Litecoin: Can whale activity and network fundamentals propel LTC to $88?

- A high hash rate and minimal fees reinforce Litecoin’s reputation as a better alternative to Bitcoin.

- Litecoin price action against Bitcoin has weakened, though, as reflected by the falling LTC/BTC ratio.

Litecoin [LTC] has seen a notable spike in high-value transactions on the network in the past four weeks, signaling growing interest from large-scale investors.

Earlier this month, Santiment noted that the network had tracked a “consistently higher level of whale activity than usual” since the last week of August amid growing social dominance.

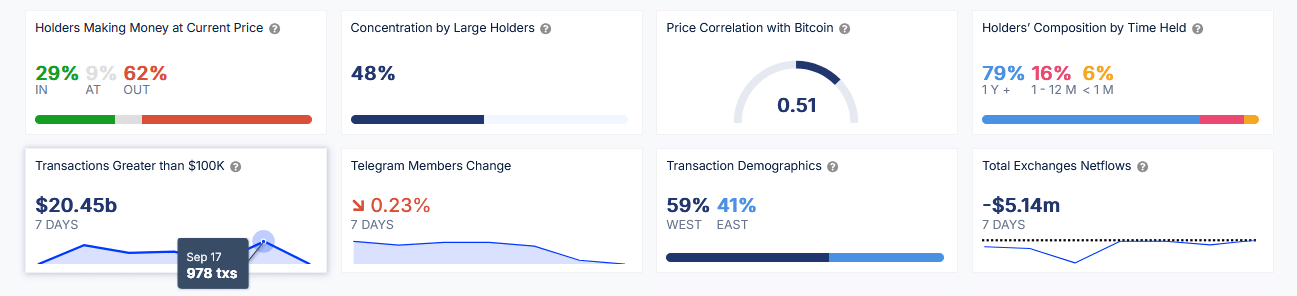

Data from on-chain resource IntoTheBlock shows that transactions greater than $100K over the past 7 days currently stand at $20.45 billion. This figure is remarkable, especially compared to Ethereum’s $24.95 billion during the same period.

The data also indicates an increase in the number of these daily large transactions from around 830 during the last week of August to over 1,000 in the first week of September. In the last 7 days, this figure has hovered above 850, peaking at 978 on September 17.

Swelling high-value transactions indicate heightened activity by large holders like institutional investors, which could influence spot market dynamics. It also points to the potential for more liquidity in the market, which may stabilize prices and reduce volatility in the short term.

