Litecoin: Will THIS pattern help LTC trigger 2025 rally?

- LTC prices were consolidating within a symmetrical triangle.

- Metrics showed heightened activity, with large transactions hinting a surging whale activity.

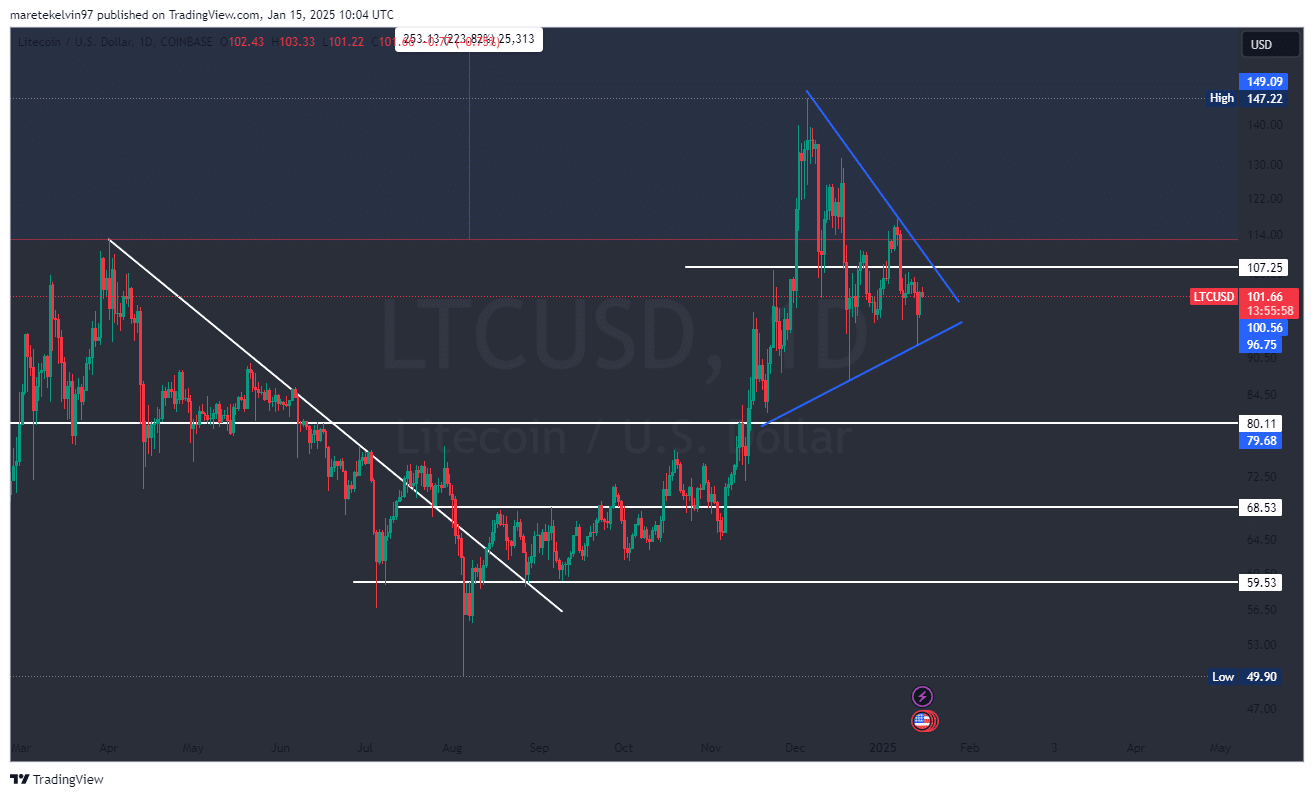

Litecoin [LTC] prices have been consolidating within a symmetrical triangle pattern since mid-November as seen on the daily chart, indicating a sign of market indecision.

This pattern often precedes significant price movements as buyers and sellers battle for dominance. At the time of writing, LTC was trading at $101, a 10% surge since its recent rebound from the key triangle support level in the last 48 hours.

Interestingly, this consolidation comes at a time when the market is awaiting a clear signal. A breakout could be imminent, but its direction depends on the volume and overall market sentiment.

Continued bullish momentum might push LTC beyond the critical triangle resistance, while bearish pressure could lead the altcoin to drop further.

