Litecoin [LTC] outcompetes other major cryptocurrencies in this area

![Litecoin [LTC] outcompetes other major cryptocurrencies in this area](https://ambcrypto.com/wp-content/uploads/2022/12/mario-dobelmann-RCU_nX9Qf8Y-unsplash-e1670502900527.jpg)

- Litecoin turns out to be a preferred mode of payment for BitPay users.

- The reading of LTC’s MVRV ratio may put some pressure on long-term holders.

According to a recent update by Litecoin, it was revealed that LTC was one of the most preferred forms of payment among other major cryptocurrencies.

Read Litecoin’s Price Prediction 2023-2024

Reportedly, Litecoin transactions on BitPay (a payment processor) had increased significantly. The number of transactions represented 27.64% of the total number of transactions being made on the platform.

Litecoin managed to outperform other popular cryptocurrencies such as Ethereum, Doge, and XRP in this regard. However, it could not surpass Bitcoin as the king coin was responsible for 41.62% of the overall transactions being made on the platform.

That said, in terms of mining, Litecoin proved to be extremely profitable for miners, as it provided a profitability rate of 58%, according to CryptoCompare.

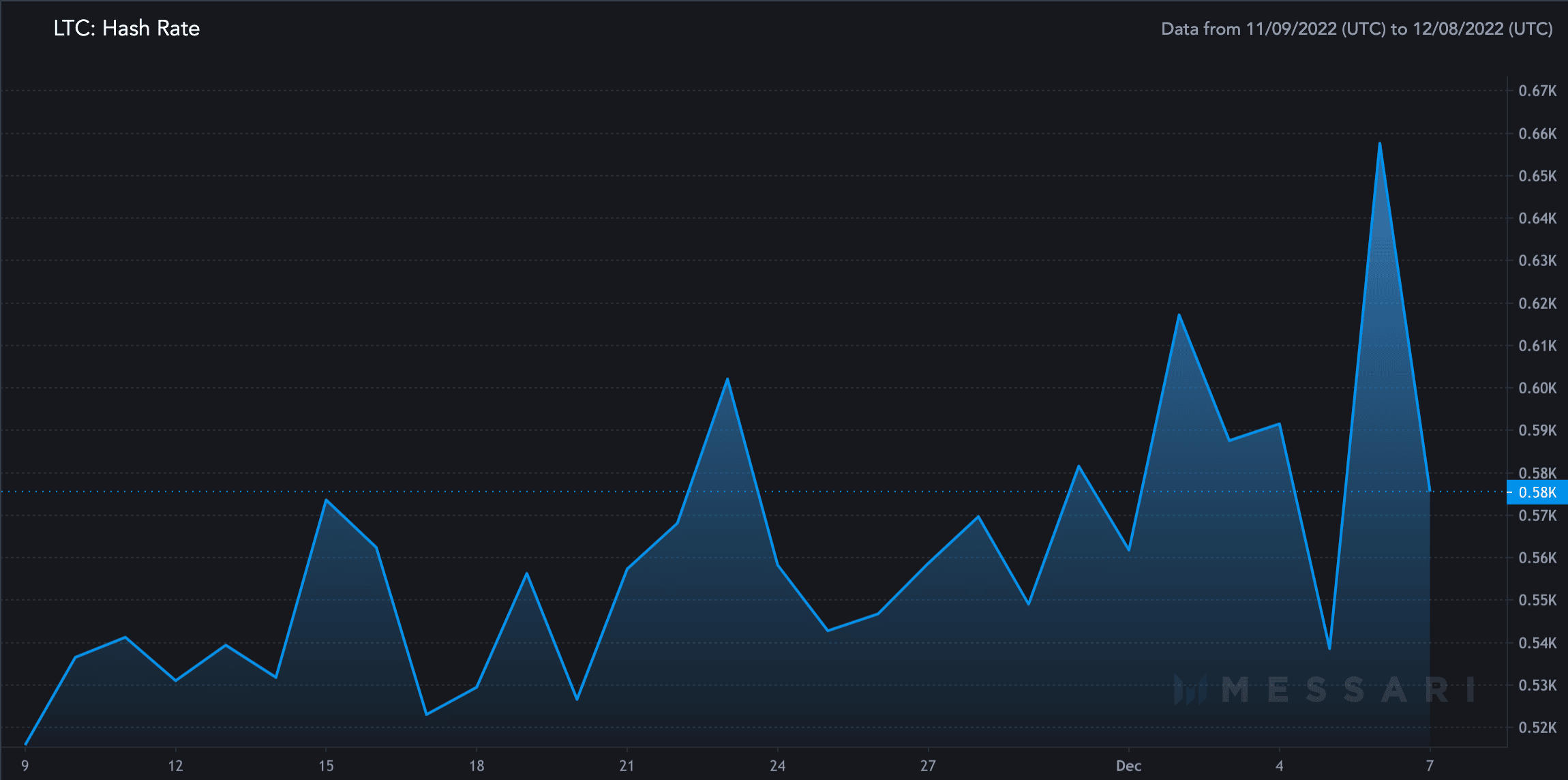

Its hash rate increased over the past month as can be seen from the image below. Over the last 30 days, Litecoin’s hashrate grew by 3.05%. An increasing hash rate indicates that the security and stability of the network have strengthened.

