LINK traders, target this range!

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Sellers exerted excessive control over Chainlink’s [LINK] market from mid-April. In fact, a recent report established that over 80% of LINK holders were at a loss after LINK dipped below $6.

However, LINK fronted a short-term trend reversal, crossing $6.6 at press time. The recovery followed BTC’s pump from $26.2 to over $27k over the weekend.

Can bulls push beyond $6.8?

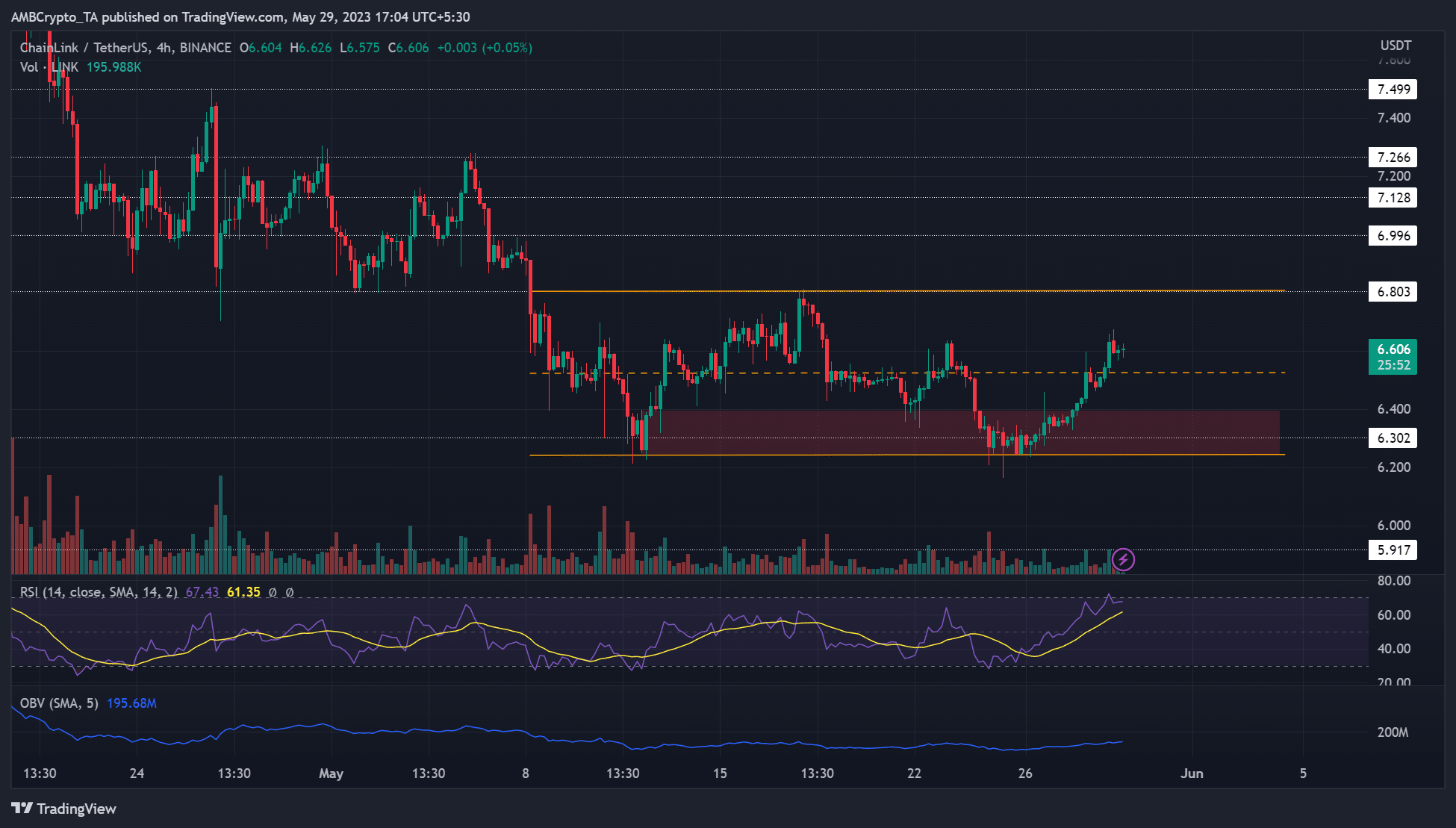

LINK’s price action in the past three weeks chalked a short-term range formation with range extremes at $6.2 and $6.8. The range low of $6.2 aligned with a bullish order block (OB) of $6.3 – $6.4 (red) formed on 12 May on the four-hour chart.

