Litecoin flips Bitcoin on this front… again

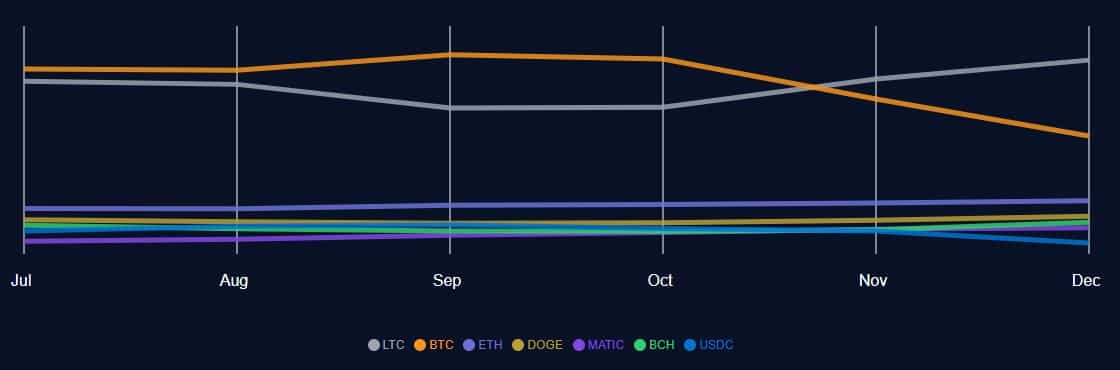

- LTC’s share of the global payments surged to an ATH of 38.25% in December.

