Lido: TVL dips despite stETH demand, what will the protocol do next

- Lido’s TVL declined over the past week as activity on the protocol fell.

- LDP token prices fell as whale interest waned.

Lido Finance [LDO], in a 28 March tweet, reported a 2% decrease in its Total Value Locked (TVL) over the past week. Despite the high demand for Lido’s stETH in the previous month, a reduction in the TVL could signal a gloomy outlook.

? Lido Analytics: Mar 20 – 27, 2023

TLDR:

– Lido TVL -1.04% down due mainly to ETH price volatility last week.

– 36.4% share of weekly ETH deposits.

– stETH/ETH rate: 0.9986.

– Expansion of stETH lending pools: @AaveAave V3 wstETH +10.6%, @MakerDAO wstETH-A +25.6%. pic.twitter.com/jzKhRR3iTj— Lido (@LidoFinance) March 27, 2023

Is your portfolio green? Check out the Lido Profit Calculator

Trouble ahead for Lido?

One reason for Lido’s decline in TVL could be the falling activity on the network. According to Token Terminal’s data, the number of daily active users on the protocol fell by 29.1% in the last few weeks.

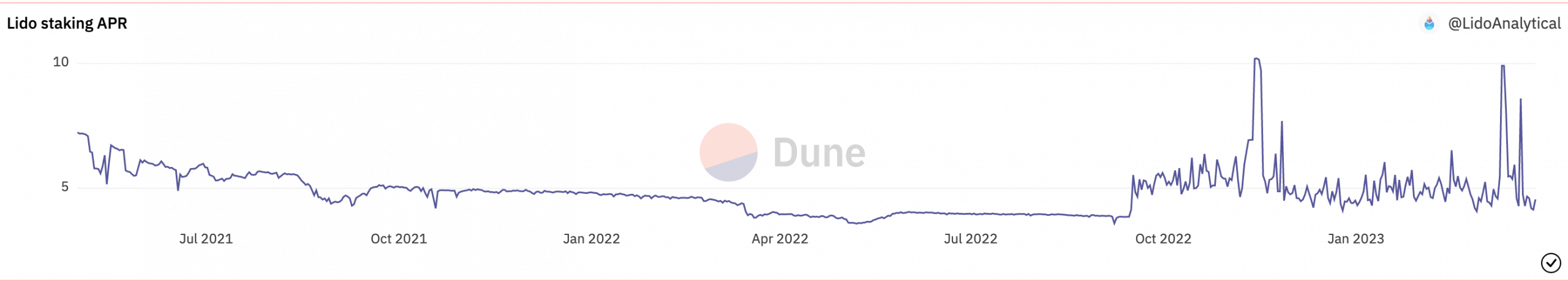

This fall in users could be a result of Lido’s declining APR. When the APR decreases, it reduces the incentive for users to provide liquidity or stake their assets through the protocol.

