Lido Finance issues update on its journey towards full decentralization

- Lido issues update about its decentralization plans and the state of progress.

- LDO fails to drum up a large enough rally to push out of the current range.

The latest update was on Lido’s migration to decentralization and self-custody. There have been concerns in the past about Lido being centralized. The update details the staking platform’s efforts to alleviate those concerns and here’s what you need to know.

Is your portfolio green? Check out the Lido Profit Calculator

According to the update, Lido has to go through three steps to transform into a fully trustless protocol. The withdrawal key rotation is the first step necessary for the transition to a trustless future.

The update sets out the aspects of every step and why they are important for the protocol’s direction. However, the token’s price seems to have not registered much gains from this new development.

An update on withdrawal key rotation:

TL;DR

– dc4bc audit (published)

– Withdrawal key-rotation ceremony (started)

– First key-rotation message (signed)Importantly, this is the 1st of 3 key steps needed to turn Lido into a fully trustless protocol.https://t.co/1Jm7dn5xLA pic.twitter.com/nFYRGuKuFL

— Lido (@LidoFinance) March 17, 2023

One of the most notable aspects of the update is that it clarified the methodology involved in unlocking ETH staked before July 2021. Lido expects the measures to facilitate a smooth unlocking and withdrawal process.

The update also reveals that eight issues were fixed and there were no critical challenges. Lido noted that the messages being generated will be broadcasted after the Shapella hard fork.

A look at how LDO is fairing after recent events

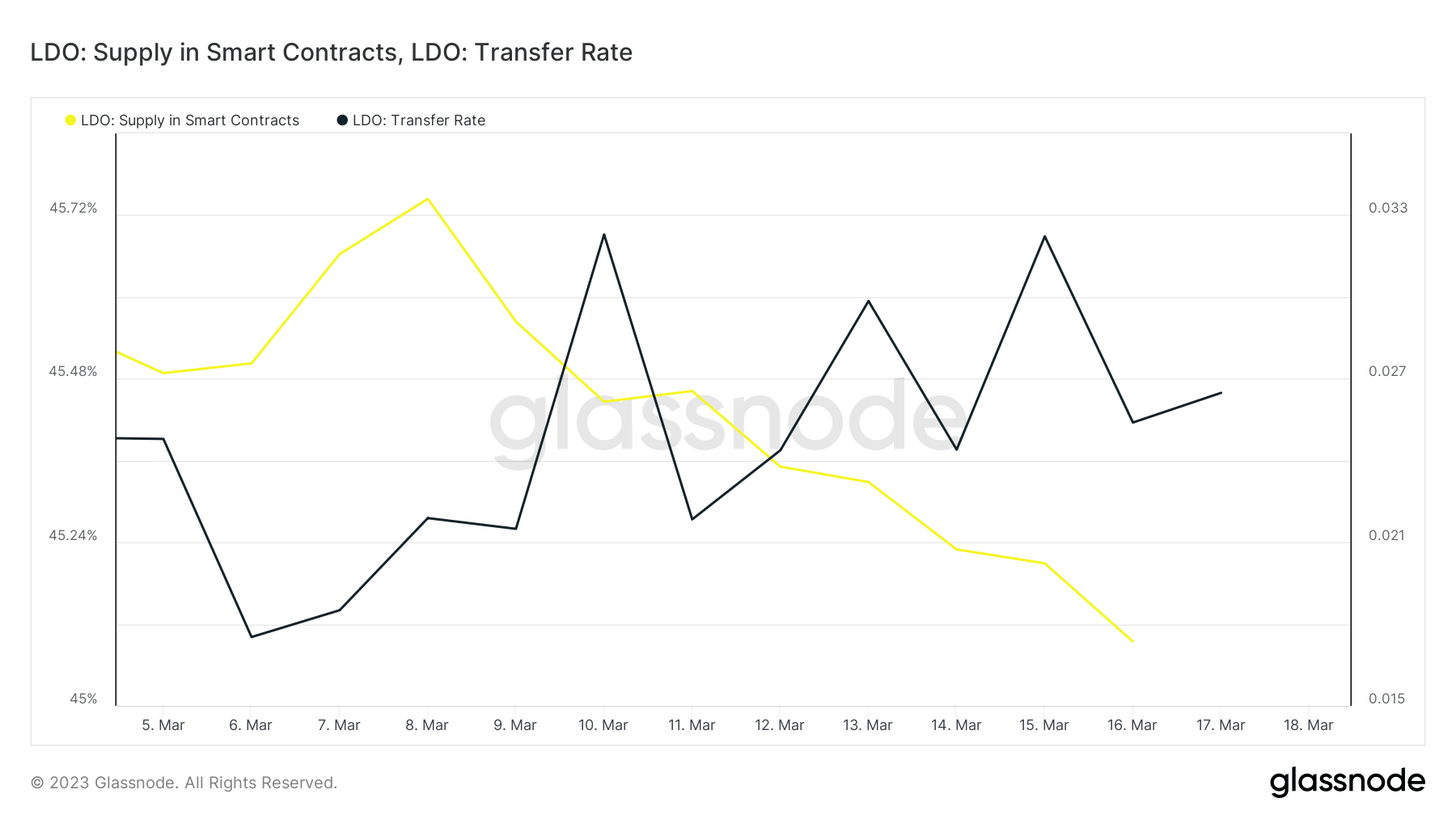

LDO’s supply in smart contracts dropped from 45.74% at the start of the second week of March, to 45.09% on 16 March. Its transfer rate experienced a marginal increase during the same period.

