s price fell materially over the last week. In addition to that, the volume of LDO being transferred fell as well. At press time, LDO was trading at $1.929.