Litecoin: Banking on a profitable Q2 for LTC? You may want to read this first

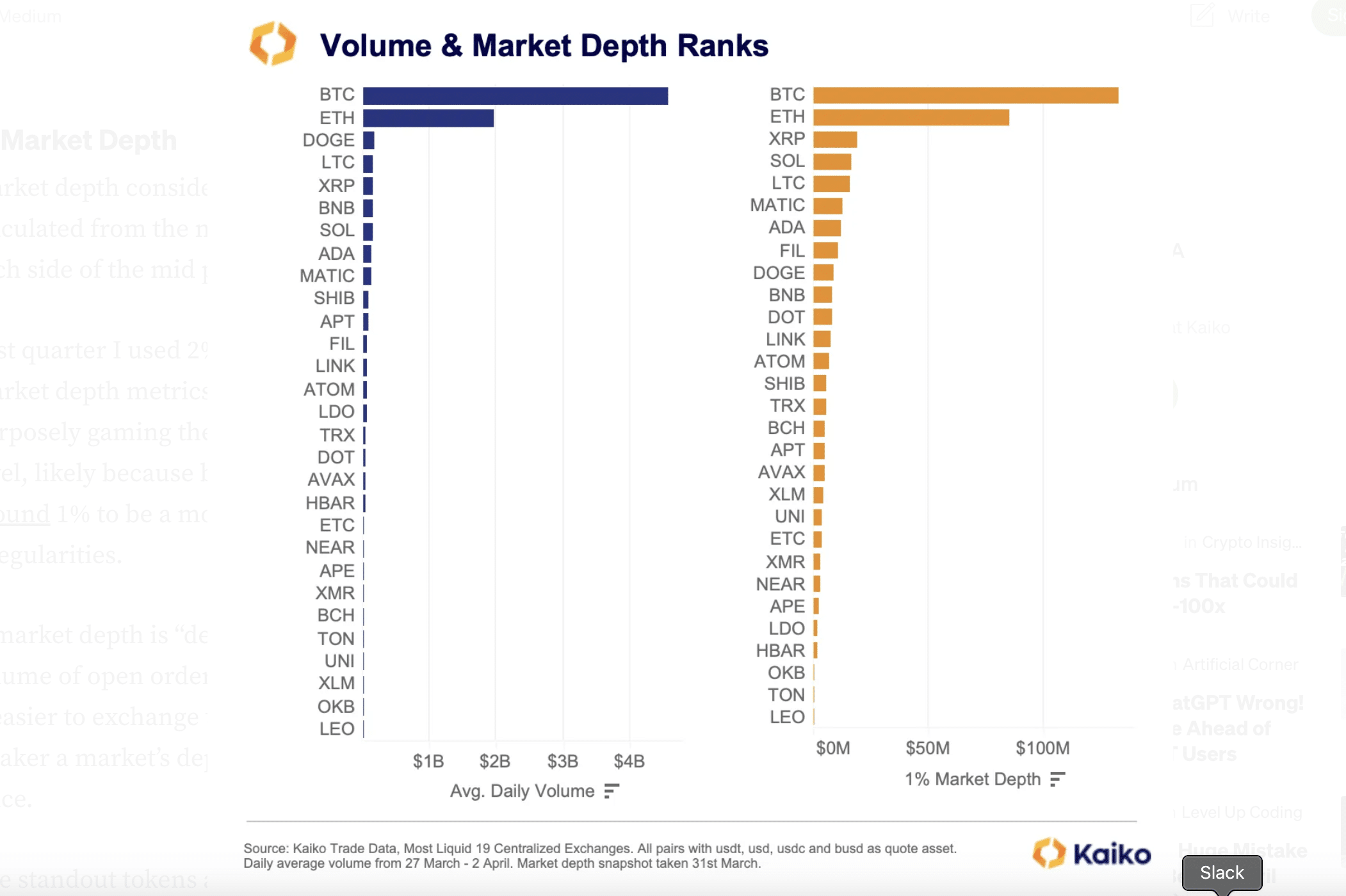

- Litecoin ranks #4 in terms of liquidity as per a new report from Kaiko

- LTC’s social dominance also witnessed a surge over the last few days

Since the beginning of 2023, Litecoin [LTC] has managed to stay in the green for most of the time. Additionally, since the beginning of Q2, the altcoin has been in a fairly decent place. However, the Proof-of-Work (PoW) network had another positive development to share with the community.