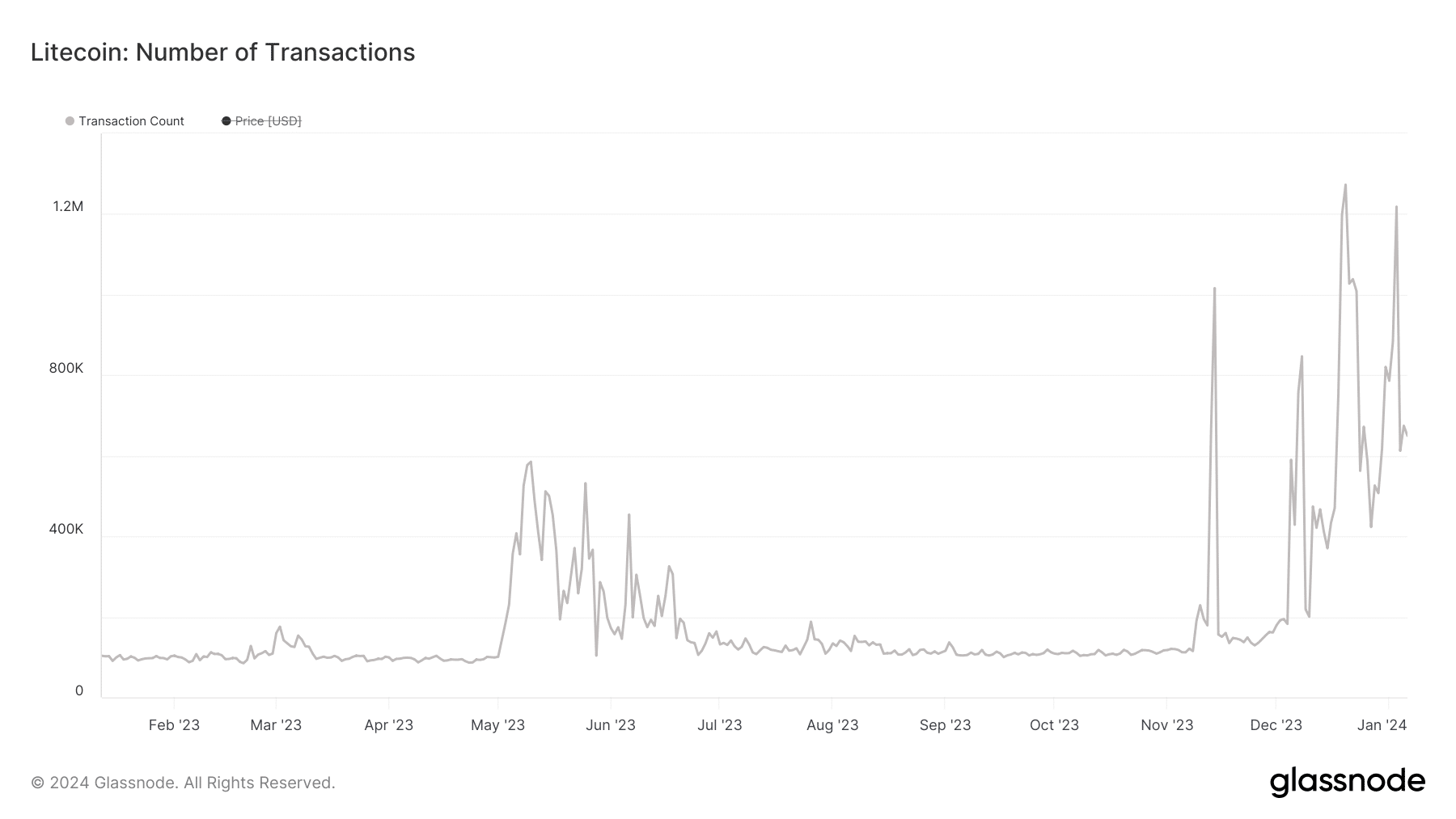

- Litecoin’s daily transactions hit their peak in December.

In a major milestone, Litecoin [LTC] became the most used crypto for payments for the second straight month in December, outperforming all major assets, including Bitcoin [BTC].

Litecoin beats Bitcoin again

As tracked by the world’s largest payment processor BitPay, LTC’s share of the global payments surged to 38.25% in December, compared to 34.52% in November. This was also Litecoin’s all-time high (ATH) in terms of market share.

It was clear that LTC scooped a big portion of Bitcoin’s market share as the latter’s pie dropped sharply from 30.55% to 23.24%.

In fact, a closer look showed that more people opted to buy goods and services using LTC than BTC and Ethereum [ETH] combined.

Litecoin sees increased network activity

It was worth noting that LTC’s transaction count bumped significantly in December, shattering all previous records, AMBCrypto discovered using Glassnode data. The daily transactions hit their peak at 1.27 million on the 20th of December.

In comparison, Bitcoin recorded less than half of this figure on the same day.