The high range also aligned with the late March/April support level. As such, bulls were not only facing a range-high hurdle but a key support-cum-resistance level. Furthermore, a negative price reaction at this level could drag LINK to lower support levels.

If that’s the case, sellers could re-enter at the range high, targeting the mid-range or range-low levels of $6.5 and $6.2, respectively.

Conversely, a close above $7 will invalidate this bearish thesis. Such an upswing, especially if BTC reclaims $28k, could rally LINK to overhead resistance levels at $7.1 and $7.3.

Meanwhile, the Relative Strength Index (RSI) hit the overbought zone while On-Balance Volume (OBV) edged higher, reiterating buying pressure and demand increased in the past few days.

CVD spot wavered

How much are 1,10,100 LINKs worth today?

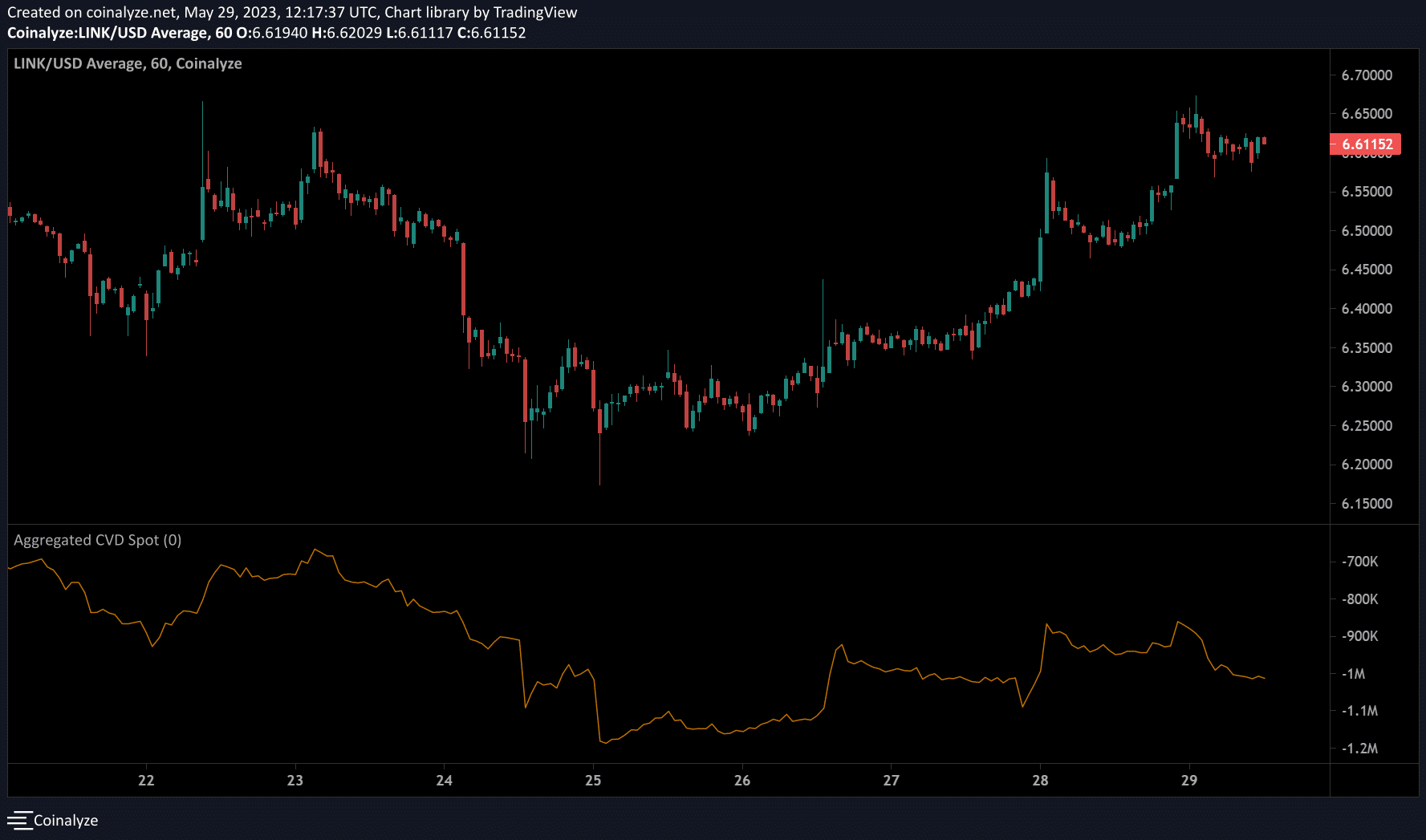

The Cumulative Volume Delta (CVD) metric on the one-hour chart wavered since 25 May. This confirmed buyers and sellers had near-equal market control in the past four days.

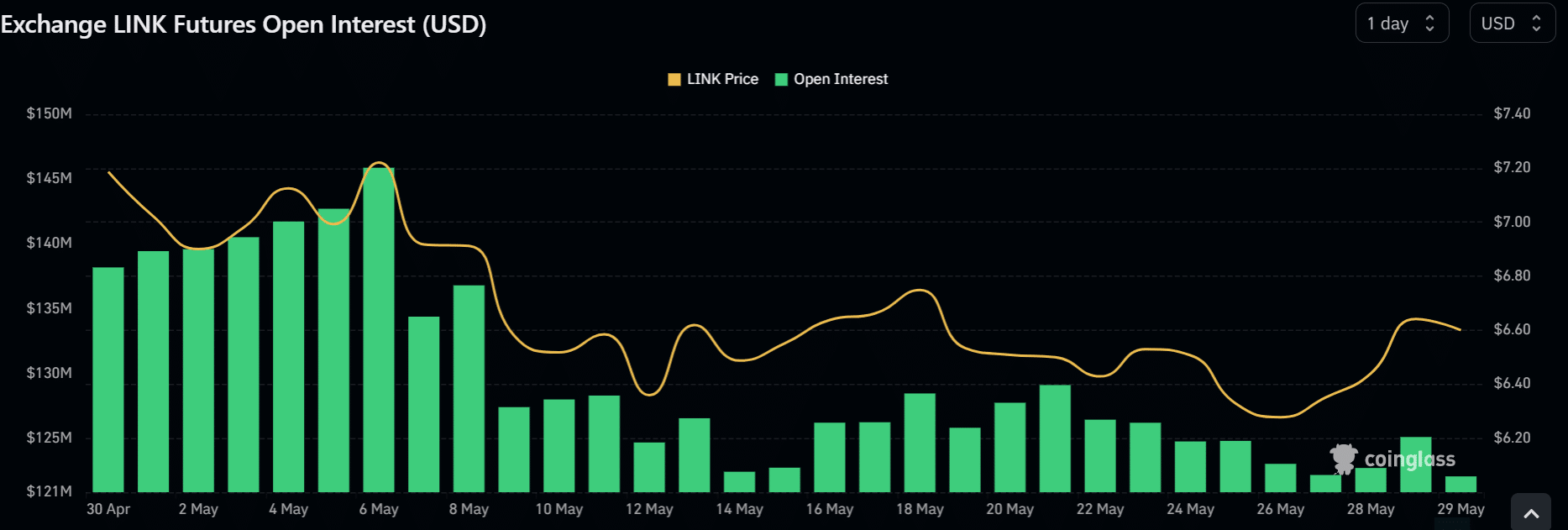

On the open interest (OI) rates front, LINK saw a decline from about $145 million peak in the first half of May to below $130 million in the second half. The drop in OI could undermine a strong rally beyond $6.8.

However, a bullish BTC in $28k will invalidate the above bearish scenario.