However, it also suggests that more energy would be required to mine Litecoin.

These factors could have played a part in LTC’s growth in the ongoing bear market.

After 23 November, Litecoin witnessed a surge of 33.46% in its prices. Following that the altcoin was observed to be trading within the range of $83.63 and $70.60.

After testing the $84.45 resistance level, Litecoin’s prices started to descend. Its RSI which was at 38.40, at press time, indicated that the momentum was with the sellers.

Its CMF was at -0.06, during press time which also suggested a bearish outlook for LTC. Thus, implying that there was a possibility of the alt going to 70.40 yet again.

To sell or not to sell

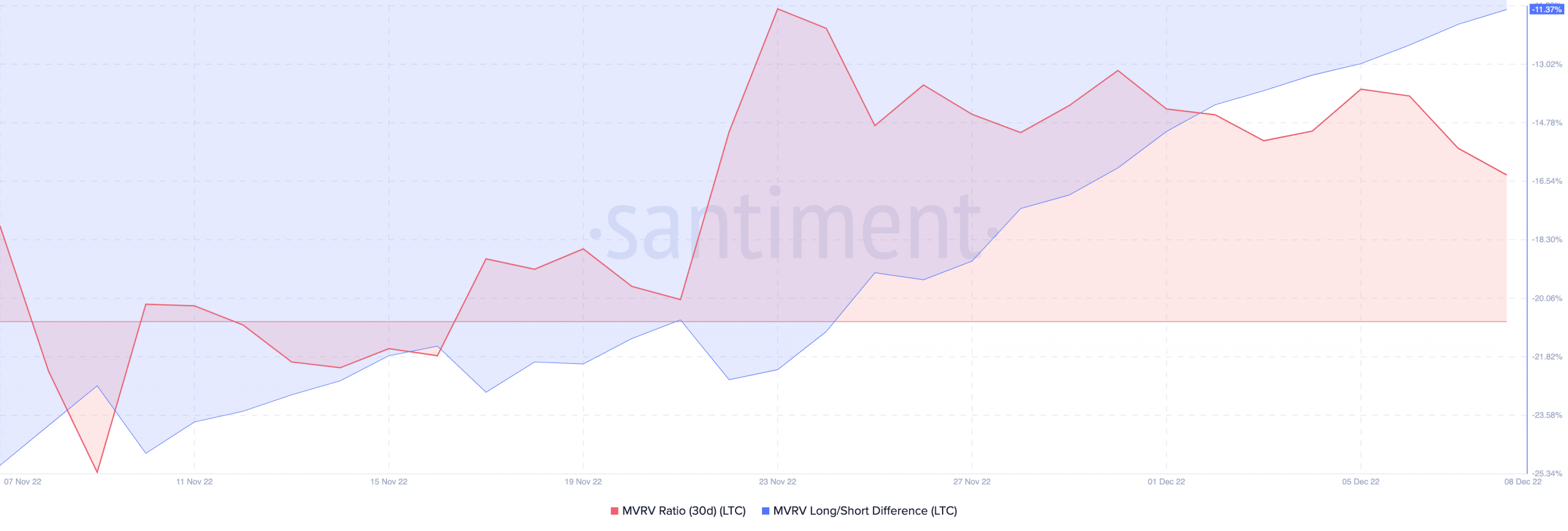

Litecoin’s MVRV ratio has grown substantially after 20 November. A high MVRV ratio suggested that most Litecoin holders would make a profit if they ended up selling their LTC.

However, the growing MVRV Long/Short difference implied that it is mostly long-term Litecoin holders that would profit from selling their holdings.

Even though there is an incentive for long-term LTC holders to sell their holdings for a profit, they are resorting to HODLing instead. And, surprisingly, this type of behavior is being exhibited by short-term traders.