Litecoin: Will 2024 be a good year for LTC’s traders

- There has been a rally in Litecoin’s transaction count since the year began.

- LTC may be due for a decline, as recent price rally seems to not be backed by any real demand.

Litecoin [LTC] has kicked off the year with a surge in transaction count, suggesting renewed interest and activity on the network, IntoTheBlock noted in a recent post on X (formerly Twitter).

Litecoin started the year strong, processing over 6.3 million transactions since the 1st of January.

?https://t.co/k1Oem7fVAg pic.twitter.com/WIXroezdaL— IntoTheBlock (@intotheblock) January 10, 2024

According to the on-chain data provider, Litecoin has processed over 6.3 million transactions in the last 10 days. AMBCrypto found that the rise in the network’s transaction count is attributable to an uptick in its active address count since the year began.

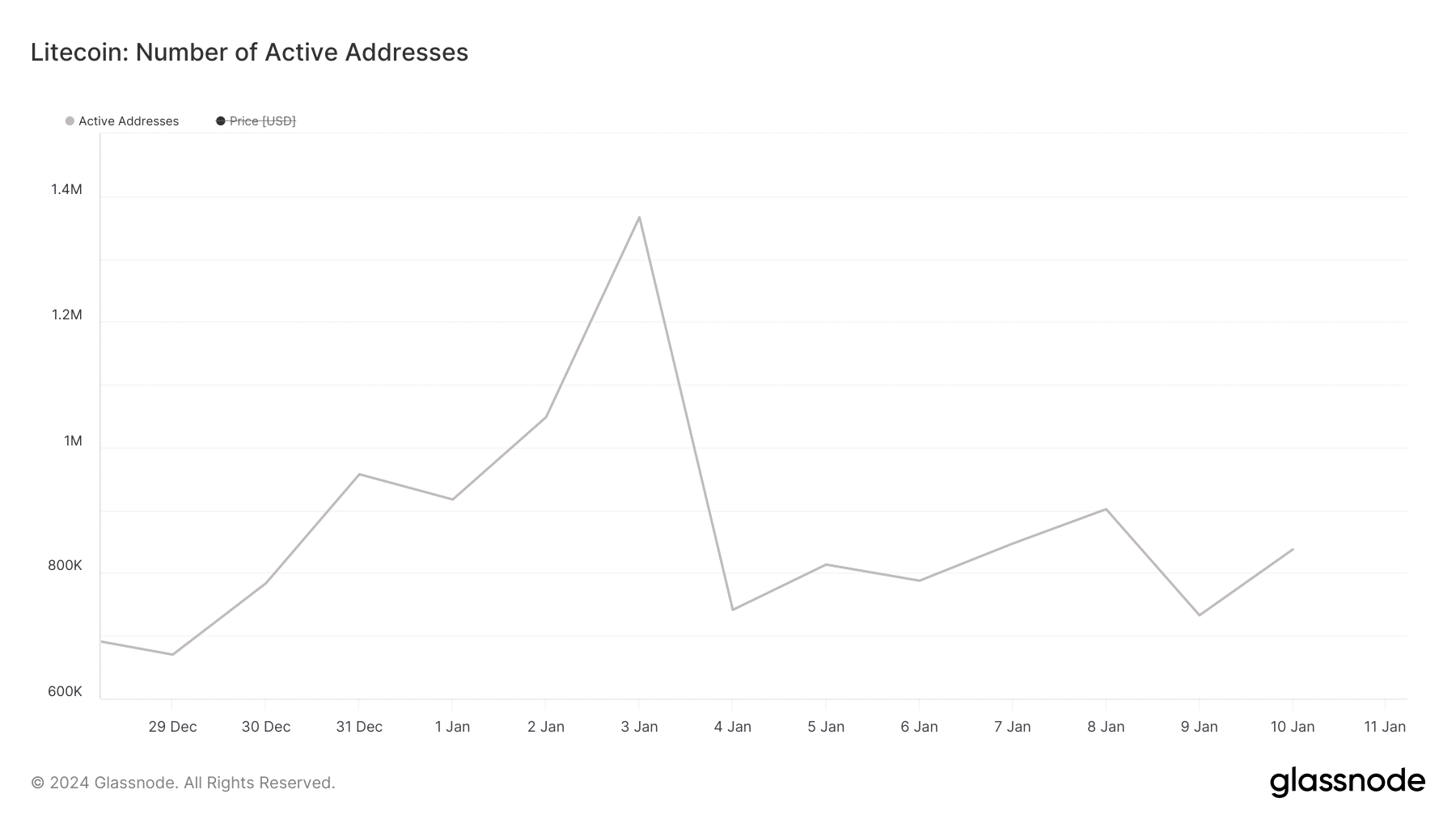

Data from Glassnode showed that since 4th January, the daily count of unique addresses that are active on Litecoin, either as a sender or receiver, has risen by 17%.

