Altcoin

Lido Finance: A-Z of how the liquid staking platform fared in the last 2 weeks

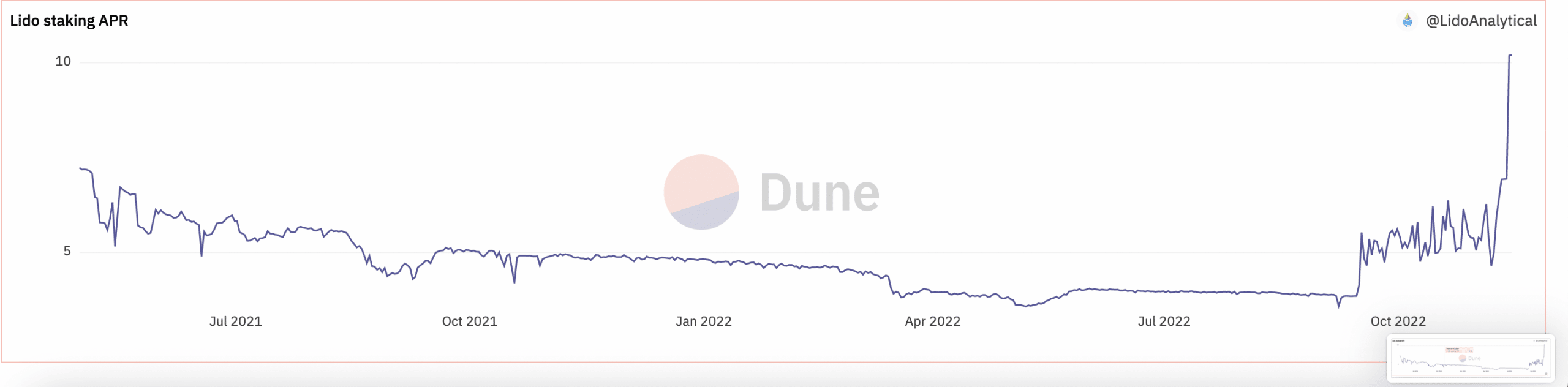

- Lido Finance recorded an all-time high for its Ethereum staking APR.

- This was due to a spike in MEV rewards on the liquid staking platform.

- The collapse of FTX led to a drop in TVL and Curve reserves on Lido Finance

Leading Ethereum [ETH] staking platform Lido Finance [LDO] clinched an all-time high of 10.21% in ETH staking annual percentage rate (APR) on the platform, data from Dune Analytics revealed.

Read Lido [LDO] Price Prediction 2022-2023

A year ago, ETH staking APR on the liquid staking platform was 4.84%. In the last 365 days, this rallied by over 100%.

The reason for the surge in ETH staking APR on Lido was because of the growth in cumulative Lido MEV rewards and the quantum of it being restaked by validators on the platform.

As of 14 November, having grown by over 70% in the preceding 14 days, cumulative Lido MEV rewards touched 17,039 ETH. As a result, the average daily rewards restaked by Lido was 255.87 ETH, leading to an 11.33% increment in stETH APR since the merge.

Retaining a 31% share of the ETH staking market, ETH staking on Lido grew by 9% since the merge, data from Glassnode

revealed.Lido in the last 14 days

While Lido saw a rally in its ETH staking APR and stETH APR, data from DefiLlama revealed a drop in the protocol’s total value locked (TVL) in the last 14 days. At $6.05 billion at press time, Lido’s TVL declined by 19% since the beginning of November.

Within the period under consideration, while staking deposits of ETH, Polkadot [DOT], and Kusama [KSM] grew by 2%, 2%, and 1.6%, respectively, Lido staked Solana [SOL], and Polygon [MATIC] fell by 35% and 17%, respectively.

⚡️Lido Deposits ⚡️

– Ethereum: 4,545,536 ETH (14d: +2.15%)

– Polygon: 45,922,978 MATIC (14d: -17.03%)

– Solana: 2,638,902 SOL (14d: -35.38%)

– Polkadot: 2,360,741 DOT (14d: +2.03%)

– Kusama: 86,093 KSM (14d: +1.63%) pic.twitter.com/g5Zs3TkxI8— Lido (@LidoFinance) November 14, 2022

As for its stETH/ETH liquidity pool on Curve Finance, Lido suffered a decline as a result of the market turbulence triggered by the collapse of the leading cryptocurrency exchange FTX.

According to data from Dune Analytics, in the last 14 days, in the liquidity pool, ETH composition fell by 58% while stETH composition declined by 29%. This led to a 56% drop in the pool’s TVL in the last two weeks.

At press time, Curve reserves were made up of 418,464 stETH and 250,750 ETH.

After a severe price decline following the downturn of the general market when FTX collapsed, LDO’s price appeared to have corrected in the last 24 hours. Per data from CoinMarketCap, LDO traded at $1.14 as of this writing, with a 9% price growth in the last 24 hours. Within the same period, its trading volume was up by 14%.