As per a tweet published by Litecoin’s official Twitter account, LTC ranked #4 in liquidity as per a research study conducted by Kaiko (@Kaikodata).

BREAKING: $LTC Ranks 4th in Liquidity!

Ranking #crypto assets by depth, volumes and spreads across 19 exchanges in Q1 research study by @KaikoData. #Litecoin moves up 4 spots since the last quarter. ? pic.twitter.com/tjYrT0ImuW

— Litecoin (@litecoin) April 7, 2023

How much are 1,10,100 LTCs worth today?

As per additional data from Kaiko’s Q1 report, it was seen that in terms of volume, LTC managed to bag the #4 position. The altcoin stood after Dogecoin [DOGE] that managed to rank at #3. However, in terms of market cap, LTC stood at rank #11. This placed the liquidity aspect of LTC in a questionable area.

Where’s the caution?

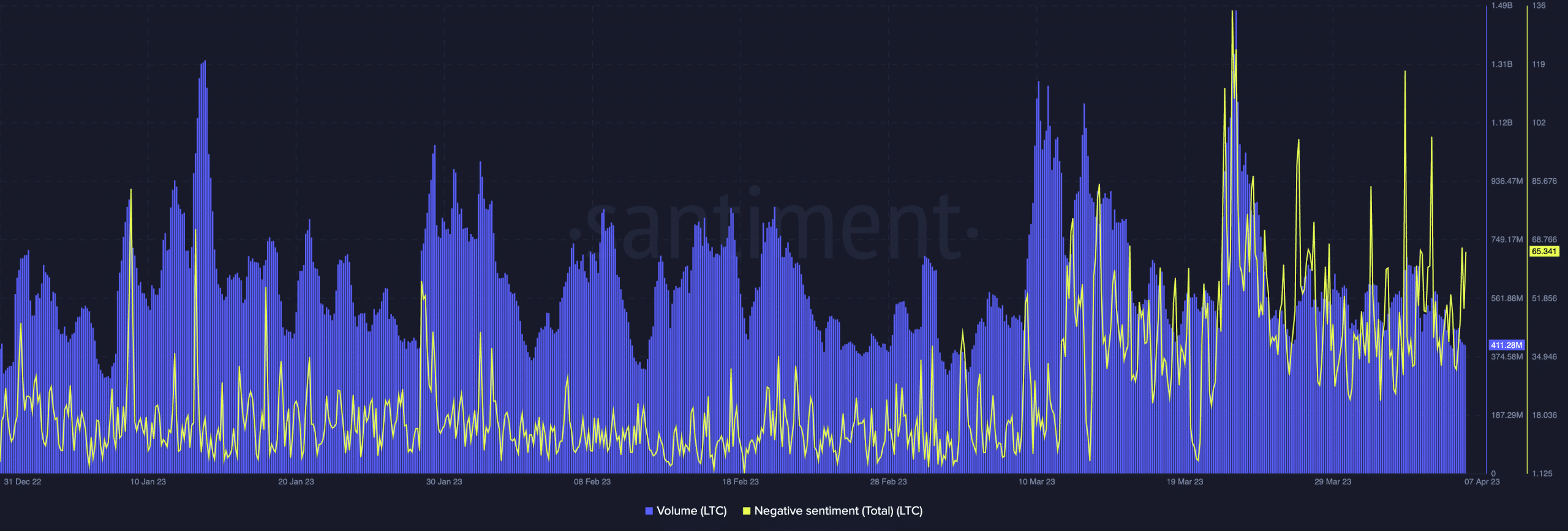

In addition to the above-mentioned information, data from Santiment showed that at the time of writing, LTC’s volume witnessed a gradual drop over the last seven days. A low volume could be taken as sign of lower LTC liquidity in the market.