The cryptocurrency market just concluded a bullish week. However, LDO’s performance may not necessarily reflect that weekly outcome.

This is because its $2.56 press time price represented a 16% discount from its weekly high. Nevertheless, it managed a 12% upside from its mid-week lows.

LDO’s inability to bounce back strong and to a new month-to-date high confirms a lack of strong momentum and low investors’ interest.

The current rally did see more attention shifting to Bitcoin and Ethereum. Nevertheless, LDO’s price has shown relative weakness which is evident by its inability to stay above the 50-day moving average.

How many are 1,10,100 LDOs worth today?

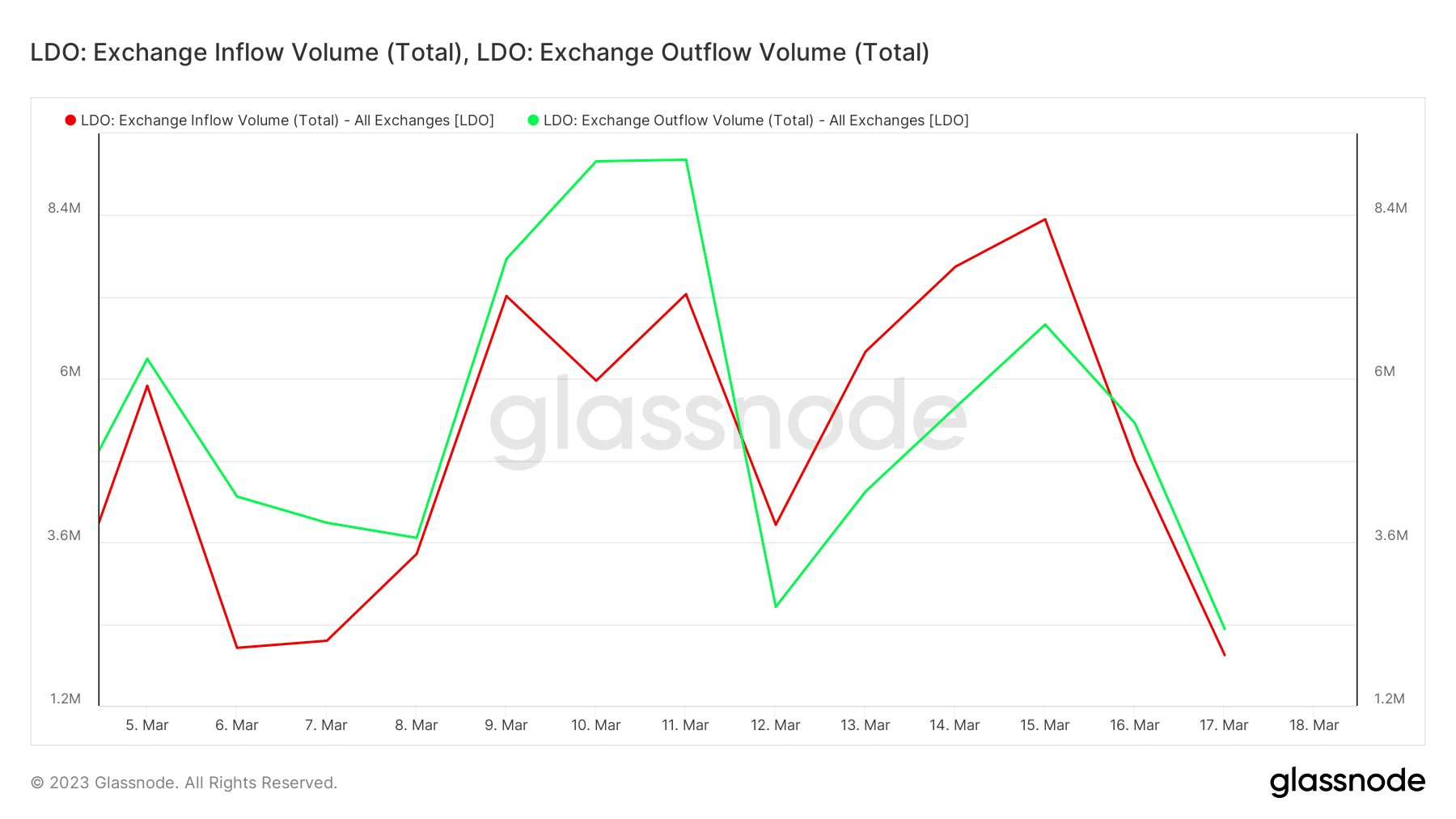

An analysis of LDO exchange flows reveals multiple key observations. The first is that both exchange inflows and outflows have declined since 15 March. This may explain the lack of strong bullish momentum, thus LDO’s failure to push to a new high in the last two weeks.

The second major observation is that exchange outflows, at press time, were still higher than inflows, hence the bullish dominance. Nevertheless, the low volumes suggest low whale activity. LDO is not expected to deliver much more upside if exchange flows continue tanking.

In addition, the uncertainty regarding whether stakers will sell staked funds when unlocked might discourage strong accumulation.