Analysis

LINK crosses $7 hurdle: Where to next?

Chainlink bulls rallied strongly to cross an important psychological price level. Will LINK finally reach the highest price of 2023?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- A strong bullish rally saw LINK smash the $7 psychological level.

- Open Interest saw a 120% rise over the past 48 hours.

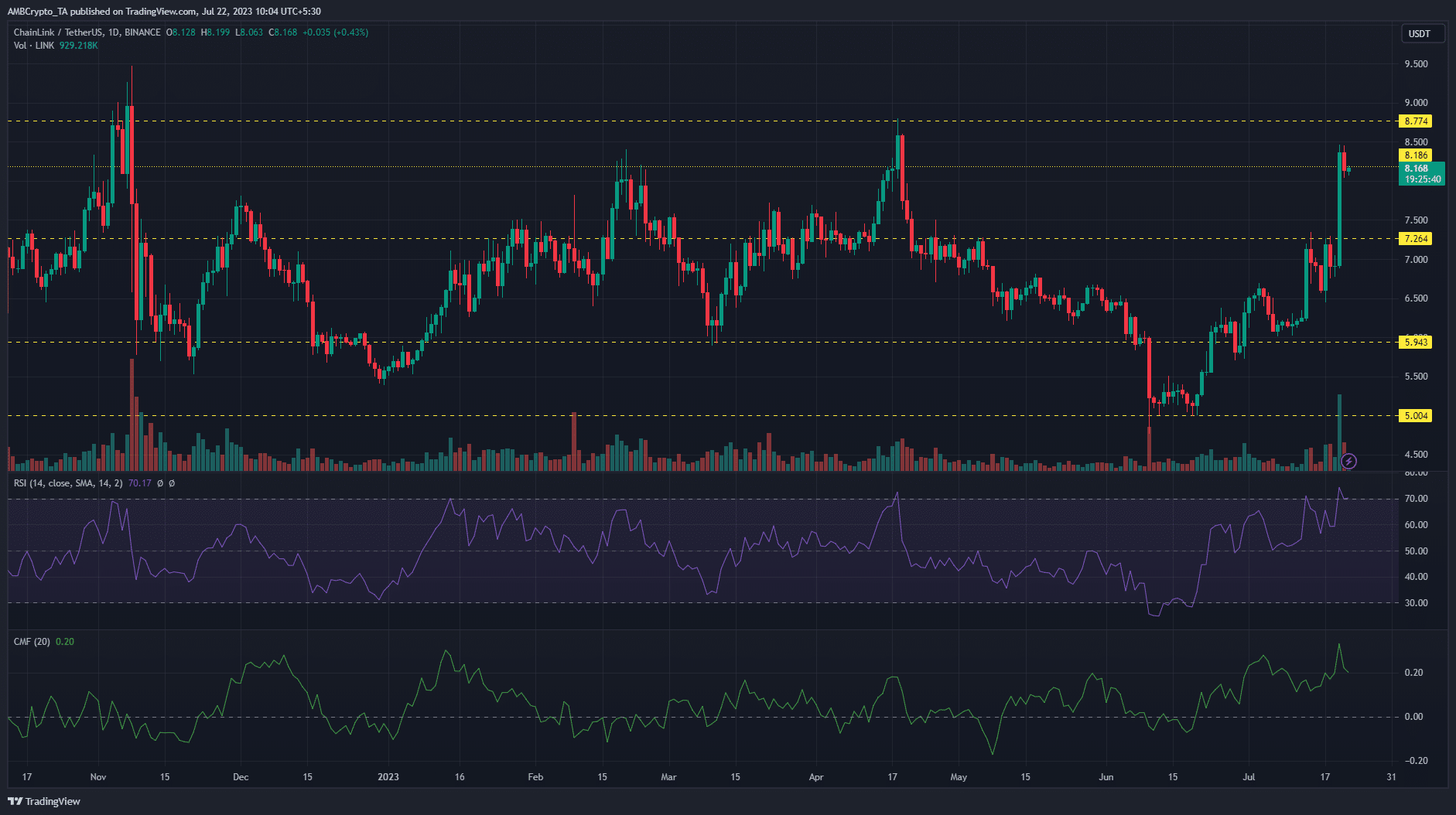

Chainlink [LINK] finally regained the $7 psychological level after a strong bullish move over the past 48 hours. LINK’s aggressive rally on 13 July took it touching distance from the critical resistance level.

Is your portfolio green? Check out the LINK Profit Calculator

However, bulls were rebuffed twice in quick succession with key retracements keeping price under the $7.2 level.

The launch of Chainlink’s Cross-Chain Interoperability Protocol (CCIP) served as a catalyst for the 22% jump in price that took LINK above the $7.2 and $8.18 resistance levels.

Clearing the $7 hurdle could lead LINK above year-high of $8.79

LINK’s bearish market structure from mid-April kept the altcoin on a downward swing for the majority of Q2. However, the upturn in market sentiment in late June saw LINK rally significantly from the $5 level.

The break in the bearish lower high on 13 July signaled the bullish intent to flip the market structure. Despite the price retracement, bulls flipped LINK bullish with a strong move above the $7.2 resistance level.

With the year high of $8.79 achieved in April firmly in sight, bulls can look to push on after this big break. A retest of the $8.18 support level offers new buying opportunities that could see LINK record a new year high ($8.8 – $9.4).

On the flip side, if Bitcoin [BTC] continues to stay under $30k, market sentiment might flip bearish. This could see bears reverse some of the bullish gains with $7.2 – $7.5 as the near-term targets.

In the meantime, the on-chart indicators supported a continuation of the bullish move. The RSI stood at 70 denoting massive buying pressure. Although the CMF eased from +0.33 to +0.20, it still hinted at strong capital inflows for LINK.

Open Interest doubled

How much are 1,10,100 LINKs worth today?

The Open Interest data from Coinalyze showed significant backing for the bullish rally in the futures market. The OI rose sharply from $136 million to $286 million within 48 hours. While it eased slightly, as of press time, it highlighted the aggressive demand for LINK.

Similarly, the Funding Rate has been consistently positive since 18 July. Collectively, it signaled strong bullish control in the short term.