Analysis

Lido [LDO] falters at $1.7 — Can buyers still benefit?

Lido’s short-term pullback could provide buying opportunities at this confluence zone if BTC doesn’t post extra losses.

![Lido [LDO] falters at $1.7 — Can buyers still benefit?](https://ambcrypto.com/wp-content/uploads/2023/10/image-1200x1000-1-1000x600.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Lido hit a $1.7 roadblock – a sticky hurdle since mid-August.

- Demand in the Futures market eased slightly at press time.

The crypto market fronted an impressive start in Q4 2023. Bitcoin’s [BTC] steady foray into the $28k tipped the altcoin market into a recovery. But most altcoins, Lido [LDO] included, hit key resistance levels, setting them to pullbacks as of press time.

How much are 1,10,100 LDOs worth today?

Will the confluence area stop the drop?

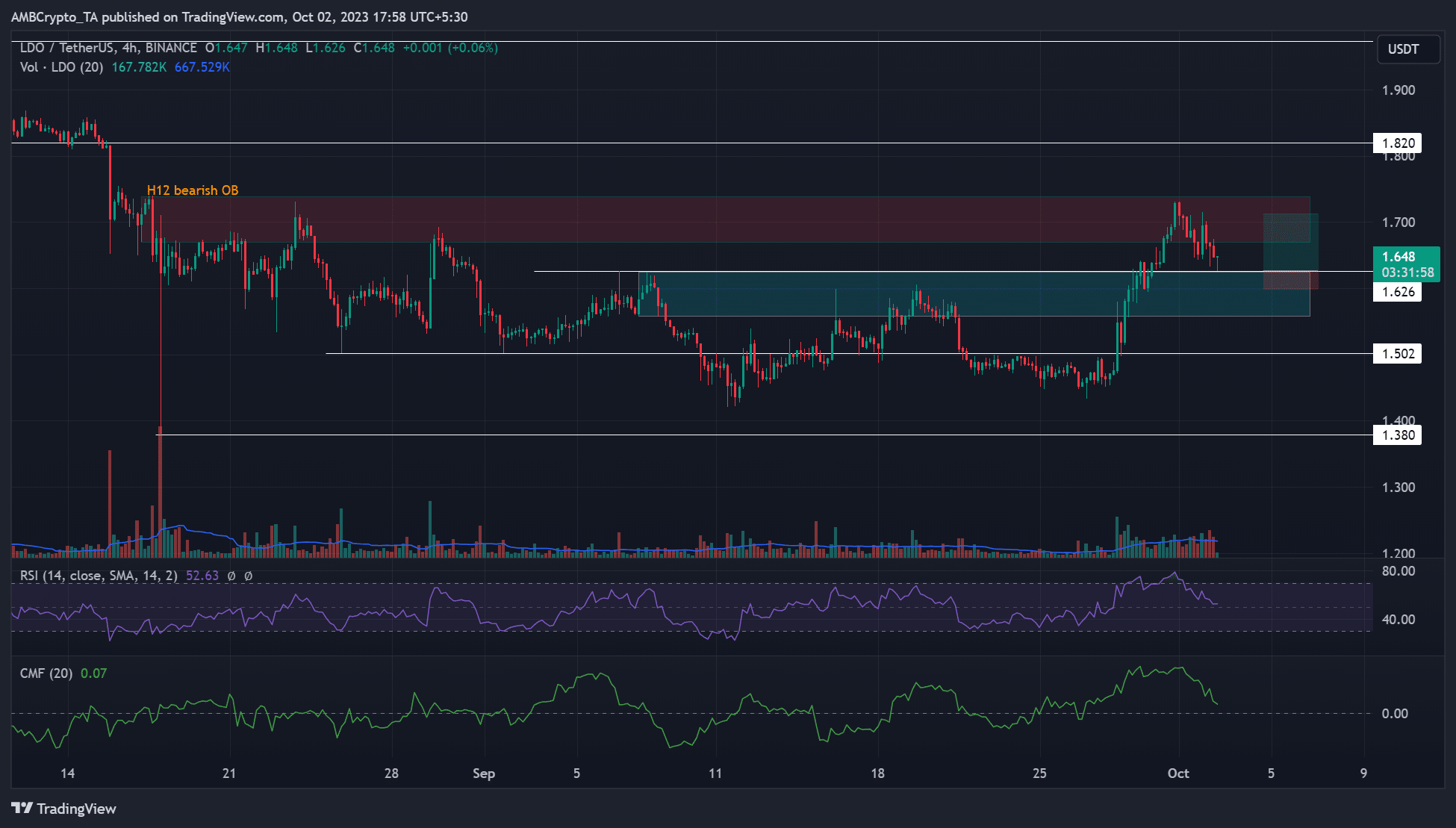

LDO retraced to a previous high of $1.626 after faltering at the H12 bearish order block (OB) of $1.670 – $1.740 (red).

The $1.626 level aligned with another invalidated H12 bearish OB of $1.558 – $1.625 (cyan). Given the confluence area at $1.6, buyers could attempt to defend it as a bullish zone. If so, the area could act as a re-entry for a long position targeting the $1.7 roadblock.

A rebound from the confluence zone could present a potential 4% gain, especially if BTC doesn’t post immediate losses.

Buyers could also have a second buying opportunity if price action convincingly mounts above the $1.7 roadblock. Such a move, primarily if BTC fronts a bullish breakout at $28.3k, could set LDO to extend the rally to $1.82.

A drop below $1.6 will invalidate the bullish thesis and weaken LDO’s market structure.

Meanwhile, the Chaikin Money Flow (CMF) and Relative Strength Index (RSI) retreated. This denoted a decline in capital inflows and buying pressure in the past few hours before press time.

Demand eased slightly in the Futures market

The demand for Lido eased slightly in the Futures market, as shown by the little dip in Open Interest rates at press time.

Read Lido [LDO] Price Prediction 2023-24

But neither buyers nor sellers had absolute control in the market, as illustrated by fluctuations in Cumulative Volume Delta (CVD) in the past few days.

So, close tracking of BTC movement is crucial. BTC’s retracement and drop below the mid-range of $27k could invalidate the above bullish bias. But a bullish breakout above $28.3k could extend Lido’s recovery.