However, the negative sentiment towards the altcoin witnessed a drop. This could mean that investors and traders maintained a fairly positive outlook towards LTC. It could also mean that the market showed a fair amount of interest in the altcoin.

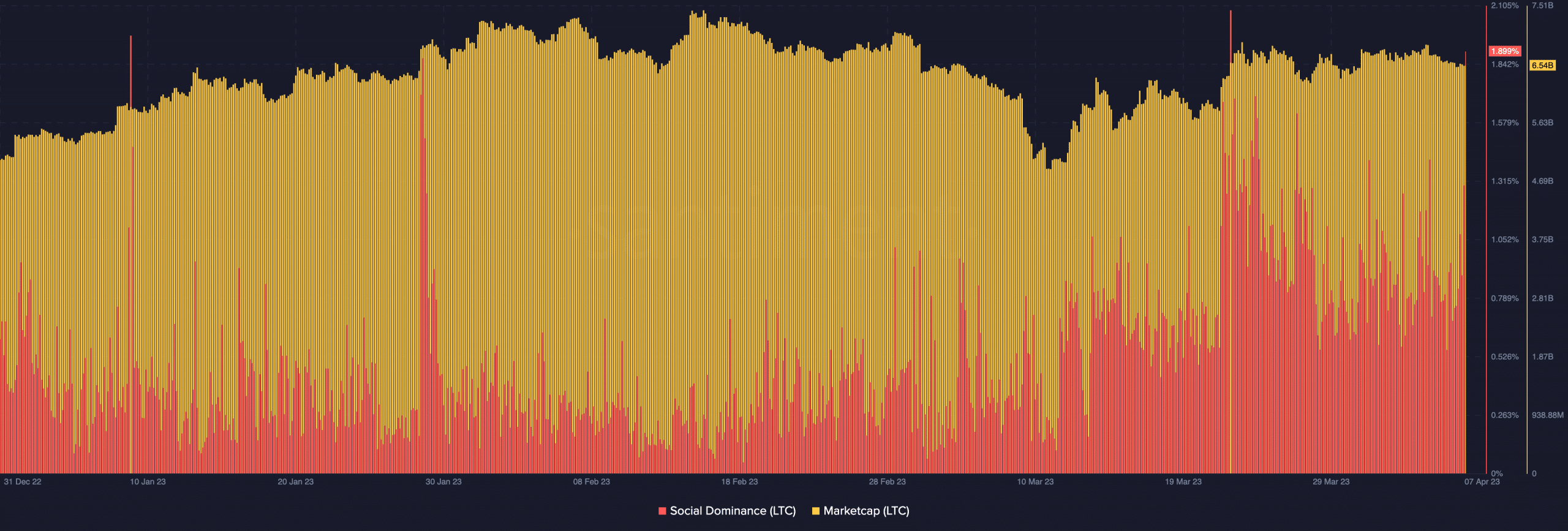

As can be seen in the chart given below, LTC’s marketcap also witnessed a drop as of 7 April. At press time, LTC had a market cap of $6,549,475,137 which was lower than its market cap at the beginning of April.

Data from Santiment also showed that despite the drop in market cap, LTC’s social dominance witnessed a surge over the last few days. This meant that market had quite a few things to mention about the cryptocurrency on a social front.

Is your portfolio green? Check out the LTC Profit Calculator

Is this red alert?