Also, the surge in activity pushed the network’s hashrate to its second-highest level of 885.09 TH/s on 10th January, according to data from CoinWarz.

Due to the rise in user activity, the year has also been marked by a jump in transaction fees on Litecoin. Since 4th January, the total amount of fees paid to process transactions on the chain daily has grown by 38%.

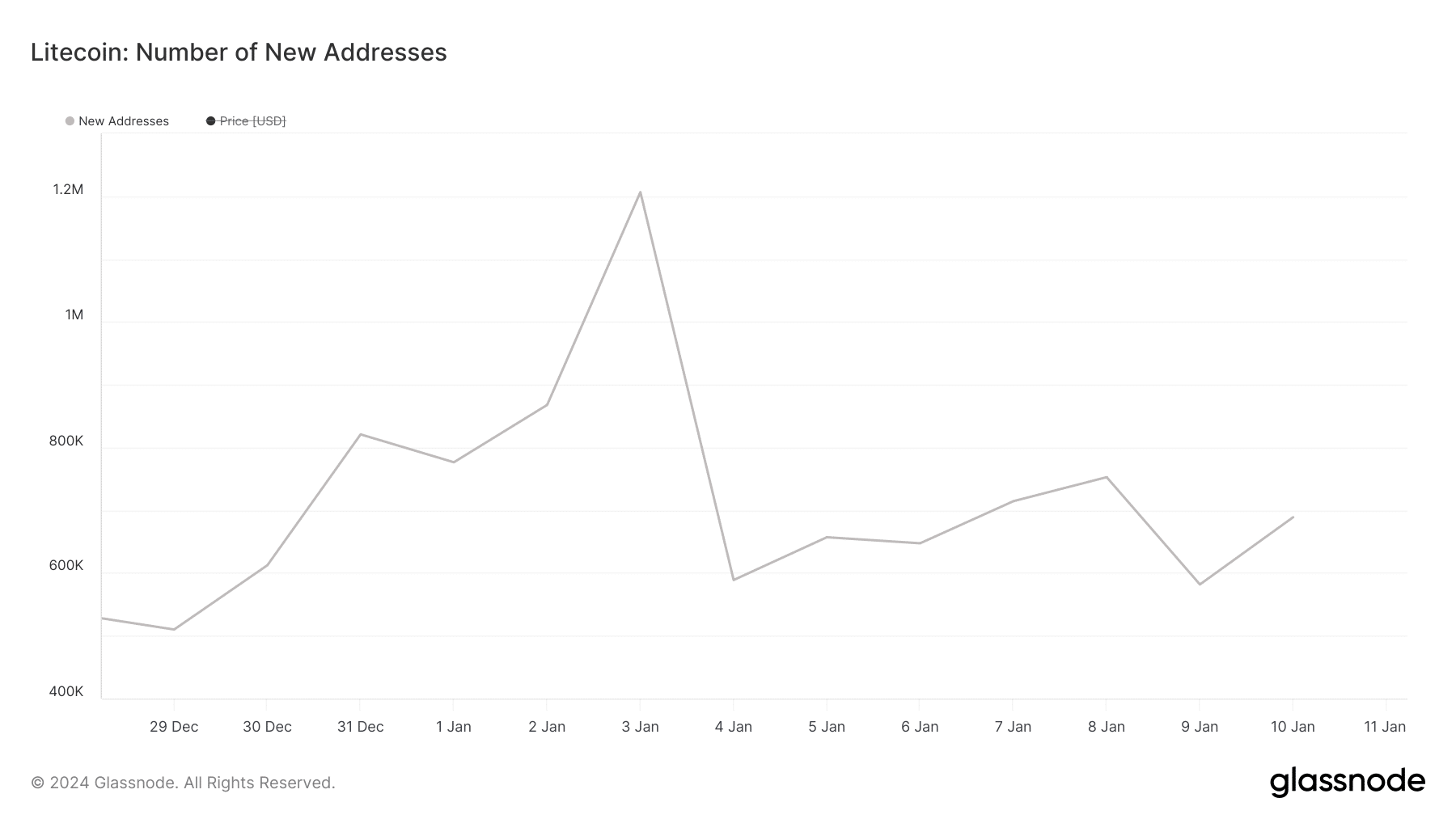

Interestingly, while Litecoin’s existing users have intensified activity, there has been a decline in new demand for the chain since the year began.

According to data from Glassnode, the daily number of unique addresses that appear for the first time in a transaction involving LTC on the network has dwindled by almost 45% in the last 10 days.

For context, as of 1st January, 1.20 million new addresses were created on Litecoin. By 10th January, it dropped to 688,000.

