Lido [LDO]: Ethereum’s Shanghai upgrade will impact the staking platform by…

- The Shanghai Upgrade will be released in three days.

- As a result of the upgrade, LDO has seen a surge in staking.

The coming week is extremely important for the Ethereum [ETH] community because the Shanghai upgrade is scheduled to take place in three days, counting down from press time. There has been a lot of speculation regarding the potential impact, especially on Lido Finance [LDO]. This is because one of the key components of the upgrade will be enabling the unlocking of staked ETH.

Is your portfolio green? Check out the LDO Profit Calculator

Once the locked ETH is unlocked, there is a likelihood that many holders will migrate to liquid staking platforms like Lido Finance. The latter recently implemented Lido V2 in readiness for the potential liquidity migration. The upgrade will reportedly allow for new node operators as well as withdrawing from Lido at a 1:1 ratio.

How will the migration affect Lido?

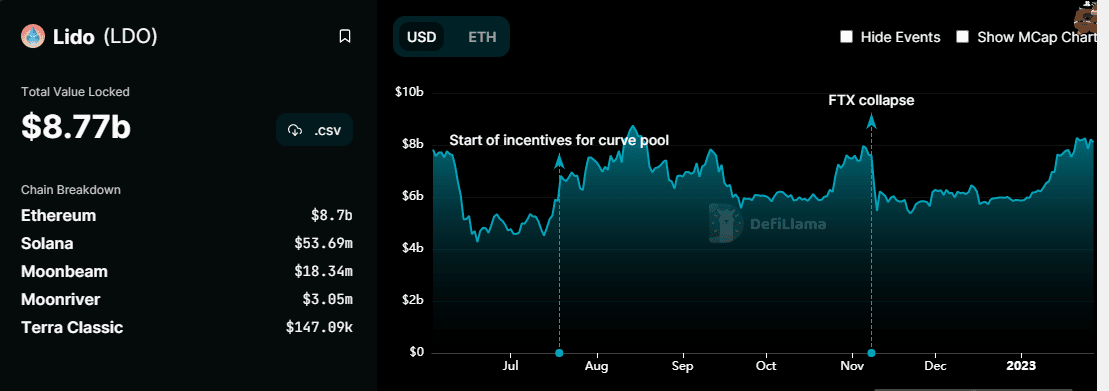

Since most of the locked ETH was staked as early as 2020, there are concerns that billions worth of the cryptocurrency will make their way into the market. However, LDO has experienced a surge in demand for liquid staking in the last six months. Hence, there is strong demand for staking services.

