Litecoin leads Cardano 12x on THIS front – What’s happening?

- The difference in active addresses showed that transactions were higher with LTC.

- ADA and LTC might target a rise to $0.79 and $95.37 in the mid-term.

Cardano’s [ADA] market cap might be higher than Litecoin’s [LTC] by almost $10 billion. But when it comes to network activity, the former does not come close.

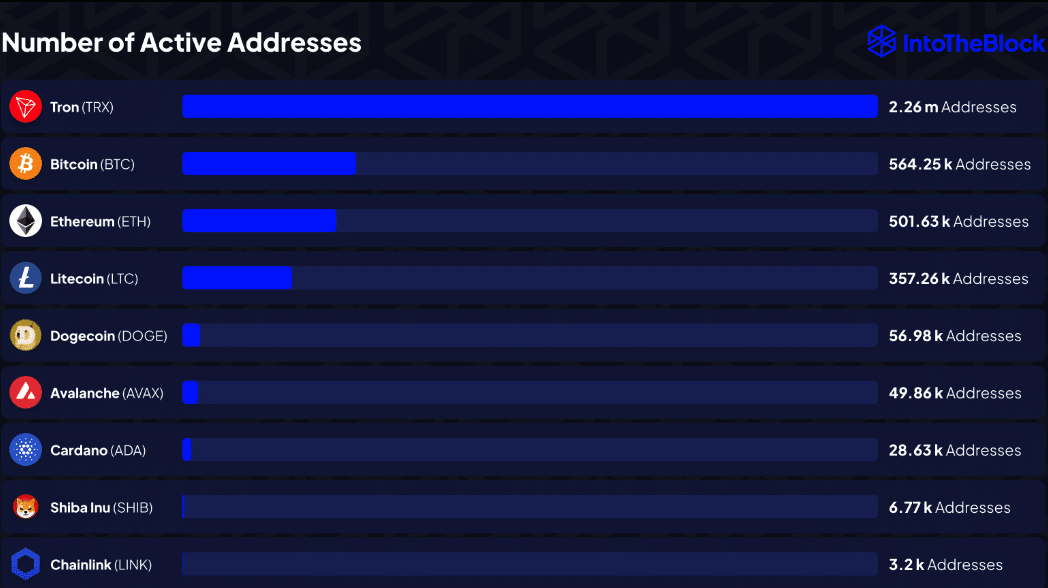

According to IntoTheBlock, the number of active addresses on Litecoin was 357,260 on the 31st of May. For Cardano, it was an eyesore as data showed that it was 28,630.

It’s Litecoin over Cardano this time

Active addresses show the number of unique wallets involved in successful transactions on a blockchain. However, it is important to note that this metric does not one address twice irrespective of the times involved in sending or receiving within a day.

Therefore, the difference means that activity on Litecoin was 12 times that of Cardano. While this might not happen all the time, a rising activity could foreshadow a higher price for a cryptocurrency.

At press time, LTC’s price was $84.52. This was a 1.53% increase in the last 24 hours. ADA, on the other hand, traded at $0.45— indicating that the token has been moving sideways.

However, AMBCrypto checked if Litecoin had any major development lately that caused the wide margin. From our findings, nothing of such occurred, meaning that market participants considered LTC worthy of attention than ADA at this time.

