Lido withdrawals, longer queues, and its impact on the protocol: Analyzing it all

- The unlocking of Lido withdrawals may cause larger queues, going forward.

- Overall activity on the protocol increased as staker APR rose.

Lido [LDO] has been dominating the DeFi market for quite some time. After the protocol took the top spot from MakerDAO [MKR] in terms of TVL, the former has been making increasing improvements to its network.

Is your portfolio green? Check out the Lido Profit Calculator

Withdrawal symptoms

However, Lido’s upcoming withdrawals may have a stressful impact on the protocol. According to Tom Wan, a research analyst at 21Shares, withdrawals on Lido would impact the queues on the network.

Lido Withdrawals are Coming! How will it impact the Queues? ?♂️

Assuming 10% unstaking request, thanks to the buffer from rewards+daily deposits, the est. number of validator exits will only be 11.6k

Current Stat:

Exit Queue: 0

Withdrawal Queue: 507k (Partial) + 1.1k (Full) https://t.co/A1Mv0D6Uho pic.twitter.com/s8HblLGwhi— Tom Wan (@tomwanhh) May 14, 2023

Lido Queues refer to the number of users who have requested to withdraw their staked Ethereum from the Lido protocol. These users have to wait in a queue until their withdrawal request is processed. However, it could take some time, depending on the number of requests and the amount being withdrawn.

According to Tom, if 10% users request to withdraw their funds, the protocol has a buffer of rewards and daily deposits to cover those withdrawals without having to liquidate too many of the staked assets on the network.

If the unstaking requests exceed 10%, it could cause a larger number of validator exits, potentially leading to longer queues for withdrawals.

At press time, there were 507,000 partial withdrawals and 1,100 full withdrawals pending on Lido.

State of the Lido Protocol

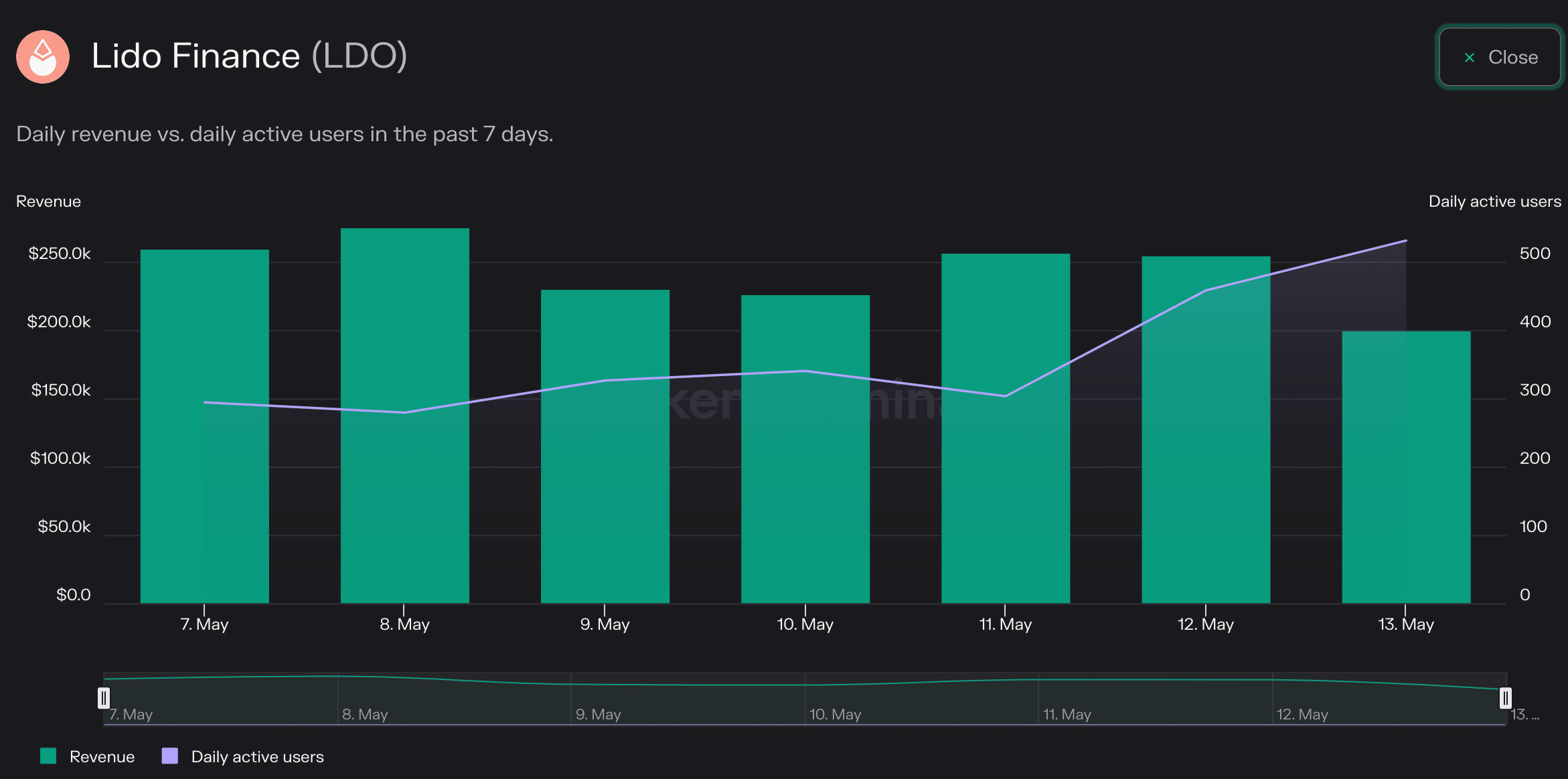

In terms of activity, the protocol observed an increase of 80.6% in the number of daily active users over the last week. The surge in activity resulted in a spike in revenue, which grew by 11% during the same period.