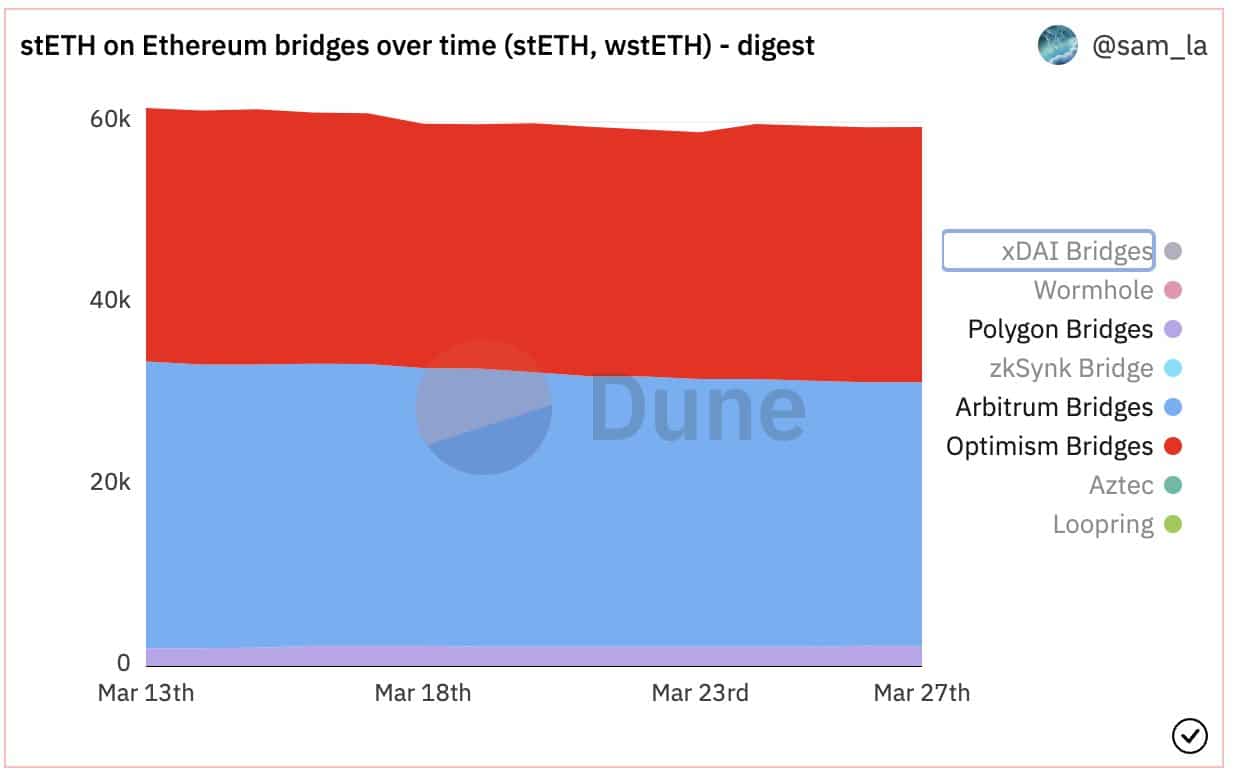

However, Lido’s wstETH did well in lending and L2 protocols. On protocols such as MakerDAO and Aave, the demand for wstETH grew by 25.96% and 10.6% respectively.

On the L2 solutions, there was a surge in wstETH deposits of 4.4% on Optimism and a 3.67% surge on Polygon [MATIC].