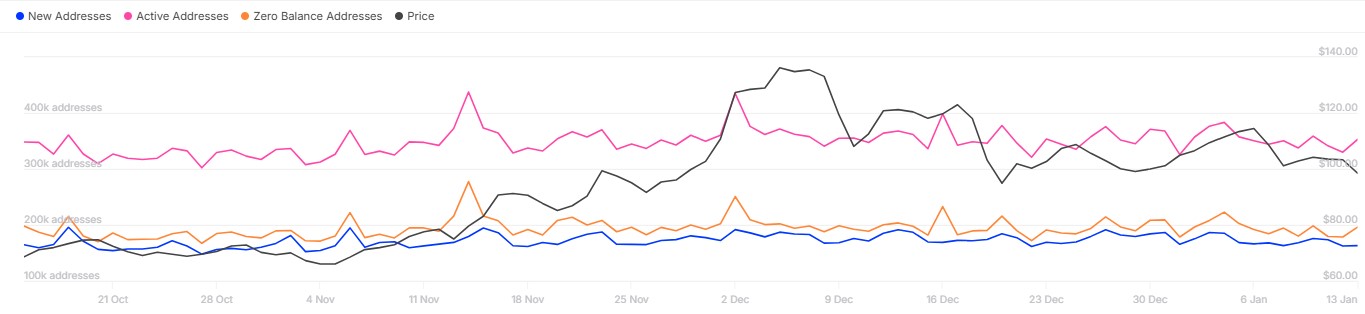

LTC active addresses paint a bullish picture

Digging deeper into on-chain metrics, Litecoin’s network is showing strong engagement. IntoTheBlock on-chain data highlights that the altcoin’s network is still buzzing. The number of active addresses surged recently by around 7%, suggesting continued LTC user activity.

Besides the active addresses, the recent surge in the altcoin’s new wallet creations adds to the bullish outlook. Increased adoption typically occurs with strong trading activity that could magnify any breakout.

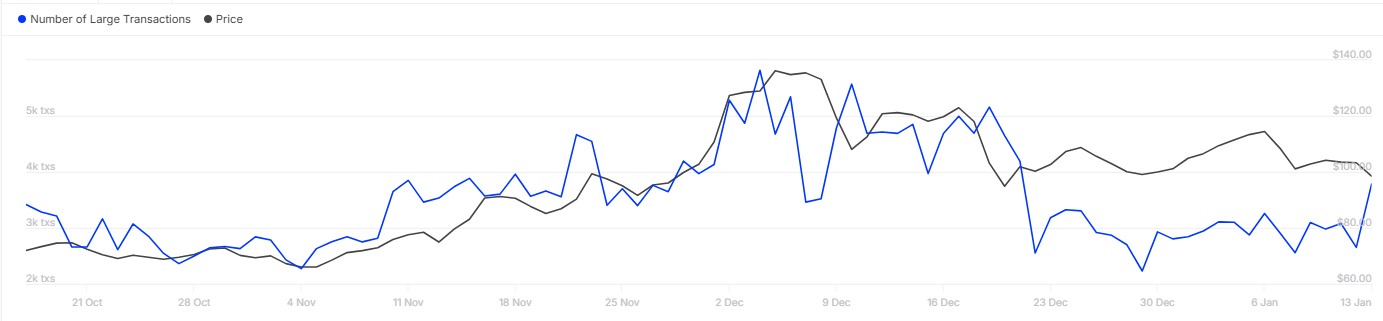

Whales are making moves

Also, there has been a noticeable spike in large transactions on the Litecoin network. This trend suggests that institutional players or high-net-worth individuals are taking an interest in LTC price developments.

Such movements usually coincide with periods of price consolidation, hinting at accumulation or strategic positioning for Litecoin.

When viewed alongside rising address activity, the presence of whales strengthens the case for a major price move. These factors make Litecoin’s current consolidation phase even more compelling, as they often foreshadow market volatility.

It remains to be seen whether the breakout will favor the bulls or the bears.

Read Litecoin’s [LTC] Price Prediction 2025–2026

All eyes are on Litecoin’s trading volumes and price action, as their development will dictate the breakout direction.

If the accumulating bullish momentum continues with positive on-chain sentiments, LTC will break out and rally further.