Litecoin set for recovery? LTC’s $36B on-chain activity suggests…

- LTC has declined by 3.74% over the past week.

- Despite the decline, Litecoin’s on chain activity surges with 512.8 million moving on-chain.

After a sustained decline, Litecoin [LTC] saw a brief uptrend breaking out of a descending channel. However, since hitting a local high of $76, the altcoin has experienced a sharp decline.

Despite the dip on weekly charts, LTC’s on-chain activities have surged to a 17 months high.

Litecoin on-chain activities surge to 2023 levels

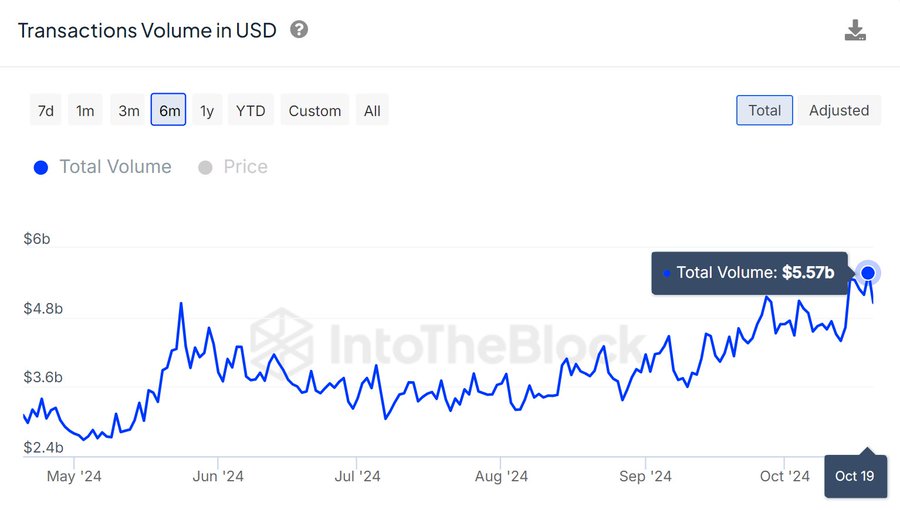

According to IntoTheBlock data, Litecoin has experienced one of the most active weeks in the past year.

As such, the Litecoin blockchain has seen 512.8 million tokens move on-chain over the past week, amounting to $36.6 billion.

Such levels were last experienced in May 2023 with an average of $5 billion daily. Based on this observation, it indicates that Litecoin is continually active with many participants across various platforms.

Usually, a surge in on-chain activity points to increased adoption, signaling a higher demand for LTC.

What it means for LTC price charts

As observed above, LTC has experienced a high demand with a rise in chain activities. This suggests the altcoin is enjoying positive market sentiment.

Notably, the past week has seen LTC decline after enjoying a strong upswing. In fact, as of this writing, LTC was trading at $68.81. This marked a 3.01% decline over the past day with the altcoin also dropping by 3.74% on weekly charts.

Prior to this, Litecoin had been on an upward trajectory hiking by 2.47% over the past month.

Although the altcoin has declined over the past week, the overall market remains positive.

For instance, +DI of DMI at 23 sits above -DI which is at 18. This suggests that the uptrend momentum still remains positive and is likely to continue.

This phenomenon was further supported by a positive Chaikin Money Flow (CMF) at 0.03. This signals a higher buying pressure suggesting that buyers are still dominant.

