Litecoin ETF next? Canary Capital makes a move, LTC surges

- Canary Capital files for Litecoin ETF.

- LTC surges 6.3% post-filing.

Institutional demand for cryptocurrency exchange-traded funds [ETFs] has grown exponentially, and Canary Capital has positioned itself to capitalize on this momentum.

On the 15th of October, the investment management firm submitted an S-1 filing with the U.S. Securities and Exchange Commission [SEC] to launch the first Litecoin [LTC] ETF.

This filing represents the initial step in the regulatory process required to introduce the fund. The next step is the 19b-4 filing, which requests SEC approval for a rule change at the exchange to enable the listing of a new ETF.

The proposed Canary Litecoin ETF will directly hold Litecoin and determine its net asset value [NAV] daily, referencing the CoinDesk Litecoin Price Index [LTX].

How did LTC react?

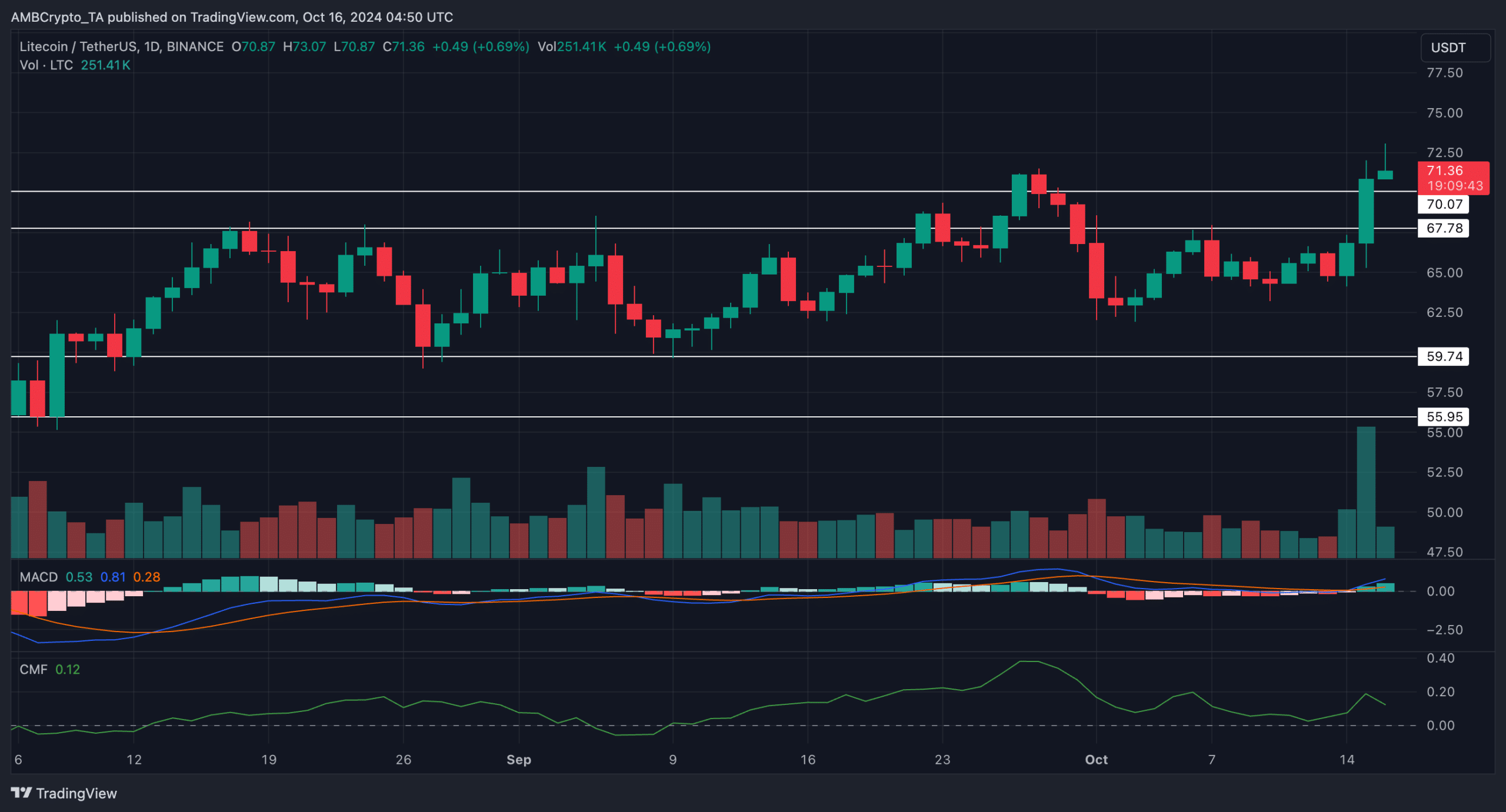

Following the announcement of the ETF filing, LTC surged past the $70 mark. An analysis of the daily chart revealed that the asset had been trading within a range for over two months.

The failure to sustain momentum over the upper range limit at $67 led to a pullback in late September.

Nonetheless, the resurgence of buying pressure flipped this level by mid-October. Furthermore, the MACD formed a bullish crossover, validating the positive momentum.

The CMF’s press-time value of 0.12 indicated asset accumulation. At press time, LTC traded at $71, up 6.3% over the last 24 hours.

After the ETH ETF slump, is LTC ETF a smart bet?

While the filing has infused optimism into the market, the Ethereum [ETH] ETF’s underwhelming performance warrants caution.

AMBCrypto recently noted that ETH ETFs have faced challenges in attracting the same positive inflows as Bitcoin [BTC] ETFs.

The dominance of outflows in ETH ETFs also raises concerns about the potential success of the proposed LTC ETF.

Furthermore, Canary Capital’s relatively limited market presence and lack of experience managing large capital could pose challenges.

Lastly, Litecoin lacks the compelling narrative that has fueled demand for BTC ETFs, which may further limit the ETF’s appeal to institutional investors.

Canary’s XRP ETF

Interestingly, the Litecoin ETF marks the firm’s second planned venture into the crypto ETF space. AMBCrypto reported that on the 8th of October, Canary Capital filed for a spot Ripple [XRP] ETF.

However, the approval of the XRP ETF faces significant obstacles due to the ongoing legal battle between the SEC and Ripple. In contrast, the outlook for the Litecoin ETF appears more favorable.

Earlier this year, the U.S. Commodity Futures Trading Commission (CFTC) labeled Litecoin a commodity in a complaint against KuCoin. This positive regulatory precedent could ease the ETF’s approval process.