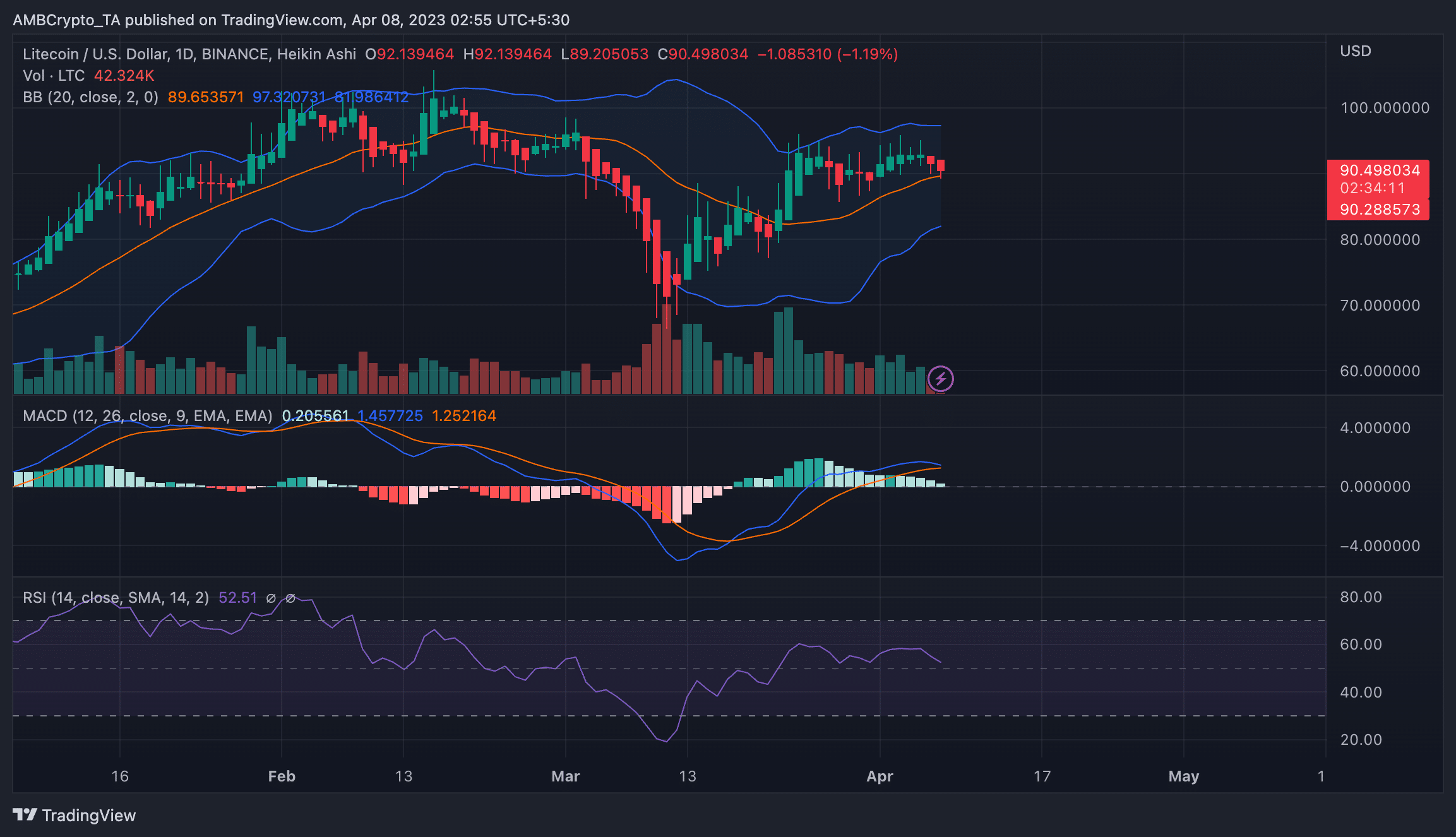

At press time, LTC was exchanging hands at $90.49. Additionally, LTC’s Relative Strength Index (RSI) stood at 52.51 and was seen in a free fall going towards the neutral 50 line. The Moving Average Convergence Divergence (MACD), at press time, didn’t show a bearish crossover. However, there possibility of one stood undisputed with the MACD and Signal line running extremely close to each other.

Furthermore, the Bollinger Bands could be seen moving away from diverging movement and were slowly moving towards a converging position. This could be an indication of a drop in the price volatility over the next few days. Although it appears that the bands could converge further, the price could move in either direction over the next couple of weeks.

At the time of writing, LTC traded 0.72% lower in the last 24 hours. However, the altcoin did exchange hands at a mere profit of 0.21% over the last seven days as per data from CoinMarketCap.