Lido governance makes future plans, but will LDO see growth in the present?

- Lido governance continued to make new plans for the future as the protocol saw growth.

- The Lido protocol received criticism due to recent validator slashing.

In the ever-evolving world of the Liquid Staking Derivative sector, Lido[LDO] managed to shine despite the market’s turbulent nature. Thus, making it a prominent figure in this burgeoning space.

Is your portfolio green? Check out the Lido Profit Calculator

New plans in action

The growth story, however, hasn’t stopped Lido’s governance from furthering its vision for the protocol. Under the banner of the Guided Open Objective Setting Exercise (GOOSE), key stakeholders shared their insights on how Lido’s governance should navigate the path forward.

Among the future plans for Lido is the development of complementary products such as restaking, DVT, wallets, stablecoins, lending, and other applications that interact with stakers, stETH, or NOs. The governance’s role involves deciding which of these could prove beneficial for development, and utilization, and which should be overlooked.

According to proponents, any new features considered for implementation should align with primary or secondary objectives without undermining the primary goals. For example, DVT enhances security with only a marginal effect on rewards, making it a core capability the DAO should focus on. Restaking, while offering increased rewards, poses a trade-off in terms of security, demanding robust risk mitigation.

However, it’s worth acknowledging that despite Lido’s success and promising future, it hasn’t been immune to criticism. The protocol faced significant backlash when 20 Lido validators suffered slashing. The Ethereum protocol imposed this punitive action.

Fame and criticism go hand-in-hand

This incident that occurred on 11 October affected 20 Lido validators operated by two professional blockchain infrastructure providers. Infrastructure and issues were the root causes. This incident resulted in a 23.06 ETH penalty, approximately $35,000, representing 2.25% of the average daily rewards earned by Lido validators.

Promptly, the penalty amount was returned to the Lido protocol to compensate the staked ETH holders for their reduced daily rewards. This wasn’t the first time Lido validators experienced slashing. In April 2023, 11 validators operated by RockLogic GmbH were also penalized. The penalties amounted to nearly 14 ETH, equivalent to about 2.4% of daily Lido rewards at the time.

Realistic or not, here’s LDO’s market cap in BTC’s terms

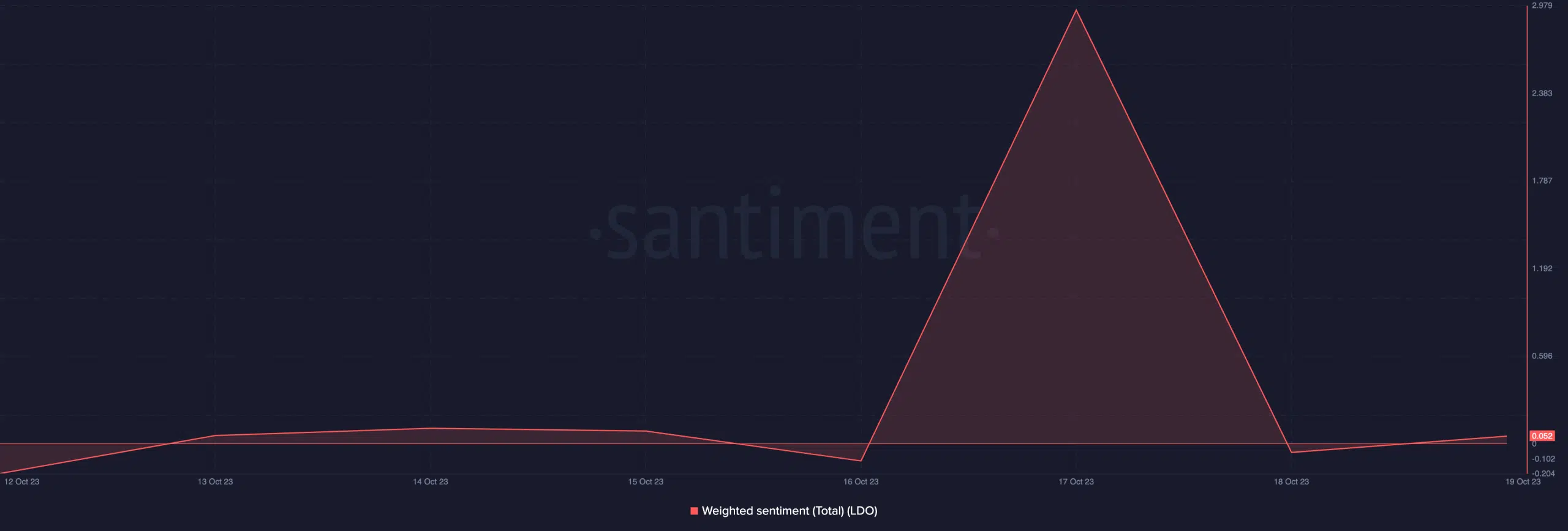

These issues could impact sentiment around both the protocol and the token. However, at press time the LDO’s Weighted Sentiment stood in a slightly positive position. This indicated that the positive comments outweighed the number of negative comments around Lido.