Litecoin: Major rally ahead? THIS data suggests…

- Litecoin sees demand surge as Spot inflows soared to 2021 levels.

- Bullish breakout attempt resulted in heavy liquidations and extreme volatility.

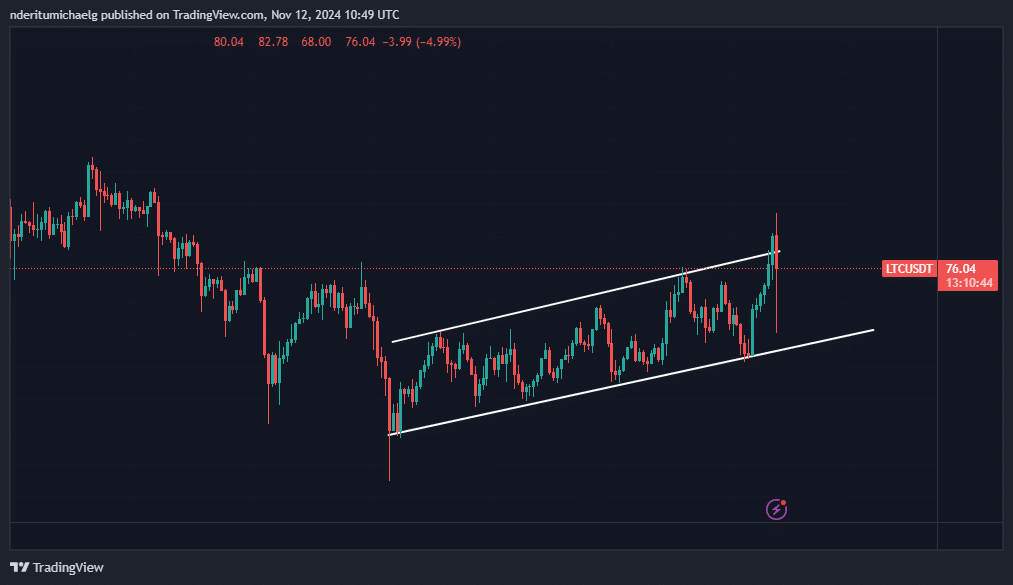

Litecoin [LTC] has been in a consolidation phase characterized by an upward trend since August. It has been seemingly missing out on the recent hype seen in the last 2 months, but that may not be the case anymore.

Litecoin bulls have been quite active this month but more importantly, the cryptocurrency’s liquidity situation also appears to be changing.

Recent data shows that LTC just experienced its highest spot net inflows since November 2021.

The timeline was significant because November 2021 marked the peak of Litecoin’s price action during that year’s bullish cycle. But could this signal that LTC is on the verge of a robust rally?

So far, the data suggests that there is a resurgence in interest in LTC.

Recent findings also revealed that short term holders are increasing their Litecoin bags. Their balances grew by 31% in the last four weeks.

IntoTheBlock suggests that this latest spike could signal a major rally ahead for the cryptocurrency as liquidity rotation in the crypto market starts to take place.

The surge in liquidity was not just observed in the derivatives segment. According to Coinglass, Litecoin’s Open Interest (OI-Weighted Funding Rates) just soared to its highest level in the last six months.

This confirmed a peak in the derivatives segment.

The surge in open interest may explain LTC’s recent volatility. The cryptocurrency has been locked in a consolidation phase since August through which it moved in an ascending upward channel.

Litecoin volatility triggers surge in liquidations

The last 24 hours were characterized by extreme volatility which saw the price attempt a breakout from its range.

Price had initially dropped to $68 in a fake out bearish move that was followed by a massive surge in demand pushing it as high as $82.78.

LTC pulled back to a $75.71 at press time, which means price reverted to the ascending consolidation range. Nevertheless, this volatile price movement indicates that there may have been a shorts and longs shakedown.

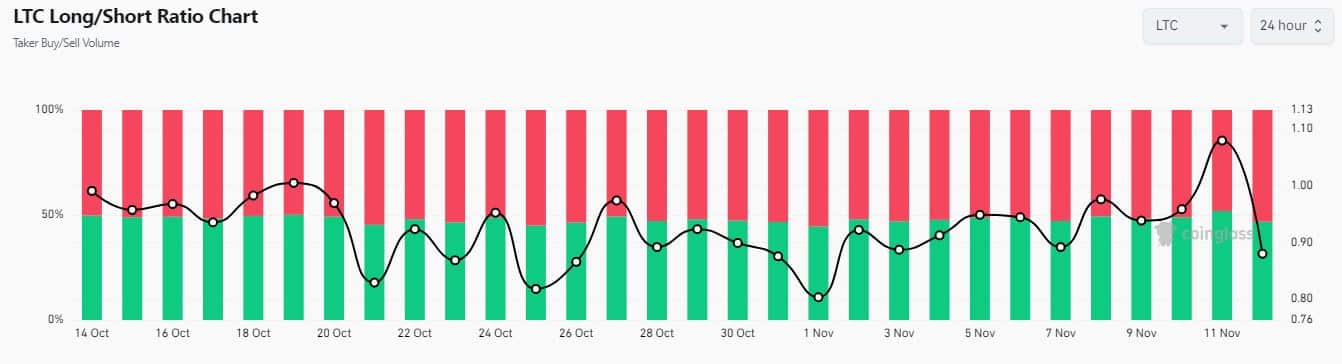

Litecoin’s price action had previously demonstrated a strong demand surge from around the 6th of November, which resulted in six days of being in the green.

Consequently, appetite for longs has been on the rise, with longs tipping the balance as of the 11th of November.

Read Litecoin’s [LTC] Price Prediction 2024–2025

A total of $3.09 million in Litecoin liquidations occurred on exchanges in the last 24 hours. Longs were higher at $2.04 million, while shorts amounted to $1.06 million.

This outcome suggested that the latest pullback after a breakout attempt may have resulted in longs being wiped out.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)