Network health: Hashrate and transaction fees

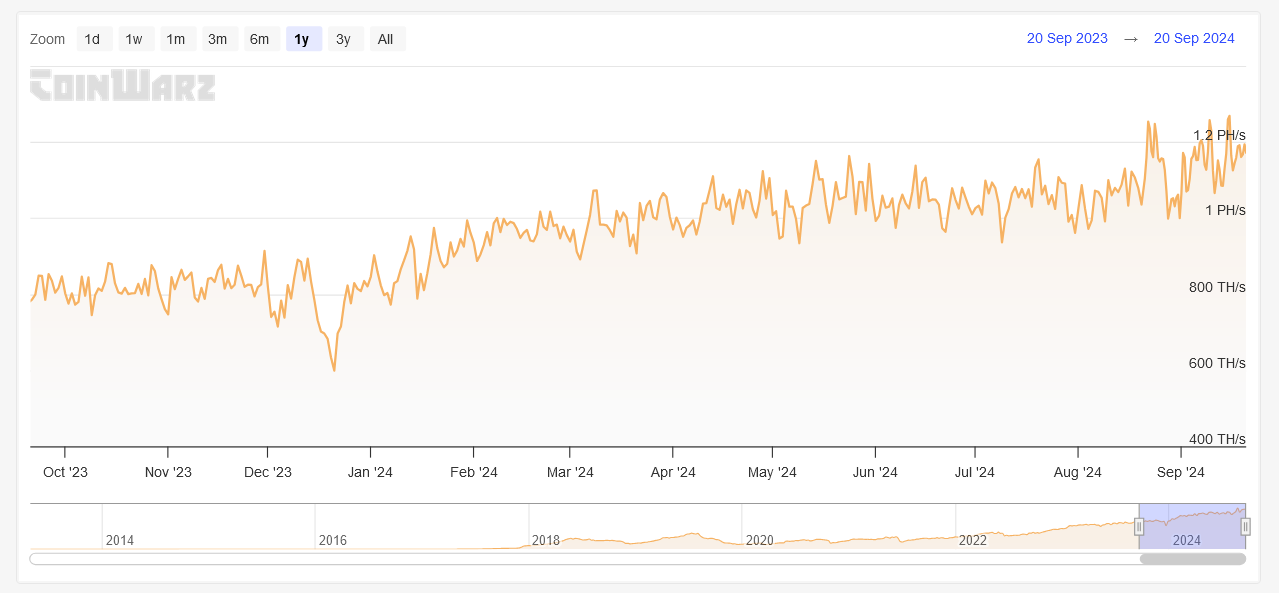

On the network side, Litecoin continues to demonstrate strong fundamentals. The hashing power in the network has trended above 1 quadrillion hashes per second since September 14.

The latest data shows that the Litecoin network’s hash rate stood at 1.19 PH/s at block height 2,759,493 with a difficulty of 41,089,116.87.

This robust hash rate growth is a positive sign for the network’s overall health and security, further reinforcing confidence in the network’s resilience against attacks.

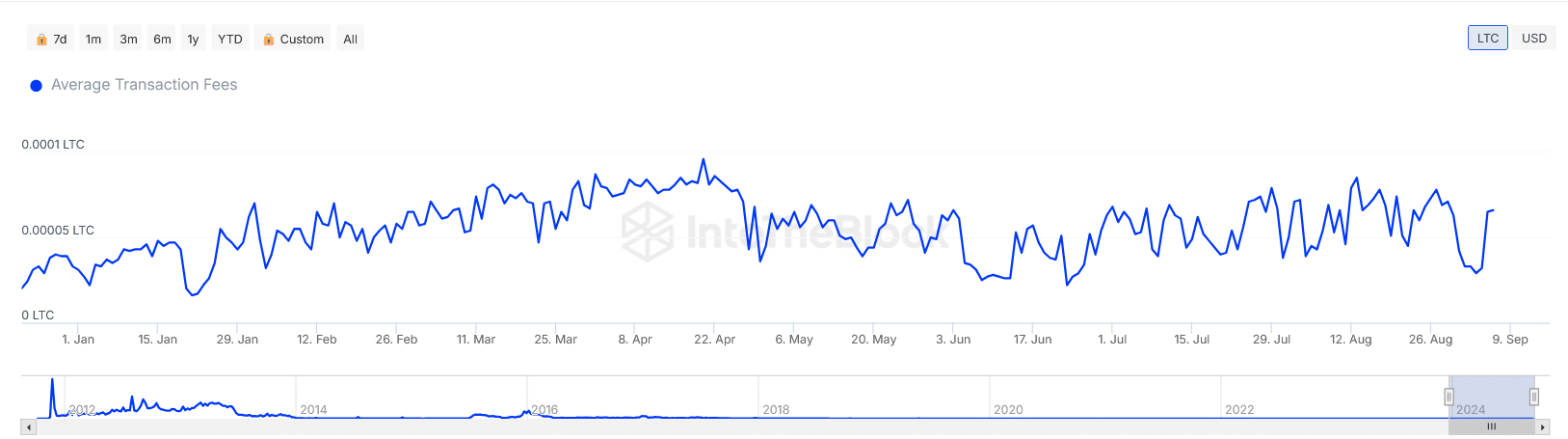

In addition, Litecoin has maintained its status as a low-cost transactional network, supporting the narrative of LTC being the “silver” to Bitcoin’s “gold.”

The daily average transaction fee has consistently stayed under 0.0001 LTC (less than $0.01) throughout the year.

Such low transaction fees make it an attractive choice for users seeking fast and cost-efficient transfers, especially during congestion phases on other networks.

Litecoin’s high processing rates also help considerably minimize the threat of double-spending, making it ideal for payments. A recent analysis by CoinGate showed that Litecoin accounted for 12.3% of payments in August, behind Tron and Bitcoin.

LTC price action and correlation with BTC

Litecoin (LTC) was trading at $65.95, having moved 4% higher in the past 7 days. Despite strong network and transaction metrics, Litecoin has struggled relative to Bitcoin.

Read Litecoin’s [LTC] Price Prediction 2024–2025

The LTC/BTC ratio has been trending downwards, signaling underperformance compared to the flagship cryptocurrency.

Moreover, Litecoin’s 30-day correlation with Bitcoin has risen from 0.46 on September 6 to 0.51 at the time of writing. This correlation, though typical for many altcoins, suggests that LTC’s price movement is being influenced by Bitcoin rather than unique catalysts.