Lido Finance [LDO]: Before you get misled by the price rally, read this

![Lido Finance [LDO]: Before you get misled by the price rally, read this](https://ambcrypto.com/wp-content/uploads/2022/11/LIDO.jpg)

- Lido Finance released a new proposal that looked to increase the conservative security check limits for maximal possible stETH rebase

- LDO rallied by over 10% in the last 24 hours, but this might not mean much

Due to the downturn of the general cryptocurrency market on 9 November, which led to a boom in execution layer rewards, leading Ethereum [ETH] staking platform Lido Finance [LDO] increased its previously set 10% APR limit for the stETH rebase.

Read Lido Finance [LDO] Price Prediction 2023-2024

In a new proposal from the protocol that sought an increment of the 10% APR limit for Oracle report to 17.5%, Lido stated that the increment in APR limit on 9 November had to happen because “the Oracle limit was set before the Merge and hadn’t accounted for potential Execution Layer rewards spikes.”

According to Lido:

“The 10% yearly threshold had been chosen before the Merge and hadn’t accounted for potential spikes in daily rewards accrued by the protocol. In order to prevent potentially economically vulnerable large token rebases 13, only 2 basis points of the stETH total supply can be accounted for rebase daily (~940 ETH at the time of writing). So, in order to accommodate for those extra 2 daily basis points, the threshold increase should be ~7.5% yearly (2 basis points * 365 days ≈7.5%).”

With voting on the proposal scheduled to end on 13 November, 504,578.009 votes have already been tallied in favor of the proposal.

Do you hold LDO?

As the rest of the market corrected in the last 24 hours, LDO’s price rallied by 14% as well. However, despite the growth in the token’s price, its trading volume within the same period declined by 11%.

This sort of disparity in LDO’s price and trading volume in the last 24 hours indicated that there was low conviction in the upward movement of the alt. Therefore, a price reversal or consolidation would follow this until investors’ conviction increases.

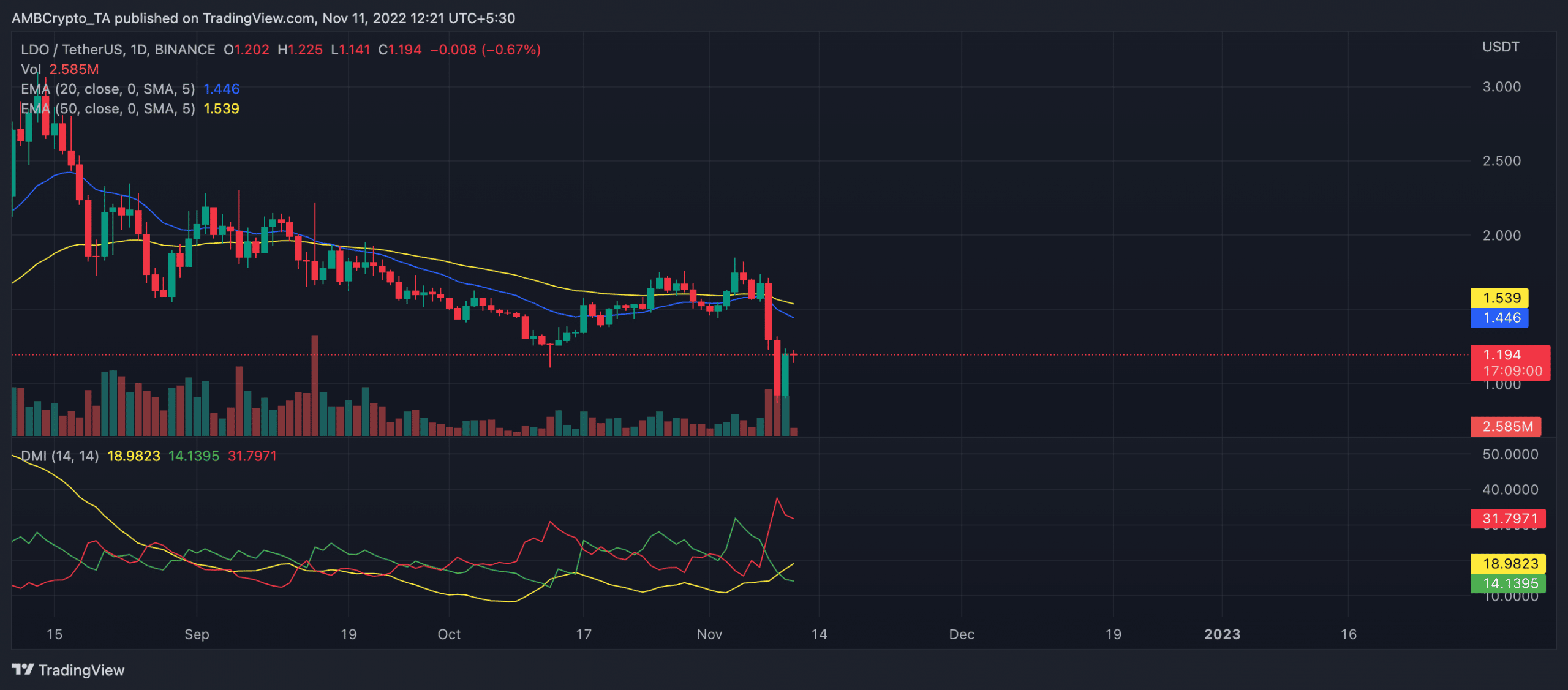

As negative convictions trailed LDO, a look at its movements on the daily chart showed that sellers controlled the market. This was confirmed by the Exponential Moving Average (EMA) position.

At the time of writing, the 20 EMA (blue) was below the 50 EMA (yellow) line. Thus, holders were more interested in distributing their assets.

In addition, the reading of the Directional Movement Index (DMI) lent further credence to this position. At press time, the sellers’ strength (red) at 31.79 was above that of the buyers’ (green) at 14.13.

The Average Directional Index (ADX) showed that the sellers’ strength was solid, and buyers might find it impossible to revoke in the short term.

Therefore, one might say that the growth in LDO’s price in the last 24 hours was due to the statistically significant positive correlation it shares with leading coin Bitcoin [BTC].

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)