Litecoin: Analyzing the impact of Montana’s new crypto bill on LTC

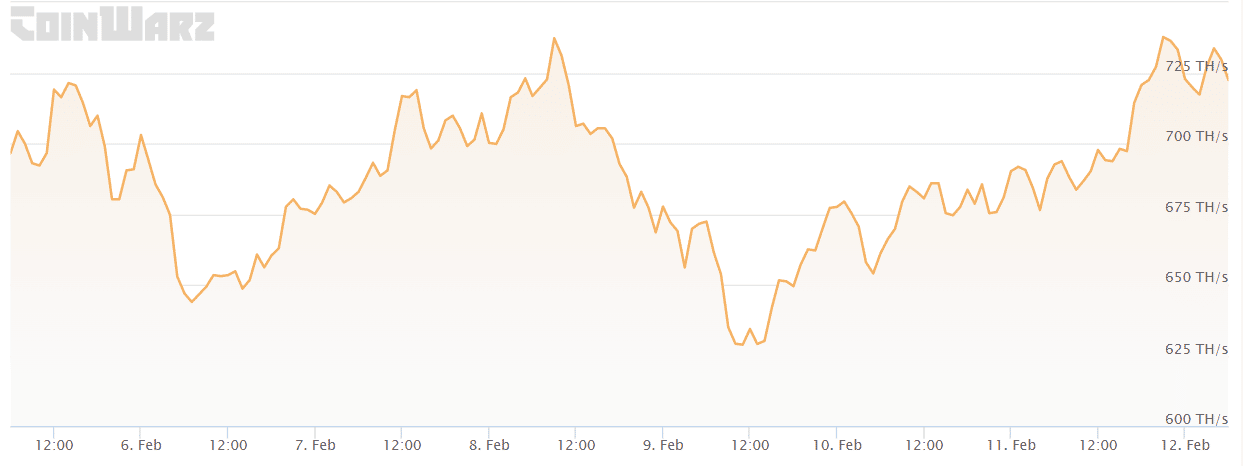

- Litecoin’s hashrate registered an increase.

- Investors might have to wait a little longer for LTC’s next bull run.

A new bill was recently passed in Montana State aimed at changing a few laws in the region regarding cryptocurrencies and crypto mining.

Interestingly, this new bill can have a positive impact on Litecoin [LTC], as it is one of the world’s largest PoW blockchains.

The bill will ensure a level playing field for all miners by prohibiting energy companies in Montana from charging various rates for different types of digital asset mining operations.

Moreover, the bill will also prohibit taxation on the use of cryptocurrency, including Litecoin, as a payment method.

In this regard, it should be noted that Litecoin recently mentioned that it was the second most transacted currency after Bitcoin [BTC] with the world’s largest crypto payment processor, and the new bill might help its adoption further.

Realistic or not, here’s LTC market cap in BTC’s terms

Miners reacted immediately

Soon after the bill was passed, Litecoin’s hashrate registered an uptick, indicating an influx of new miners into the network.

As per CoinWarz, at the time of writing, LTC’s hashrate was 722.42 TH/s. Surprisingly, despite the hike in hashrate, LTC’s mining difficulty declined slightly, and the value stood at 23.72 million.

This increase in hashrate was an optimistic development for the network as the date of the LTC halving approaches.

However, LTC’s response on the price front was not satisfactory. This could be attributed to the ongoing bearish market trend.

CoinMarketCap’s data revealed that LTC remained less volatile in the last 24 hours, and at press time, it was trading at $93.34 with a market capitalization of more than $6.7 billion.

How much are 1,10,100 LTCs worth today?