LTC follows trend

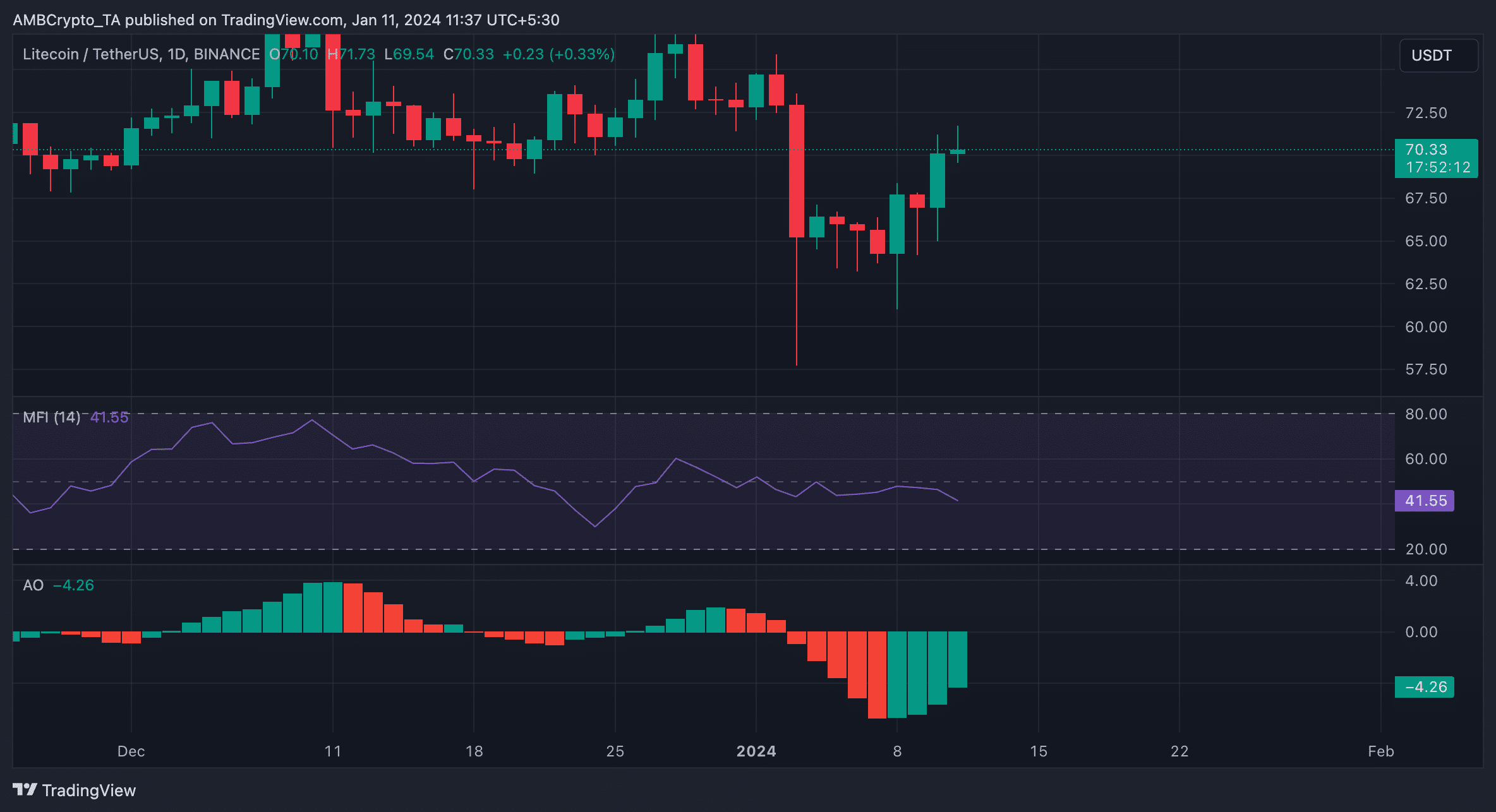

While LTC’s price has climbed in recent days, a closer look at some key indicators suggested that the surge might be fueled more by Bitcoin ETF anticipation than genuine demand for the coin itself.

At press time, LTC traded at $70.72, rising by 8% in the last seven days. Following the BTC Spot ETF approval granted by the U.S. Securities and Exchange Commission, the coin’s value has risen by 5% in the last 24 hours, according to data from CoinMarketCap.

However, with its Awesome Oscillator indicator returning green down-facing histogram bars, LTC might be poised to shed these gains.

When this indicator has green-down facing bars, it generally indicates a weakening bullish trend. This means that while the price may still be rising, the rate of increase is slowing down, which could be a sign of an upcoming trend reversal.

Read Litecoin’s [LTC] Price Prediction 2023-24

Likewise, there has also been a steep decline in LTC accumulation among daily traders. The coin’s Money Flow Index (MFI) rested below its center line and in a downtrend at the time of writing.

This suggested that selling pressure exceeded buying pressure, putting downward pressure on the alt’s price.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)