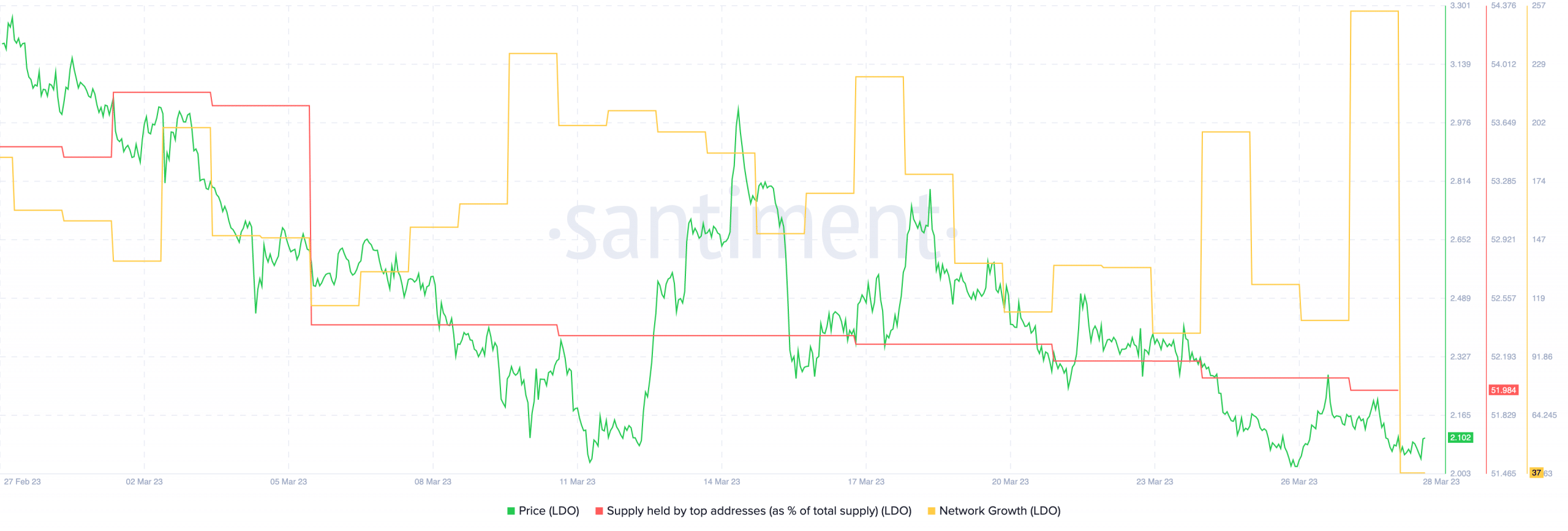

Moreover, LDO did not have a positive week as well, as its prices declined significantly over the past few days. One reason for the dip in LDO’s price could be the decline in interest from whales as indicated by Santiment’s data.

The network growth for LDO also took a hit, implying that new addresses were not interested in buying the token at the given price.

Realistic or not, here’s LDO market cap in BTC’s terms

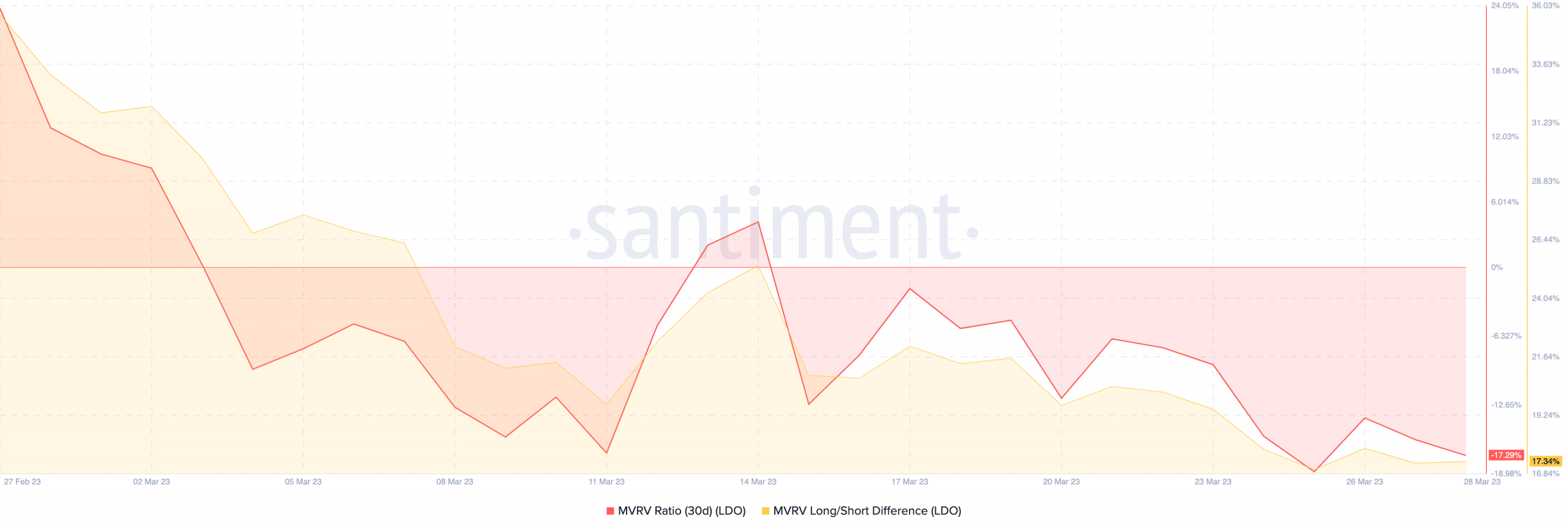

However, it appeared that LDO may not decrease further as the token’s MVRV ratio turned negative. A negative MVRV ratio implied that most holders of the LDO token were not profitable at press time. Therefore, at press time, they were much more likely to wait for LDO’s prices to increase before selling their positions.

Even though LDO’s prices may surge yet again in the future, the current price drops could impact the protocol immensely. This is because 82.9% of Lido’s treasury consisted of the LDO token. If the prices continued to decline, the protocol may not have enough resources to make improvements on its network.