Litecoin surges past $118 – What’s driving LTC ahead?

- Whales accumulated 250K LTC in six days as holdings surge to 48.89M – largest sustained buying spree since December rally.

- CanaryFunds’ amended S-1 filing coincides with LTC’s 16.1% market cap jump and $118 breakthrough.

Litecoin[LTC] has broken above crucial resistance levels. It surged to $118.35 amid growing institutional interest and significant whale accumulation.

The movement coincides with CanaryFunds’ amended S-1 ETF filing, suggesting potential regulatory engagement that could reshape LTC’s market dynamics.

ETF optimism: CanaryFunds’ filing sparks speculation

CanaryFunds’ amended S-1 filing for a Litecoin ETF has sparked waves of optimism. Although the filing lacks the SEC’s 19b-4 approval, it signals potential regulatory engagement and rekindles hope for institutional exposure to Litecoin.

Historical precedents suggest that the mere prospect of an ETF can drive speculative buying, as seen in Litecoin’s decoupling from other altcoins during this surge. If approved, an ETF could be a game changer, paving the way for broader adoption and liquidity.

Whale activity: The fuel behind Litecoin’s rally?

On-chain data reveals substantial whale activity, with addresses holding 10,000+ LTC accumulating 250,000 coins since the 9th of January.

This aggressive accumulation pattern mirrors the behavior observed in early December, with total whale holdings reaching 48.89M LTC.

This accumulation has coincided with Litecoin’s price breaching $118 for the first time in 2025. The concentrated buying pressure from these large holders has historically preceded significant price movements.

Market cap surge reflects growing confidence

Litecoin’s market capitalization has witnessed a remarkable 16.1% increase in just eleven hours, indicating renewed market confidence.

This surge, decoupling from broader altcoin trends, coincides with the amended ETF filing and suggests institutional positioning ahead of potential regulatory developments.

LTC’s price action demonstrates robust technical formation, with the 50-day Moving Average(MA) at $111.62, maintaining a healthy gap above the 200-day MA at $80.01.

The Bollinger Bands (105.90, 118.43, 93.36) suggest increased volatility, with price testing the upper band, indicating strong bullish momentum despite the recent surge.

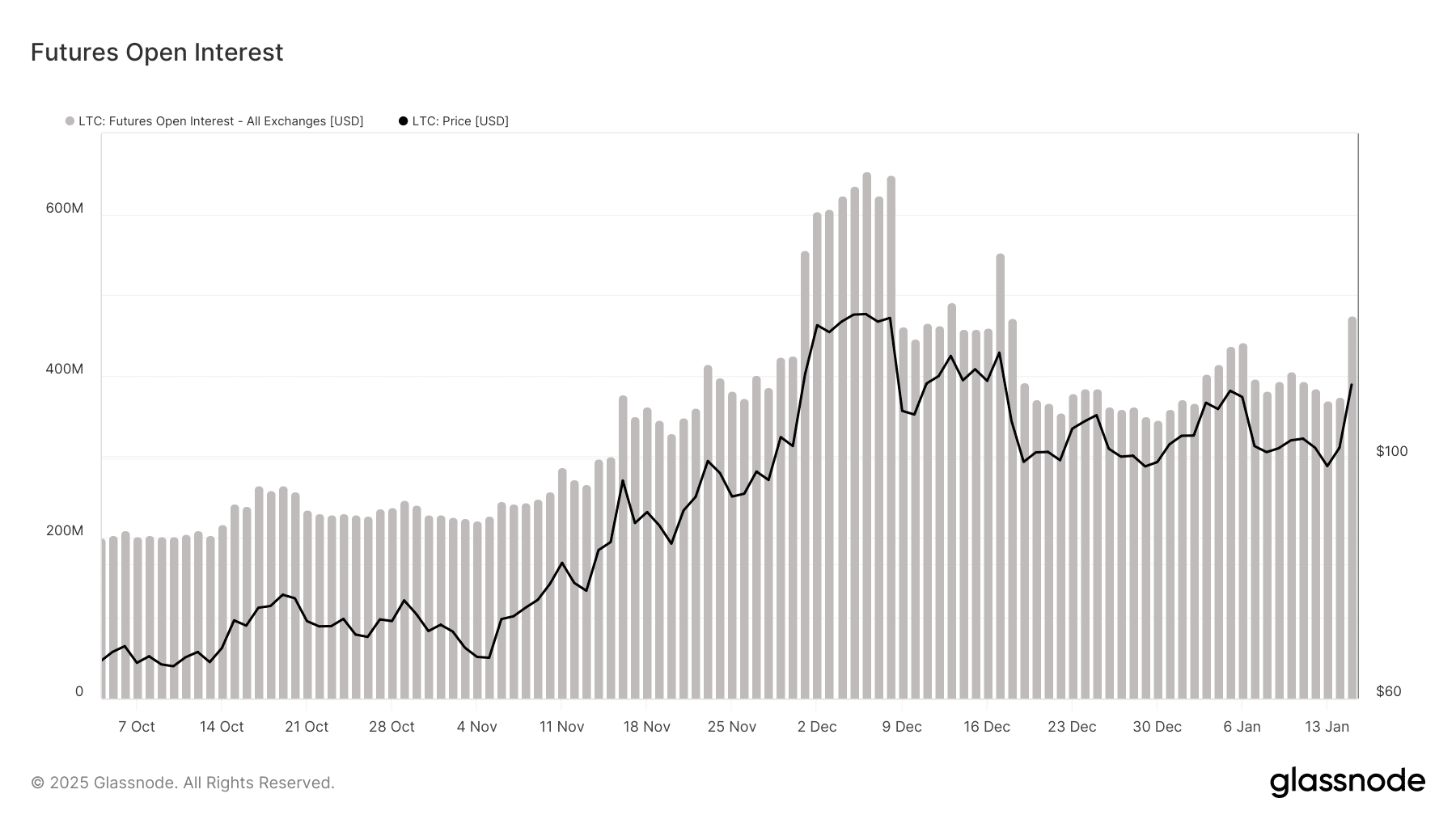

Derivatives market shows increased interest

Futures Open Interest for Litecoin is currently over $474 million across exchanges, reflecting heightened trading activity and institutional confidence.

The pattern suggests sophisticated investors are building positions, potentially anticipating positive developments around the ETF filing.

Looking ahead, LTC’s immediate challenge lies at the psychological $120 level, with the recent whale accumulation providing strong support at $115.11.

The convergence of institutional interest through both spot accumulation and derivatives positioning suggests a potentially sustained upward trajectory, particularly if the ETF filing continues to show positive progress.

– Is your portfolio green? Check out the Litecoin Profit Calculator

The technical structure, supported by substantial whale accumulation and increasing institutional interest, presents a compelling case for continued momentum. However, traders should monitor ETF developments for potential catalysts.