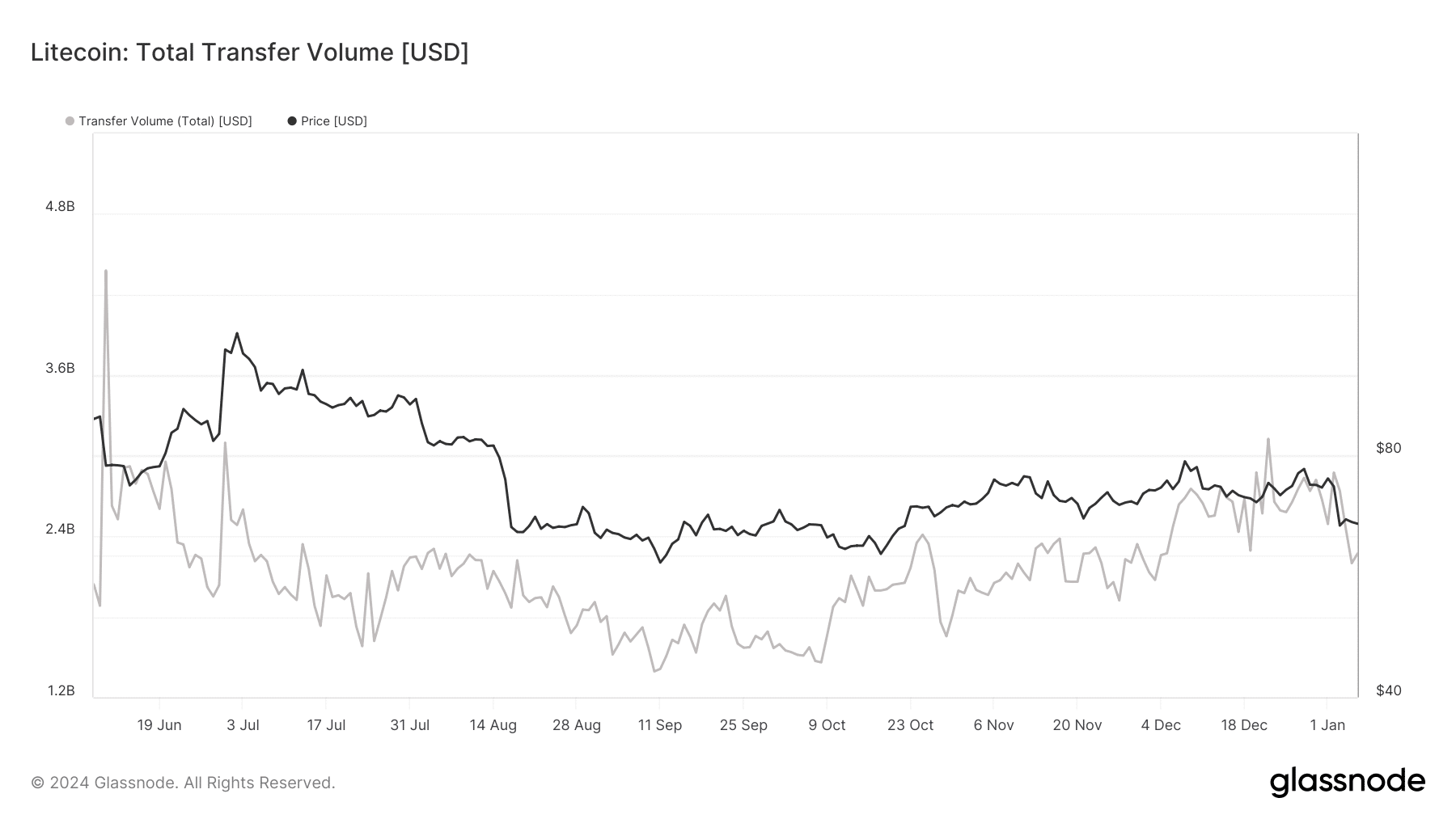

Additionally, the USD value of coins transferred on-chain also witnessed a considerable move upward in December. LTC’s transfer volume averaged around $2.7 billion during the month, the highest since July.

Litecoin’s market cap is still on the lower side

All said and done, Litecoin’s impressive on-chain indicators failed to exert any upward pressure on its native token. The “Digital Silver” lost 11% of its market value over the last month, according to CoinMarketCap.

In fact, LTC traded significantly below its 2023 peak in recent months. Even the halving event failed to provide a meaningful push to the coin, which was ranked 19th in the list of cryptos by market cap at the time of publication.

Is your portfolio green? Check out the LTC Profit Calculator

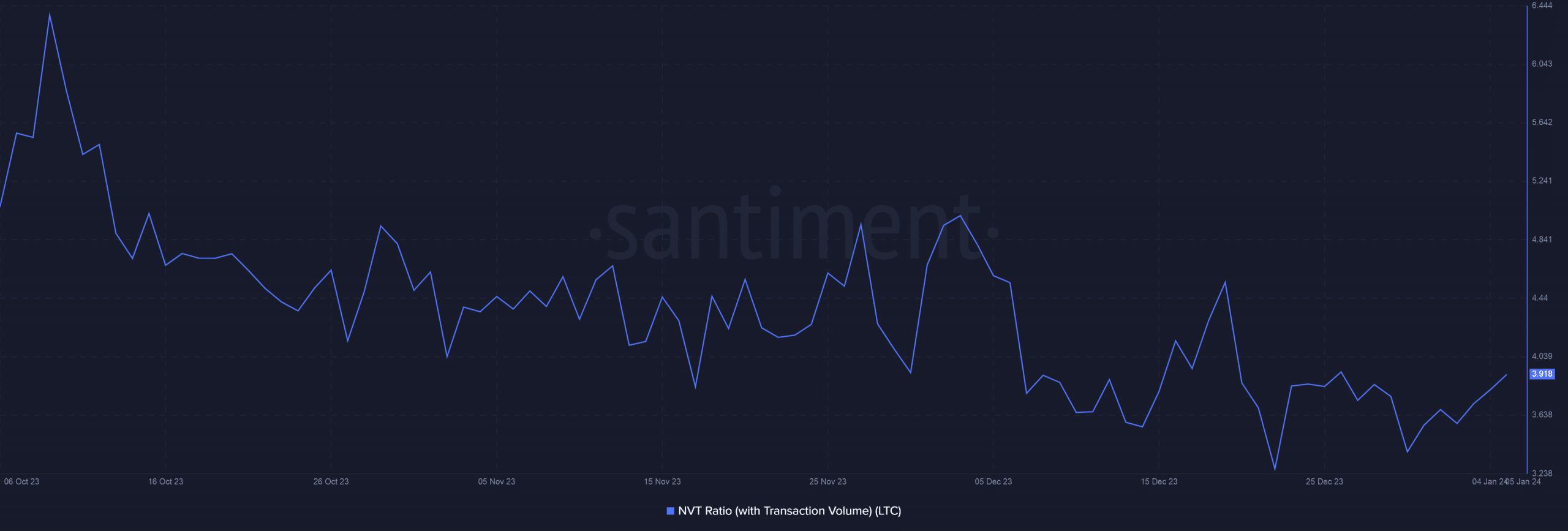

However, there was something to cheer in between the muted price action. Litecoin’s NVT ratio, which is negatively correlated to transaction volumes, has been steadily declining over the past few months.

This implied that network utilization outpaced market cap growth, historically seen as a bullish signal.