Lido’s impact on Ethereum staking, revealed

- More ETH has been staked through Lido by existing stETH holders.

- LDO has not followed the staking trajectory as it continued to trend downwards.

Since the Ethereum [ETH] merge, the Lido [LDO] platform has taken center stage in the former’s staking. Its significance and influence increased immensely, particularly following the Shanghai upgrade. But what has been the far-reaching impact on the platform?

Read Lido’s [LDO] Price Prediction 2023-24

Lido sees return stakers

On 15 May, Lido introduced its highly anticipated V2 update. This update allowed node operators to withdraw their staked ETH, enabling those who held Lido’s stETH token to exchange it for ETH directly.

As a result, there was a notable redemption of 400,000 stETH tokens, equivalent to around $721 million. This redemption led to a contraction in the overall stETH supply.

However, despite this reduction, Lido experienced an impressive influx of new ETH deposits that more than compensated for the decline. This influx was so substantial that it pushed the all-time high (ATH) of stETH to a remarkable 7.49 million tokens.

This accomplishment further solidified Lido’s position as the undisputed leader in the liquid staking sector, with its supply surpassing that of its nearest competitor by a staggering 16 times.

New Lido addresses holding stETH is oscillating between 230-590/day, which is more or less unchanged YTD.

This leads us to the conclusion that many new deposits made via Lido are driven by existing stETH token holders increasing their exposure. pic.twitter.com/AoW2l004kA

— glassnode (@glassnode) July 6, 2023

Additionally, the number of new Lido addresses holding stETH tokens exhibited a consistent pattern throughout the year, ranging between 230 and 590 per day, per Glassnode. This indicated that a significant portion of the new deposits made through Lido were driven by existing stETH token holders seeking to increase their exposure to the platform.

The current share of the staking market

According to the latest data from Dune Analytics, Lido boasted the largest market share in ETH staking at press time. It commanded around 31.9% of the ETH stake, solidifying its dominant position in the industry.

These statistics indicated notable growth for the platform over different time frames. In the past week alone, Lido experienced a 2% increase in its market share, showcasing a continuous upward trajectory.

Looking at a broader timeline, Lido has seen a substantial 7% growth in the past month and an impressive 63% surge over the past six months.

Lido TVL in an overall upward trend

An intriguing trend was observed when examining the Total Value Locked (TVL) in Lido, as depicted by DefiLlama. The chart revealed that its TVL experienced an upward trajectory following the activation of ETH withdrawal functionality.

This aligned with data from Glassnode, which reported that users staked more on withdrawal activation. Also, as of this writing, the TVL in Lido was over 14 billion.

How much are 1,10,100 LDOs worth today?

LDO unimpressed

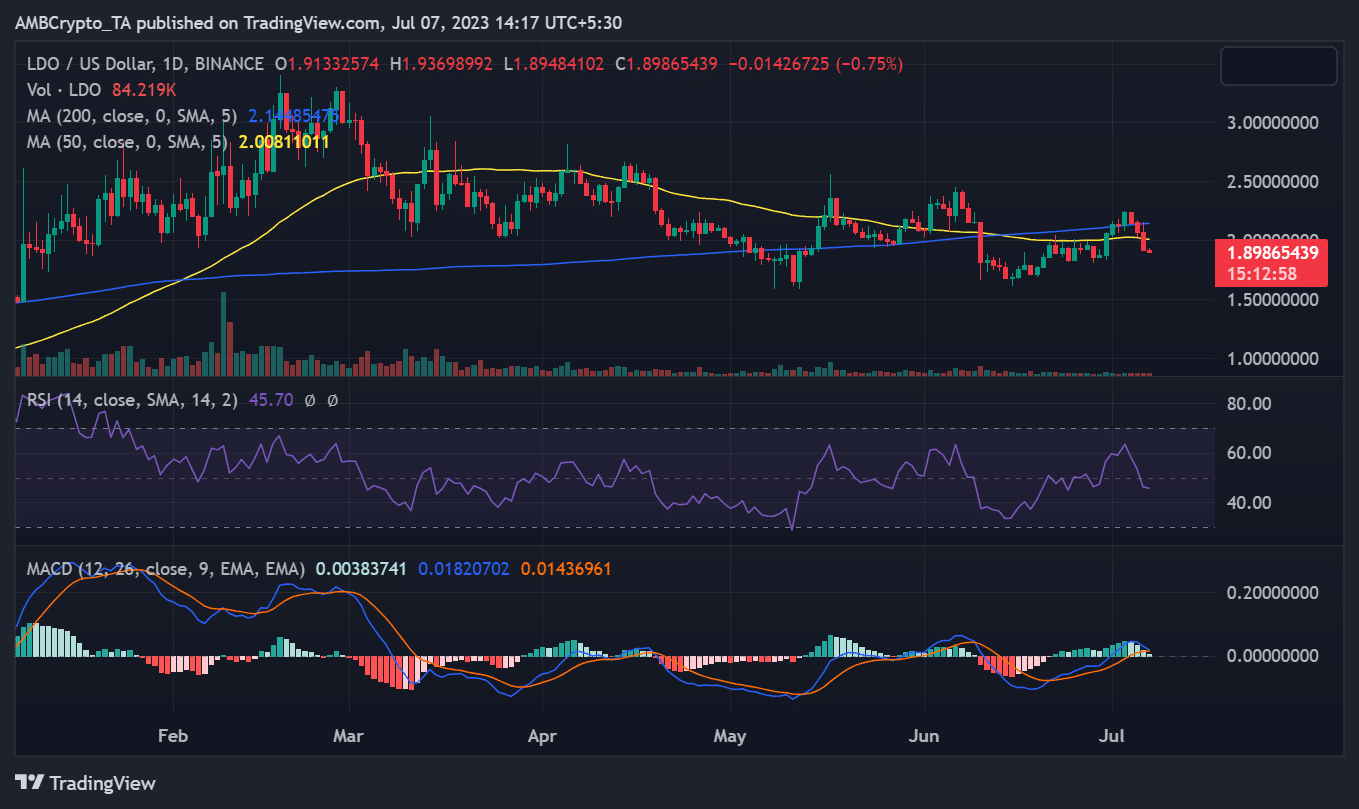

However, the native token of the platform, LDO, has been experiencing a less favorable trend based on its daily timeframe chart. As of this writing, LDO was trading at approximately $1.89, reflecting a decline of nearly 1% in its value.

Furthermore, the token closed at a loss of over 7% in the previous trading session. This price movement has further declined the Relative Strength Index (RSI), indicating an emerging bear trend.

Source: TradingView