Lido Finance in July: Pain, pleasure, and the task ahead

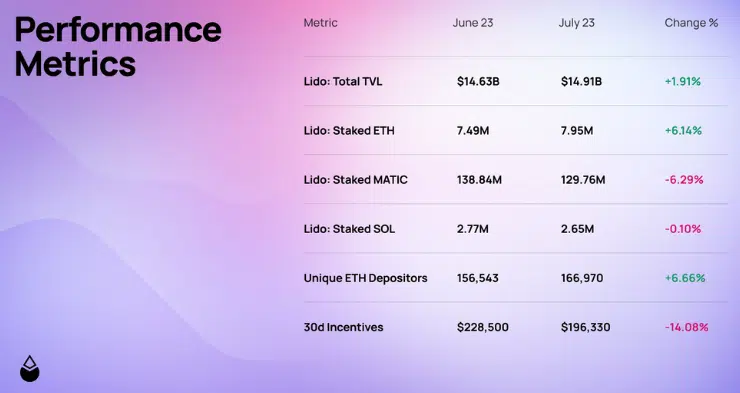

- Lido’s TVL increased while there was a little change in treasury.

- The recent Curve exploit affected stETH deposits.

The month of July brought a mix of challenges and glory for the prominent DeFi protocol Lido Finance [LDO]. Known for its approach to staking and providing liquidity, Lido had its fair share of hurdles and also breakthroughs, according to its recently-released monthly report.

How much are 1,10,100 LDOs worth today?

TVL gets back on top

First off, Lido’s Total Value Locked (TVL) hit $15 million for the first time since May 2022. The TVL measures liquidity entering into a protocol based on the confidence market participants have in it. The more the metric rises, the more trustworthy it has become. But when it falls, it means the health of the protocol is not at 100%.

Although the TVL had been pegged back at press time, the rise in unique Ethereum [ETH] deposits played a role in the hike. According to Lido’s report, unique ETH deposits on the protocol increased by 6.66%.

Staked Ethereum [stETH] also increased. However, Solana [SOL] and Polygon [MATIC] being staked on the protocol did not get as much attention as stETH. Lido explained that,

“The remarkable adoption of the protocol is evident with over 10,000 new stakers opting to use it for the first time. This surge represents more than a 50% increase from last month, further reflecting the protocol’s impressive growth and market demand.”

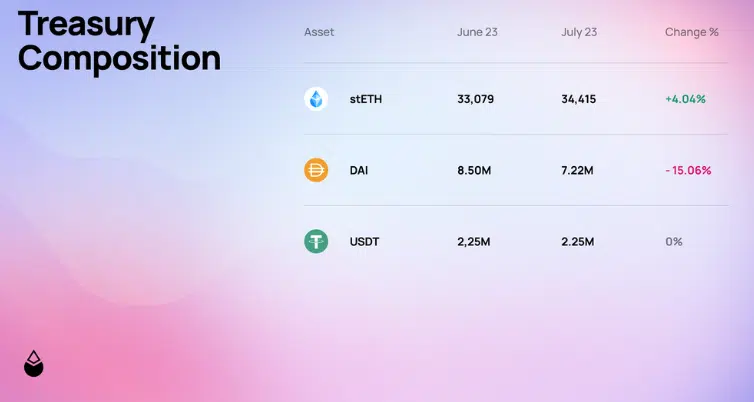

Concerning its treasury, Lido reported that it increased its stETH holdings. It also reduced its DAI stablecoin balance, and the amount in Tether [USDT] remains the same. The protocol mentioned that the increase in stETH could be linked to its decision to convert all of its ETH to stETH in June.

The past can’t stop the future

Meanwhile, Lido also mentioned that it was affected by the Curve Finance [CRV] exploit. This was because liquidity providers withdrew their stETH in droves:

“Despite the Curve Finance exploit this past week not affecting the stETH-ETH pool, many liquidity providers chose to prudently withdraw their stETH holdings until the matter is resolved.”

Lido also highlighted that Ethereum’s remained very involved in the contribution to the protocol. As a result, Lido was able to secure partnerships that propelled the listing of stETH on exchanges and lending platforms.

In explaining this, the Lido Finance report mentioned that there were several node operator calls from both ends. Node operators are individuals or entities that certify transactions on the blockchain. These operators do this by writing new blocks and broadcasting them to the network. And in August, Lido noted that there will be more:

“The Ethereum Node Operators Wave 5 update revealed that successful Stage 1 applicants will undergo onboarding in mid-August, while the LNOSG is diligently working towards finalizing a shortlist of 7-9 Node Operators for Stage 2 by the last week of August.”