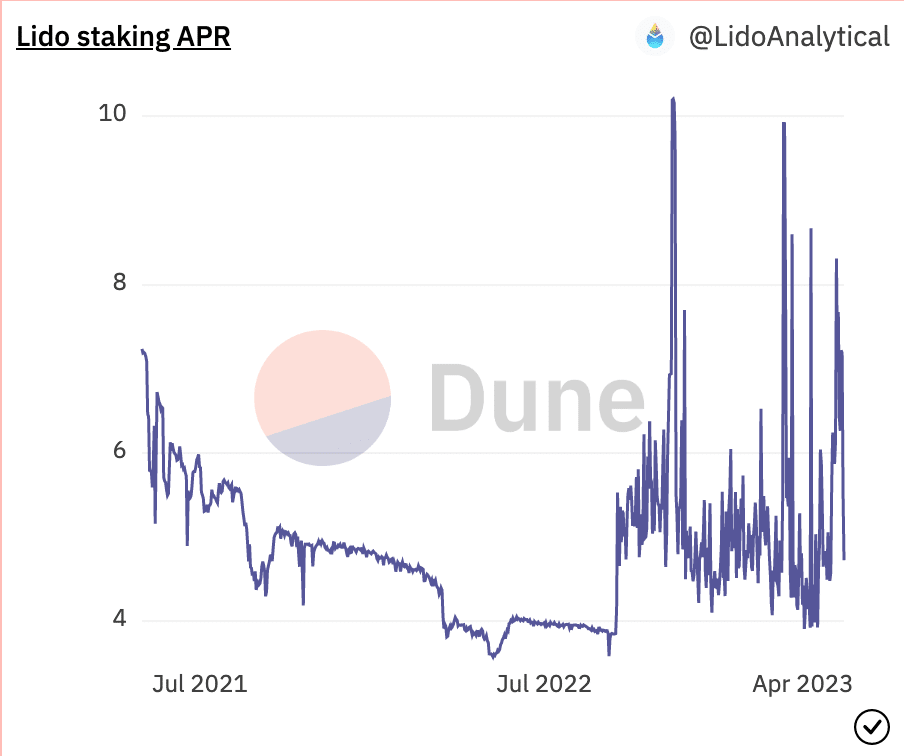

The increasing activity on the protocol could be attributed to Lido’s APR (Annual Percentage Rate), which reached 8.31 over the last month. The high APR can encourage users to stake their Ethereum [ETH] with Lido and earn a higher yield.

Realistic or not, here’s LDO’s market cap in BTC’s terms

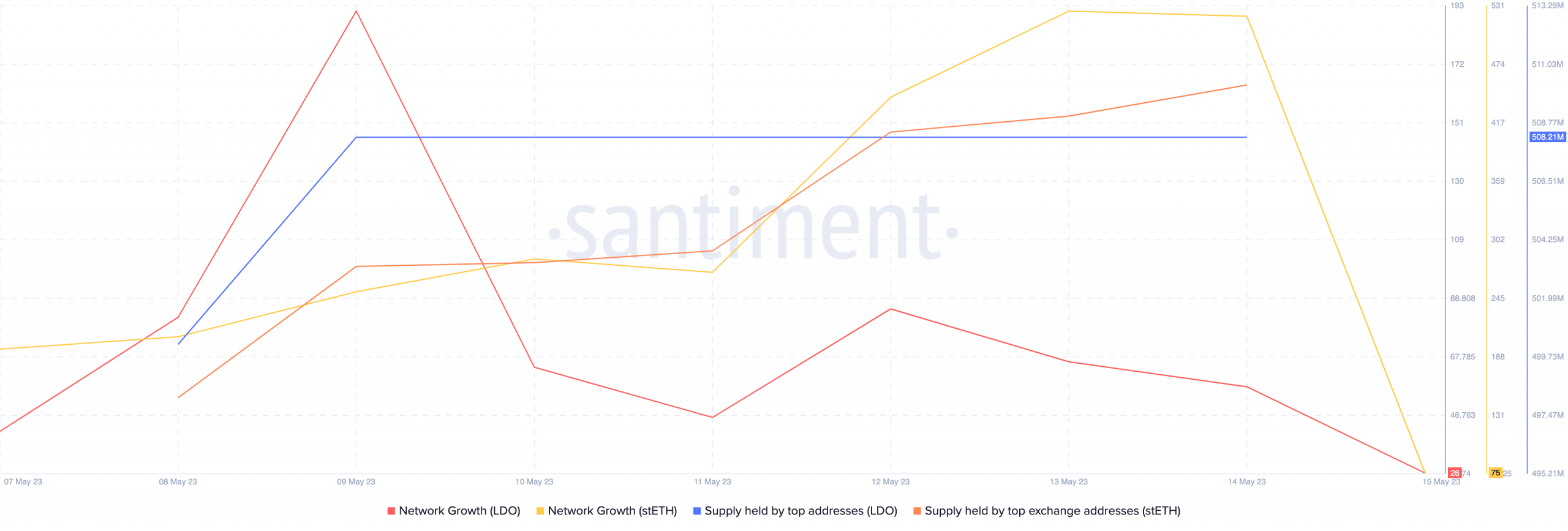

These factors led to a rise in interest in stETH. The network growth of stETH surpassed that of the LDO token over the last week, indicating that users were interested in stETH more than the protocol’s token itself.

Additionally, whale interest in stETH also surpassed that of LDO, showcasing that many addresses had faith in Lido protocol’s staking services.