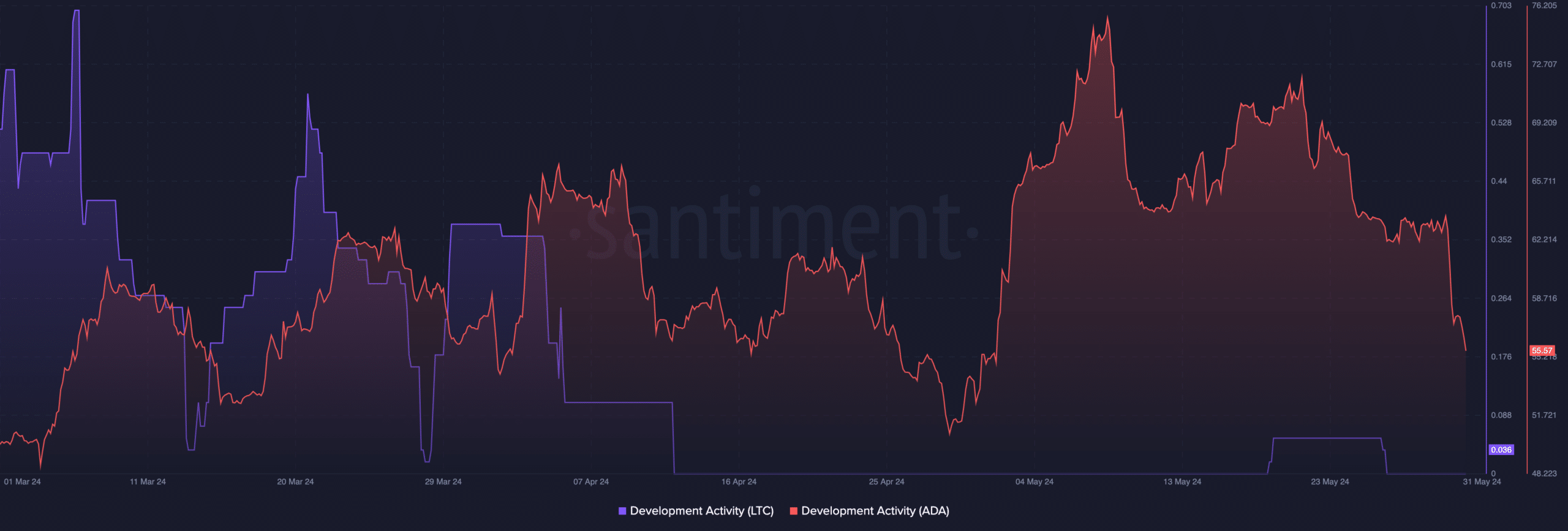

But did Litecoin outpace Cardano on all fronts? Let’s find out. One metric we evaluated was development activity. This was one area where Cardano consistently thrived.

As of this writing, data from Santiment showed that the project’s development activity fell to 55.57. This metric reveals how committed developers are to ensuring the proper function of a blockchain.

As such, the decline implied that code commits to Cardano’s network health had dropped. For Litecoin, it was not the same situation with the active addresses.

ADA and LTC show promise

At press time, development activity on the Litecoin network was 0.036. Compared to Cardano, the public GitHub repositories dedicated to Litecoin were almost non-existent.

However, this metric does not affect prices in most cases. Therefore, the margin does not imply that ADA would outperform LTC.

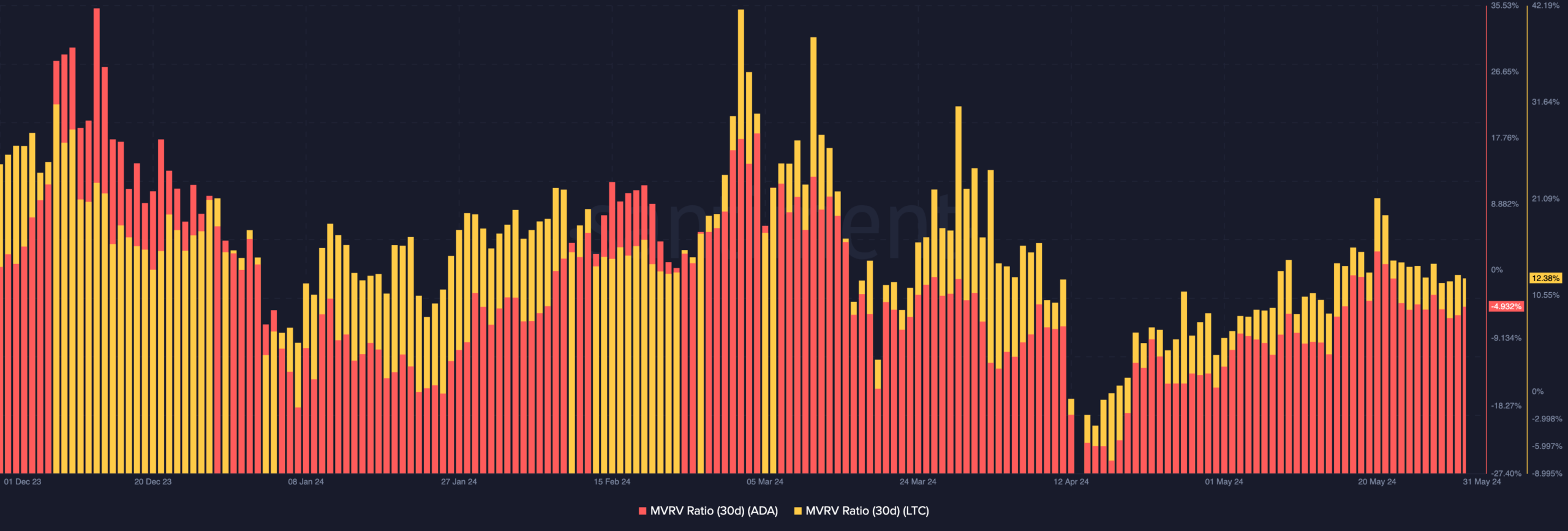

In terms of the price, AMBCrypto assessed the MVRV ratio. MVRV stands for Market Value to Realized Value, and it measures profitability and the valuation of a cryptocurrency.

At press time, Cardano’s 30-day MVRV ratio was -4.932%. This meant that a lot of ADA holders were dealing with unrealized losses.

However, LTC’s situation was different as its ratio was 12.38%. This positive reading implies that the average LTC holder (30-day window) was in profit.

Realistic or not, here’s LTC’s market cap in ADA terms

When it comes to valuation, both cryptocurrencies could be termed undervalued.

If the market returns to its extremely bullish phase, ADA might jump to $0.79. Litecoin might also be able to hit $95.37.