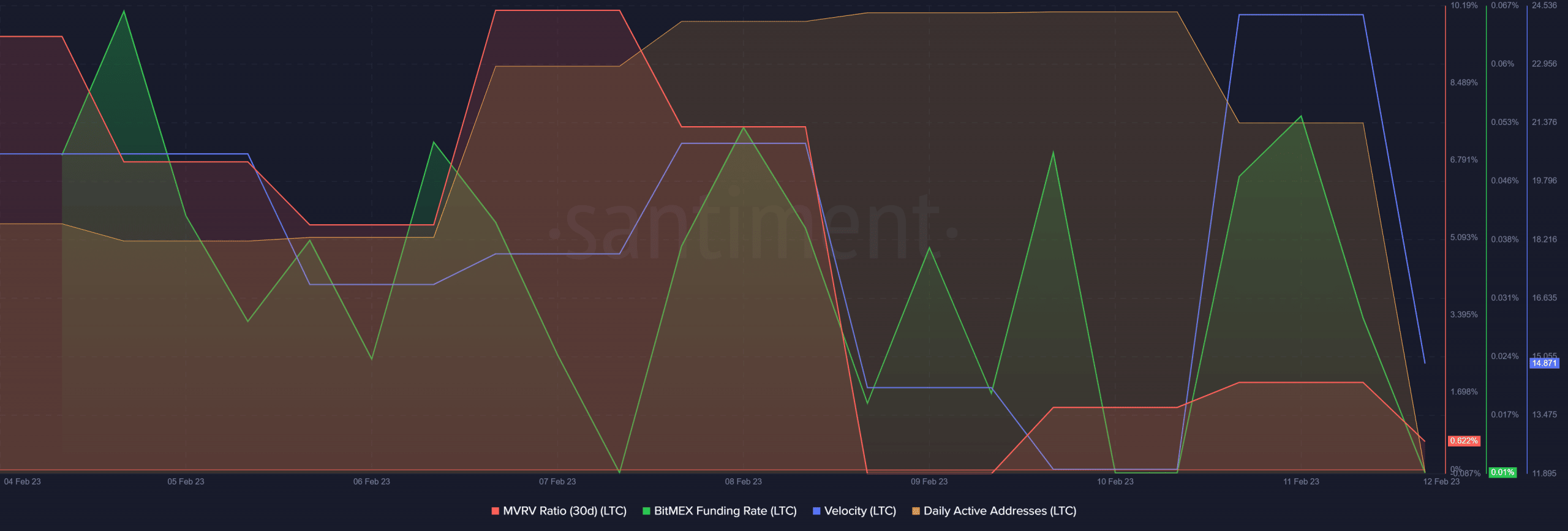

Interestingly, though LTC’s price action was dormant, a few metrics looked positive for the network. For example, the number of daily active addresses increased in the last week. Thus, indicating that there were more users on the network.

LTC also managed to be in demand in the derivatives market as its BitMEX funding rate was consistently up.

Moreover, its velocity, after declining, registered an uptick, which was also in the network’s favor. Nonetheless, the altcoin’s MVRV Ratio has decreased significantly, indicating a bearish outlook in the near future.

Investors can expect a few slow days

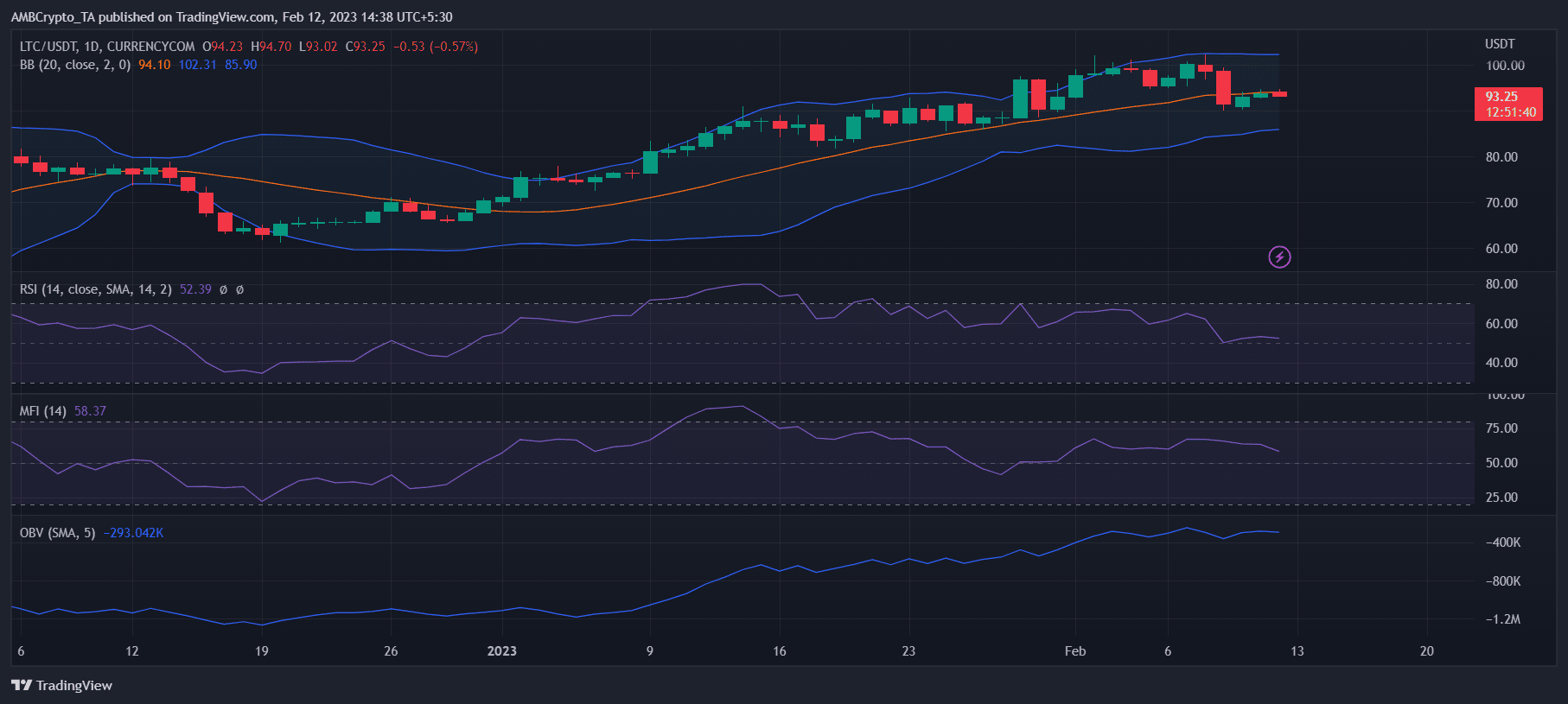

LTC’s daily chart revealed that the market was somewhat neutral, suggesting that investors might have to wait for a while to witness highly volatile price movements.

LTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) were both hovering near the neutral mark.

The Bollinger Bands pointed out that LTC’s price was in a squeezed zone, decreasing the chances of a breakout in either direction.

Nonetheless, LTC’s On Balance Volume (OBV) was relatively up, which looked bullish.