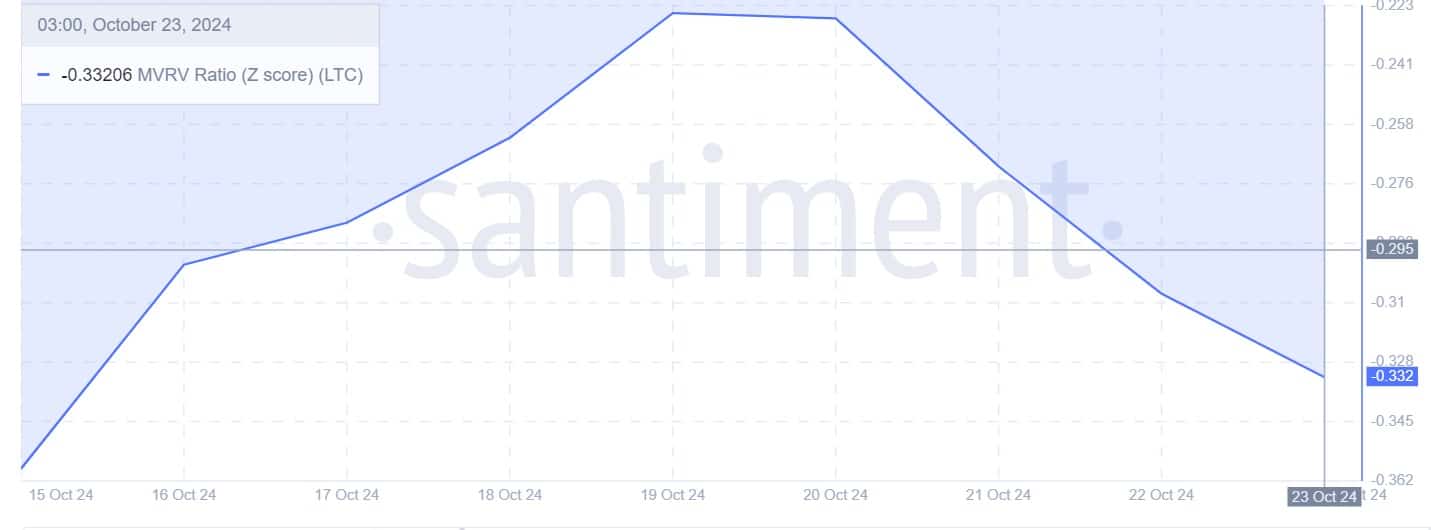

Looking further, the MVRV ratio Z score 0f -0.3 suggests a good buying opportunity for long-term holders and investors to accumulate. Thus, with the dip, buyers can enter the market which in turn increases buying pressure, thus driving prices up.

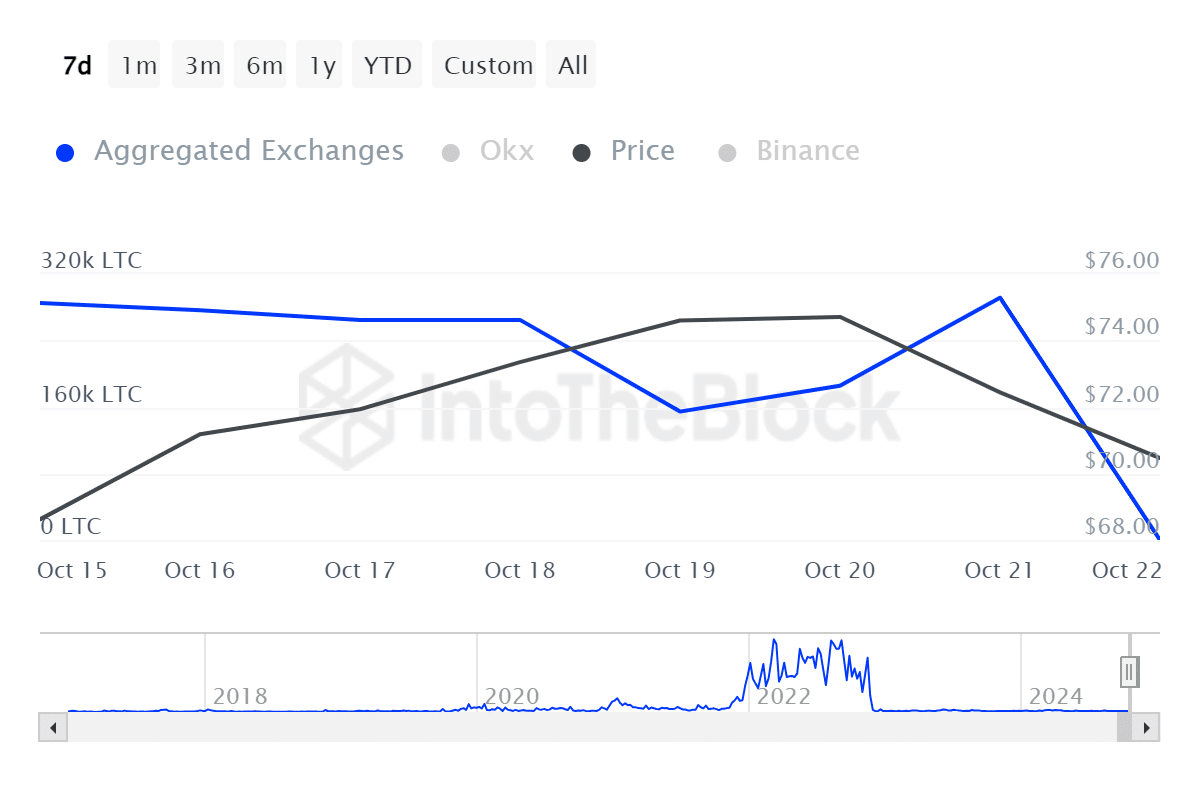

Additionally, Litecoin’s Total Flows have declined from a high of 291.5k to a low of zero. This suggests that there are reduced flows into exchanges signaling holding behavior. Therefore, investors are keeping their LTC off exchanges anticipating price appreciation.

Read Litecoin’s [LTC] Price Prediction 2024–2025

Simply put, the surge in on-chain activities suggests that LTC is experiencing a high demand. With positive positive sentiment and investor favorability, LTC is well-positioned to reclaim, the monthly trend.

Therefore, if these conditions hold, will reclaim the $76 resistance level where it has faced multiple rejections. Consequently, if the downside persists, LTC will find the next support at $63.4.