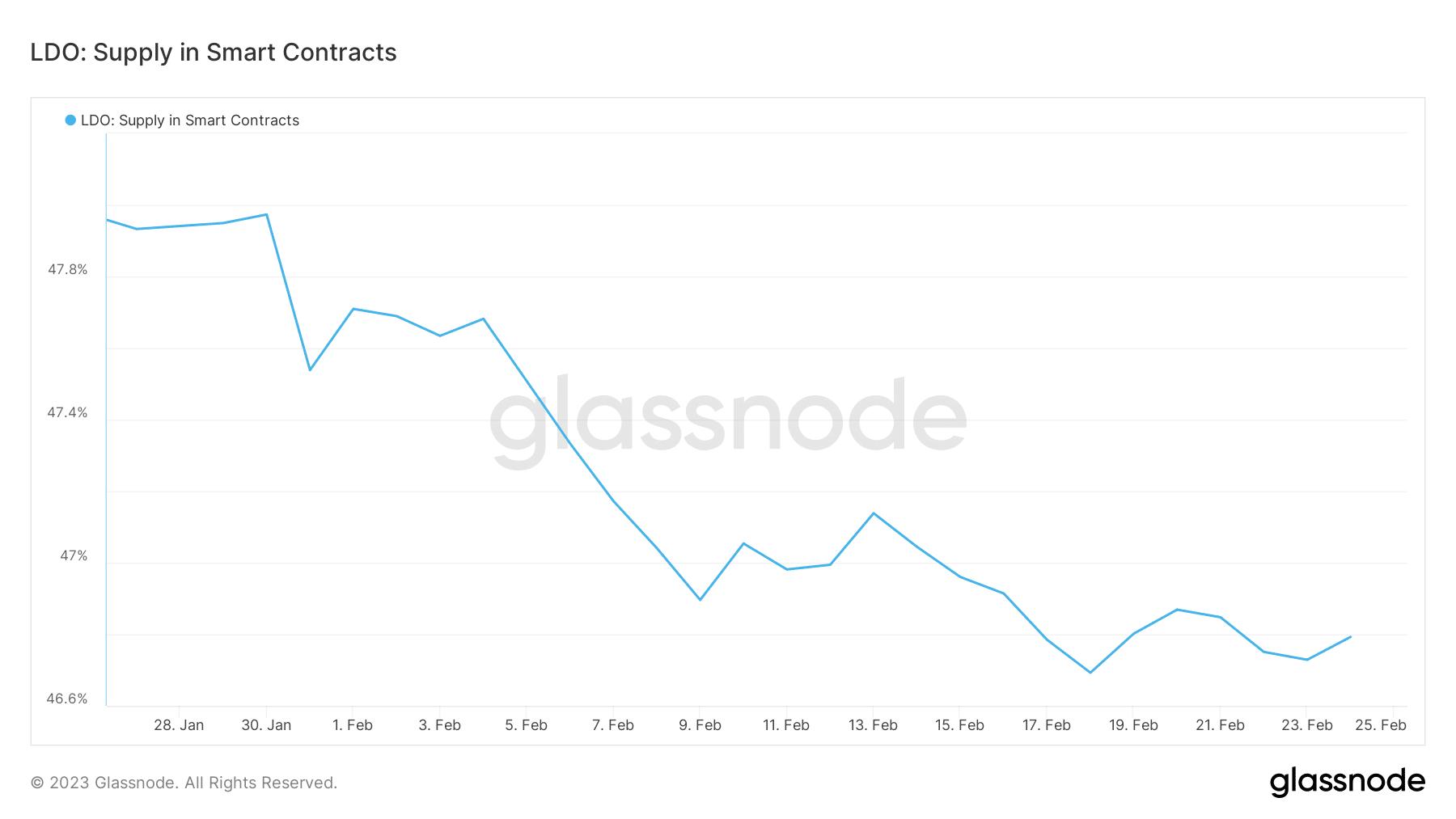

The TVL surge, especially since December 2022, suggested that a migration was more likely, as opposed to sell pressure. Despite this, there has been a drop in the amount of LDO supply in smart contracts, which declined in the last 30 days. However, we see a bit of an uptick since 18 February, suggesting that a potential pivot may be in place.

LDO experienced a bit of sell pressure this week, which was consistent with the sell pressure observed in the crypto market. Its $2.77 press time price represented a 16% pullback from its current monthly high, but despite this, LDO is still holding on to most of its recent gains.

How many are 1,10,100 LDOs worth today?

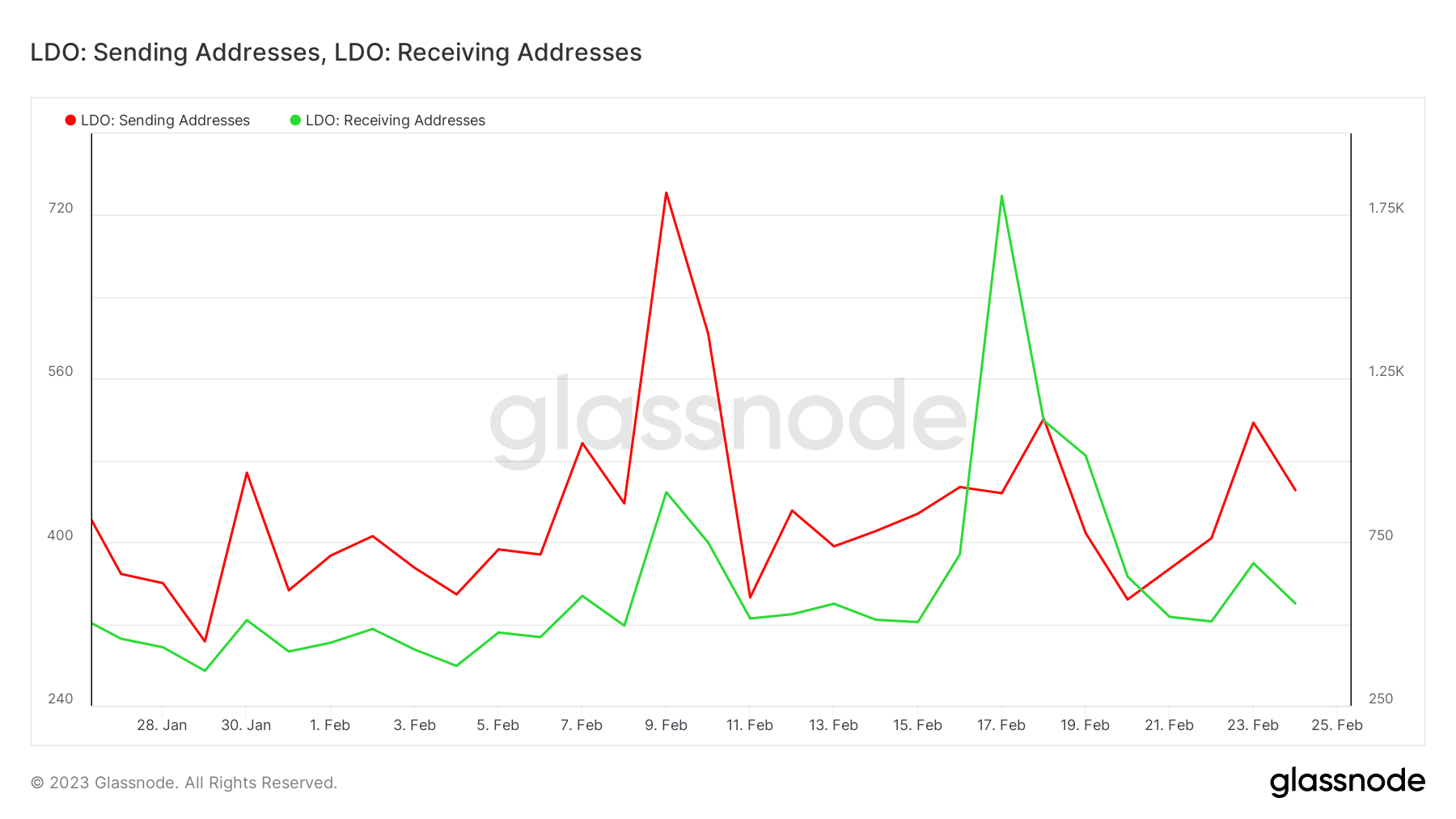

The lack of a stronger pullback is evident that there is not much sell pressure taking place. This is consistent with address flows on Glassnode. The number of receiving addresses has been notably higher than sending addresses in the last few months, despite a slowdown in market conditions.

While the next few days will be critical, reasonable volatility is also to be expected. Some sell pressure for both ETH and LDO might occur, but a migration to Lido may boost LDO demand in the mid to long term.